Latest Global Findex Data Chart 10 Years of Progress in Financial Inclusion

Story highlights.

- Financial accounts give people a safe way to make payments, store and save money, and access loans. As a result, financial inclusion facilitates investments in education and job opportunities, and increases resiliency to shocks.

- Data from the Global Findex—launched in 2011 as the world’s first and only source of data collected from users of financial services on financial account ownership, usage, and financial resilience based on nationally representative surveys of adults—show a 50 percent increase over the past decade in the worldwide share of adults with an account. Key gaps still remain, however, based on gender, income, and education level.

- The COVID-19 pandemic catalyzed a rise in financial digitalization, demonstrated by millions of adults using digital payments in lieu of cash-based payments for the first time.

At a recent Policy Research Talk, World Bank Lead Economist Leora Klapper presented key findings from the Global Findex 2021—a nationally representative survey of adults that has taken place roughly every three years since 2011 and quantifies financial account ownership and usage in economies around the world. Initially delayed by the outbreak of the COVID-19 pandemic, the Global Findex 2021 captured data from more than 128,000 adults in 123 countries—bringing the global total of survey participants to more than half a million adults since 2011.

The talk spanned subjects such as the impact of mobile money on financial inclusion and equity in Sub-Saharan African and other economies; how COVID-19 influenced changes in financial usage patterns, particularly for digital payments; new insights on financial resilience; and how focused policies and well-designed products can help close remaining inclusion and usage gaps.

In the aggregate, the Global Findex 2021 shows much cause for celebration among financial inclusion advocates. Since the first Global Findex survey in 2011, the share of adults worldwide with a financial account rose from 51 percent to 76 percent. In developing economies, account ownership has increased by 30 percentage points, bringing the total account ownership for adults in developing countries up to 71 percent. Digitalization facilitated that increase, as millions of adults opened accounts and began using them.

“Financial inclusion means that adults have access to appropriate financial services and can effectively use them to safely manage their money, save, and invest in their financial wellbeing,” said Klapper.

An impressive array of research has tallied the many benefits of financial inclusion, including enabling greater investments in businesses , increasing control over money (especially for women), reducing fees and increasing the security of money , and helping households cope with shocks through savings and insurance.

The trends driving increased account adoption and usage were already underway when the COVID-19 pandemic struck and catalyzed remarkable digital payment adoption as a work-around during lock-downs and other restrictions.

Three key messages emerged from the Global Findex 2021

To paint a picture of the current global situation surrounding financial inclusion, Klapper summarized three key messages from the Global Findex 2021 data and accompanying report .

The first message highlights the importance of technology-enabled accounts. Digital financial services such as mobile money, cards, e-wallets, and direct account-to-account payments have driven tremendous growth in account ownership and account usage around the world.

The second message emphasizes the way in which increases in financial inclusion have gone hand-in-hand—at least at the global level—with reductions in the account ownership gender gap. On average in developing economies, the gap between men and women in account ownership fell to six percentage points for the first time in the past decade.

The third message is that the COVID-19 pandemic accelerated the use of digital payments. During the pandemic, digital payments helped governments transfer money to those who most needed it, supported consumers when the use of cash was not possible, and became a lifeline for many small businesses.

The impact of digital financial services on account adoption and usage

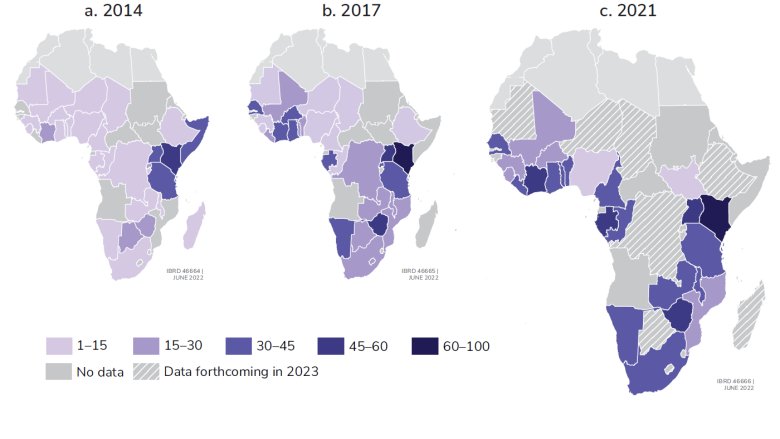

Mobile money accounts offered by telecom and fintech companies have been a key enabler of financial inclusion as well as a major contributor to the increase in account ownership in Sub-Saharan Africa, as well as in select economies such as Bangladesh and Peru (Figure 1).

“Mobile money accounts, which are easily accessible and offered through companies already familiar to the user, can be less intimidating and more convenient,” said Klapper. “Mobile money is also designed for small, high frequency transactions—which is exactly what they are being used for.”

Figure 1: Visualization of Mobile Money Accounts in Africa for 2017, 2017, and 2021 Mobile money accounts have increased dramatically since Global Findex data collection began.

The gender gap has narrowed, though there is still room to prioritize equity

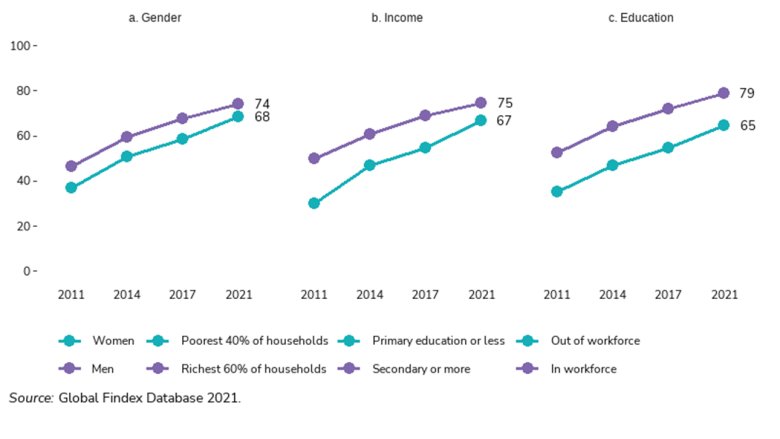

Despite recent advances, key gaps in account ownership still exist based on gender, income, and education levels (Figure 2). While social norms undoubtedly play a large role in the gender gap, more resolvable regulatory and technical issues are also at play. For example, men in some countries are more likely than women to have valid documentation such as government-issued IDs, which people need to open a financial institution or mobile money account as well as to purchase a mobile phone and SIM card.

“In Pakistan, for example, 88 percent of men have their own phone, compared to 42 percent of women,” said Klapper. “This presents a barrier for financial and digital inclusion as well as e-commerce opportunities, online education opportunities, and more.”

Figure 2: Three Key Gaps in Financial Inclusion Account Ownership in Developing Economies by Gender, Income, and Education

Adults now use a variety of financial services—and COVID-19 catalyzed wider adoption of digital payments

Digital payments are the most popular financial service. Fifty-seven percent of adults in developing economies made or received a direct payment in 2021, compared to only 35 percent in 2014.

One type of payment that has been enabled by account adoption is domestic remittances. In many countries across Sub-Saharan Africa, mobile money accounts were originally marketed as an option for domestic remittances (both sending and receiving). Now, mobile money account holders use them for a variety of financial services, including saving. More broadly, saving in any kind of account saw a boost in 2021—for the first time, more than half of adults who chose to save did so through a formal account, whether provided by a bank or similar institution or a mobile money provider.

Payments are a gateway for further financial inclusion

Governments and other actors can leverage the trends in digital payment adoption to further spread the benefits of financial inclusion to the approximate 1.4 billion adults worldwide who still lack a financial account. Digitizing payments is a start.

One third of the adults who receive government payments still receive them in cash or through some method other than directly into an account. Government-led policies could help put more of these payments into accounts and thus enable safer access and usage.

“The goal of financial inclusion is to design the right financial products and digitize payments in a way that enables people to alleviate their biggest worries, like saving for emergencies, making sure they can pay their bills, and having a secure place to keep their money,” said Klapper. Addressing the remaining barriers for adults in opening financial accounts and achieving financial security remains a key priority area for research and policy.

The Global Findex, Financial Inclusion & Resilience

Presentation (PDF)

The Global Findex Database

The Little Data Book on Financial Inclusion 2022

COVID-19 Boosted the Adoption of Digital Financial Services

Event Information

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here .

Delivering Rigorous Research that Advances Inclusive Finance

an Independent global think tank

We work to drive evidence-based change for inclusive and responsible financial systems.

Financial Inclusion Week 2024

The Role of Data Exchange in Financial Inclusion

25 Sep 2024

Citizen Experiences with DPI: Kenya’s Digital ID Transition

28 Aug 2024

Positive Friction for Responsible Digital Lending: A Call to Action

21 Feb 2024

Responsible DPI for Improving Outcomes Beyond Inclusion

26 Jun 2024

BUILDING DPI SYStEMS for positive outcomes

Responsible Digital Public Infrastructure (DPI) for Inclusive Finance

Upcoming event

Register for the 10 th anniversary of Financial Inclusion Week!

October 15-18, 2024

Latest Articles from CFI

Cybersecurity: a crucial ingredient for responsible finance and consumer protection.

11 Jan 2024

Privacy by Design for Inclusive Finance: Moving from Liminal Space to Concrete Practice

30 Jan 2024

Year in Review, Future in Focus: The Evolving Tale of Inclusive Finance

19 Dec 2023

Responsible Finance for the Consumer: Q & A with Nataša Goronja, CFI Managing Director

28 Jun 2024

Our Research Priorities

We believe that people belong at the center of inclusive finance, and we take a customer-centric approach in all that we do. In today’s digital era, the risks people face when using financial tools and services are quickly evolving. At CFI, we conduct research, test new approaches to consumer protection, and build knowledge on emerging risks. By working with financial service providers, investors, and policymakers, we strive to ensure inclusive finance practices promote the well-being of consumers.

The Hidden Traps of Deceptive Design: Embedding Consumer Protection into DFS

23 Jan 2023

Data is key to financial services and is increasingly becoming ubiquitous in today’s digital era. Consumer data can help people get access to personalized, effective financial tools that can help them achieve their goals and improve their livelihoods. Yet, the use of consumer data also poses new risks. At CFI, we focus on promoting data transparency and responsible privacy practices, protecting already underserved populations against algorithmic bias, and monitoring emerging data privacy and protection frameworks around the world to understand what does and does not work to advance inclusive finance.

Embedding Trust: The Potential of Privacy by Design for Inclusive Finance

01 Dec 2022

Equitable AI for Inclusive Finance

22 Aug 2023

We know that financial services are an indispensable tool to help people prepare for climate-related events and to help them recover when crises do happen. We also know that the people who have contributed the least to climate change are the ones most affected by its impacts. At CFI, we work to understand vulnerable populations’ constraints and what financial tools they need the most. We aim to help people build resilience to climate risks, adapt to changing climatic conditions, and in some cases even transition to new livelihoods.

Green Inclusive Finance: A Framework for Understanding How Financial Services Can Help Low-Income and Vulnerable People Respond to Climate Change

10 Jan 2023

Climate Vulnerability and Financial Exclusion Go Hand in Hand – What Can Be Done?

15 May 2023

Despite decades of focus on women as an important client group for financial services, there has been limited progress in reducing the gap in women’s access to finance. At CFI, we believe that women’s financial inclusion is powerfully shaped by broader societal norms. We focus on building evidence for what works to address the systemic barriers contributing to gender inequality and on how to scale successful norms-transformative initiatives. We aim to influence the policy environment to move the needle on women’s financial inclusion.

Normative Constraints to Women’s Financial Inclusion: What We Know and What We Need to Know

13 Jul 2021

Gender Bias in AI: An Experiment with ChatGPT in Financial Inclusion

25 Aug 2023

Explore our Research

Resource Library

We conduct rigorous research and share our findings to promote evidence-based decision making.

Attend an Event

Our global convenings bring stakeholders together to mainstream new ideas and ignite collaboration.

CFI is an independent think tank housed at Accion.

Accion founded CFI in 2008 to serve as an independent think tank on inclusive finance. Accion is a global nonprofit on a mission to create a fair and inclusive economy where underserved people can make informed decisions and improve their lives.

Sign up for updates

Advertisement

Financial inclusion and sustainable development: A review and research agenda

- Original Article

- Published: 14 February 2024

Cite this article

- Nejla Ould Daoud Ellili ORCID: orcid.org/0000-0003-1032-3965 1

197 Accesses

2 Citations

Explore all metrics

This bibliometric review explores the relationship between financial inclusion and sustainable development. It aims to identify key concepts in this research area and summarize the main findings of previous studies. The study is based on trends in the number of papers, keyword analysis, and an examination of the progression of the research topics over time. It identifies three main clusters of sustainable development—economic, social, and environmental—as well as the top authors, countries, organizations, the most frequently cited papers, reference papers, and journals. The study presents specific trends highlighting the role of financial inclusion in promoting economic growth, reducing income inequality and poverty, and mitigating climate change. This review provides a comprehensive perspective on the role of financial inclusion in sustainable development, emphasizing the need for integrated strategies that combine economic growth, social equity, and environmental sustainability. It recommends ideas for future research to further explore these relationships, providing valuable insights for policymakers and stakeholders in developing inclusive and sustainable development policies.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Sustainability, Sustainability Assessment, and the Place of Fiscal Sustainability

The Inclusive Sustainable Transformation Index

Emerging Economic Models of Sustainability—An Introduction

Explore related subjects.

- Artificial Intelligence

Data availability

The data are available upon request from the author.

https://data.worldbank.org/ .

https://unstats.un.org/sdgs/indicators/indicators-list/ .

https://stats.oecd.org/ .

https://www.fao.org/statistics/en/ .

https://www.who.int/data/gho .

https://www.footprintnetwork.org/ .

https://sedac.ciesin.columbia.edu/ .

https://ec.europa.eu/eurostat .

https://www.thegef.org/ .

https://www.iea.org/data-and-statistics .

Achugamonu, U.B., K.A. Adetiloye, E.O. Adegbite, A.A. Babajide, and F.A. Akintola. 2020. Financial exclusion of bankable adults: Implication on financial inclusive growth among twenty-seven SSA countries. Cogent Social Sciences 6 (1): 1730046. https://doi.org/10.1080/23311886.2020.1730046 .

Article Google Scholar

Adegbite, O.O., and C.L. Machethe. 2020. Bridging the financial inclusion gender gap in smallholder agriculture in Nigeria: An untapped potential for sustainable development. World Development 127: 104755. https://doi.org/10.1016/j.worlddev.2019.104755 .

Akeju, K.F. 2022. Household financial behaviour: The role of financial inclusion instruments in Nigeria. Journal of Sustainable Finance and Investment . https://doi.org/10.1080/20430795.2022.2034595 .

Ali, K., D. Jianguo, and D. Kirikkaleli. 2022a. Modeling the natural resources and financial inclusion on ecological footprint: The role of economic governance institutions. Evidence from ECOWAS Economies. Resources Policy 79: 103115. https://doi.org/10.1016/j.resourpol.2022.103115 .

Ali, M.M., V. Rattanawiboonsom, C.M. Perez, and A.A. Khan. 2017. Comparative positioning of small and medium enterprises in Bangladesh Thailand and the Philippines. Economy of Region 13 (2): 381–395.

Ali, M., M.I. Nazir, S.H. Hashmi, and W. Ullah. 2022b. Financial inclusion, institutional quality and financial development: Empirical evidence from OIC countries. Singapore Economic Review 67 (1): 161–188. https://doi.org/10.1142/S0217590820420084 .

Anu, S.A.K., S.A. Raza, J. Nakonieczny, and U. Shahzad. 2023. Role of financial inclusion, green innovation, and energy efficiency for environmental performance? Evidence from developed and emerging economies in the lens of sustainable development. Structural Change and Economic Dynamics 64: 213–224. https://doi.org/10.1016/j.strueco.2022.12.008 .

Arner, D.W., R.P. Buckley, D.A. Zetzsche, and R. Veidt. 2020. Sustainability, fintech and financial inclusion. European Business Organization Law Review 21 (1): 7–35. https://doi.org/10.1007/s40804-020-00183-y .

Aslan, G. 2022. Enhancing youth and women’s financial inclusion in South Asia. Cogent Economics and Finance 10 (1): 2136237. https://doi.org/10.1080/23322039.2022.2136237 .

Article MathSciNet Google Scholar

Asongu, S.A., and N.M. Odhiambo. 2020. How enhancing gender inclusion affects inequality: Thresholds of complementary policies for sustainable development. Sustainable Development 28 (1): 132–142. https://doi.org/10.1002/sd.1977 .

Asongu, S.A., and N.M. Odhiambo. 2022. The role of economic growth in modulating mobile connectivity dynamics for financial inclusion in developing countries. World Affairs 185 (3): 530–556. https://doi.org/10.1177/00438200221104515 .

Azmat, F., W.M. Lim, A. Moyeen, R. Voola, and G. Gupta. 2023. Convergence of business, innovation, and sustainability at the tipping point of the sustainable development goals. Journal of Business Research 167: 114170. https://doi.org/10.1016/j.jbusres.2023.114170 .

Babajide, A.A., E.O. Oluwaseye, A.I. Lawal, and A.A. Isibor. 2020. Financial technology, financial inclusion and MSMEs financing in the south-west of Nigeria. Academy of Entrepreneurship Journal 26 (3): 1–17.

Google Scholar

Bank of Canada. 2018. 2017 Methods-of-payment survey report. https://doi.org/10.34989/sdp-2018-17

Bu, F., H. Wu, H.A. Mahmoud, H.M. Alzoubi, N.K. Ramazanovna, and Y. Gao. 2023. Do financial inclusion, natural resources and urbanization affect the sustainable environment in emerging economies. Resources Policy . https://doi.org/10.1016/j.resourpol.2023.104292 .

Cao, G.-H., and J. Zhang. 2022. The entrepreneurial ecosystem of inclusive finance and entrepreneurship: A theoretical and empirical test in China. International Journal of Finance and Economics 27 (1): 1547–1568. https://doi.org/10.1002/ijfe.2230 .

Carrillo-Hidalgo, I., and J.I. Pulido-Fernández. 2019. The role of the world bank in the inclusive financing of tourism as an instrument of sustainable development. Sustainability (switzerland) 12 (1): 285. https://doi.org/10.3390/su12010285 .

Chen, H., Y. Shi, and X. Zhao. 2022. Investment in renewable energy resources, sustainable financial inclusion and energy efficiency: A case of US economy. Resources Policy 77: 102680. https://doi.org/10.1016/j.resourpol.2022.102680 .

Chen, W., and X. Yuan. 2021. Financial inclusion in China: An overview. Frontiers of Business Research in China . https://doi.org/10.1186/s11782-021-00098-6 .

Article PubMed Central Google Scholar

Chibba, M. 2009. Financial inclusion, poverty reduction, and the millennium development goals. The European Journal of Development Research 21 (2): 213–230. https://doi.org/10.1057/ejdr.2008.17 .

Chima, M.M., A.A. Babajide, A. Adegboye, S. Kehinde, and O. Fasheyitan. 2021. The relevance of financial inclusion on sustainable economic growth in sub-Saharan African nations. Sustainability (switzerland) 13 (10): 5581. https://doi.org/10.3390/su13105581 .

Chirambo, D. 2017. Enhancing climate change resilience through microfinance: Redefining the climate finance paradigm to promote inclusive growth in Africa. Journal of Developing Societies 33 (1): 150–173. https://doi.org/10.1177/0169796X17692474 .

Cruz Rambaud, S., J. López Pascual, R. Moro-Visconti, and E.M. Santandreu. 2022. Should gender be a determinant factor for granting crowdfunded microloans? Humanities and Social Sciences Communications . https://doi.org/10.1057/s41599-022-01475-z .

Dahdal, A., J. Truby, and O. Ismailov. 2022. The role and potential of blockchain technology in Islamic finance. European Business Law Review 33 (2): 175–192.

Demir, A., V. Pesqué-Cela, Y. Altunbas, and V. Murinde. 2022. Fintech, financial inclusion and income inequality: A quantile regression approach. European Journal of Finance 28 (1): 86–107. https://doi.org/10.1080/1351847X.2020.1772335 .

Donthu, N., S. Kumar, D. Mukherjee, N. Pandey, and W.M. Lim. 2021. How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research 133: 285–296. https://doi.org/10.1016/j.jbusres.2021.04.070 .

Duan, D., and K. Liu. 2023. Do financial inclusion, natural resources and green innovation affect the sustainable environment in resource rich economies. Resources Policy . https://doi.org/10.1016/j.resourpol.2023.104190 .

Dupas, P., and J. Robinson. 2013. Savings constraints and microenterprise development: Evidence from a field experiment in Kenya. American Economic Journal: Applied Economics 5 (1): 163–192.

Dutta, K.D., and M. Saha. 2022. Does financial development cause sustainable development? A PVAR approach. Economic Change and Restructuring . https://doi.org/10.1007/s10644-022-09451-y .

Duvendack, M., L. Sonne, and S. Garikipati. 2023. Gender inclusivity of India’s digital financial revolution for attainment of SDGs: Macro achievements and the micro experiences of targeted initiatives. European Journal of Development Research 35 (6): 1369–1391. https://doi.org/10.1057/s41287-023-00585-x .

Ellili, N.O.D. 2022. Bibliometric analysis and systematic review of environmental, social, and governance disclosure papers: Current topics and recommendations for future research. Environmental Research Communication 4: 092001. https://doi.org/10.1088/2515-7620/ac8b67 .

Article ADS Google Scholar

Ellili, N.O.D. 2023. Is there any association between fintech and sustainability? Evidence from bibliometric review and content analysis. Journal of Financial Services Marketing 28: 748–762. https://doi.org/10.1057/s41264-022-00200-w .

Erdoğan, H., B. Tutcu, H. Talaş, and M. Terzioğlu. 2022. Performance analysis in renewable energy companies: Application of SWARA and WASPAS methods. Journal of Sustainable Finance and Investment . https://doi.org/10.1080/20430795.2022.2144107 .

Fungáčová, Z., and L. Weill. 2015. Understanding financial inclusion in China. China Economic Review 34: 196–206. https://doi.org/10.1016/j.chieco.2014.12.004 .

Gancarczyk, M., P. Łasak, and J. Gancarczyk. 2022. The fintech transformation of banking: Governance dynamics and socio-economic outcomes in spatial contexts. Entrepreneurial Business and Economics Review 10 (3): 143–165.

Gbongli, K., Y. Xu, and K.M. Amedjonekou. 2019. Extended technology acceptance model to predict mobile-based money acceptance and sustainability: A multi-analytical structural equation modeling and neural network approach. Sustainability (switzerland) 11 (13): 3639. https://doi.org/10.3390/su11133639 .

Goodell, J.W., S. Kumar, W.M. Lim, and D. Pattnaik. 2021. Artificial intelligence and machine learning in finance: Identifying foundations, themes, and research clusters from bibliometric analysis. Journal of Behavioral and Experimental Finance 32: 100577. https://doi.org/10.1016/j.jbef.2021.100577 .

Grohmann, A., T. Kluhs, and L. Menkhoff. 2018. Does financial literacy improve financial inclusion? Cross country evidence. World Development 111: 84–96. https://doi.org/10.1016/j.worlddev.2018.06.020 .

Guo, L., H. Kuang, and Z. Ni. 2022. A step towards green economic policy framework: Role of renewable energy and climate risk for green economic recovery. Economic Change and Restructuring . https://doi.org/10.1007/s10644-022-09437-w .

Hagawe, H.M., A. Mobarek, A. Hanuk, and A. Jamal. 2023. A unique business model for microfinance institution: The case of Assadaqaat community finance (ACF). Cogent Business & Management 10: 1. https://doi.org/10.1080/23311975.2022.2135202 .

Hawash, M.K., M.A. Taha, A.A. Hasan, H.T. Braiber, R.A. Al Mahdi, K.M. Thajil, and A.M.A. Albakr. 2022. Financial inclusion, foreign direct investment, green finance and green credit effect on Iraq manufacturing companies sustainable economic development: A case on static panel data. Cuadernos De Economia 45 (128): 53–60.

Huang, H., W. Mbanyele, S. Fan, and X. Zhao. 2022. Digital financial inclusion and energy-environment performance: What can learn from China. Structural Change and Economic Dynamics 63: 342–366. https://doi.org/10.1016/j.strueco.2022.10.007 .

Hussain, S., R. Gul, and S. Ullah. 2023. Role of financial inclusion and ICT for sustainable economic development in developing countries. Technological Forecasting and Social Change . https://doi.org/10.1016/j.techfore.2023.122725 .

Jiang, C., A. Feng, and C. Xiao. 2021. Does capital account liberalization spur entrepreneurship: The role of financial development. Sustainability (switzerland) 13 (16): 9238. https://doi.org/10.3390/su13169238 .

Kandpal, V. 2020. Reaching sustainable development goals: Bringing financial inclusion to reality in India. Journal of Public Affairs . https://doi.org/10.1002/pa.2277 .

Kandpal, V. 2022. Socio-economic development through self-help groups in rural India–a qualitative study. Qualitative Research in Financial Markets 14 (5): 621–636. https://doi.org/10.1108/QRFM-10-2021-0170 .

Karlan, D., R. Osei, I. Osei-Akoto, and C. Udry. 2014. Agricultural decisions after relaxing credit and risk constraints. The Quarterly Journal of Economics 129 (2): 597652. https://doi.org/10.1093/qje/qju002 .

Kebede, J., A. Naranpanawa, and S. Selvanathan. 2023. Financial inclusion and income inequality nexus: A case of Africa. Economic Analysis and Policy 77: 539–557. https://doi.org/10.1016/j.eap.2022.12.006 .

Khan, K., J.W. Goodell, M.K. Hassan, and A. Paltrinieri. 2022. A bibliometric review of finance bibliometric papers. Finance Research Letters . https://doi.org/10.1016/j.frl.2021.102520 .

Koomson, I., E. Martey, and P.M. Etwire. 2022. Mobile money and entrepreneurship in East Africa: The mediating roles of digital savings and access to digital credit. Information Technology and People . https://doi.org/10.1108/ITP-11-2021-0906 .

Kraus, S., M. Breier, W.M. Lim, M. Dabić, S. Kumar, D. Kanbach, D. Mukherjee, V. Corvello, J. Piñeiro-Chousa, E. Liguori, D. Palacios-Marqués, F. Schiavone, A. Ferraris, C. Fernandes, and J.J. Ferreira. 2022. Literature reviews as independent studies: Guidelines for academic practice. Review of Managerial Science 16 (8): 2577–2595. https://doi.org/10.1007/s11846-022-00588-8 .

Kumar, S., W.M. Lim, U. Sivarajah, and J. Kaur. 2022. Artificial intelligence and blockchain integration in business: Trends from a bibliometric-content analysis. Information Systems Frontiers 25 (2): 871–896.

PubMed PubMed Central Google Scholar

Kumar, K., and A. Prakash. 2019. Developing a framework for assessing sustainable banking performance of the Indian banking sector. Social Responsibility Journal 15 (5): 689–709. https://doi.org/10.1108/SRJ-07-2018-0162 .

Le, T.H., H.C. Le, and F. Taghizadeh-Hesary. 2020. Does financial inclusion impact CO2 emissions? Evidence from Asia. Finance Research Letters 34: 10145. https://doi.org/10.1016/j.frl.2020.101451 .

Lee, C.-C., R. Lou, and F. Wang. 2023. Digital financial inclusion and poverty alleviation: Evidence from the sustainable development of China. Economic Analysis and Policy 77: 418–434. https://doi.org/10.1016/j.eap.2022.12.004 .

Liaqat, I., Y. Gao, F.U. Rehman, Z. Lakner, and J. Oláh. 2022. National culture and financial inclusion: Evidence from belt and road economies. Sustainability (switzerland) 14 (6): 3405. https://doi.org/10.3390/su14063405 .

Lim, W.M. 2022. The sustainability pyramid: A hierarchical approach to greater sustainability and the United Nations Sustainable Development Goals with implications for marketing theory. Practice, and Public Policy. Austraalasian Marketing Journal 30 (2): 142–150.

Lim, W.M., and S. Kumar. 2023. Guidelines for interpreting the results of bibliometric analysis: A sensemaking approach. Global Business and Organizational Excellence 00: 1–10. https://doi.org/10.1002/joe.22229 .

Lim, W.M., S. Kumar, and F. Ali. 2022. Advancing knowledge through literature reviews: ‘What’, ‘why’, and ‘how to contribute.’ Service Industries Journal 42 (7–8): 481–513. https://doi.org/10.1080/02642069.2022.2047941 .

Liu, H., A. Sinha, M.A. Destek, M. Alharthi, and M.W. Zafar. 2022. Moving toward sustainable development of sub-Saharan African countries: Investigating the effect of financial inclusion on environmental quality. Sustainable Development 30 (6): 2015–2024. https://doi.org/10.1002/sd.2367 .

Liu, J., V.T. Kim Loan, S. Mousa, A. Ali, I. Muda, and P.T. Cong. 2023. Sustainability and natural resources management in developed countries: The role of financial inclusion and human development. Resources Policy 80: 103143. https://doi.org/10.1016/j.resourpol.2022.103143 .

Lontchi, C.B., B. Yang, and Y. Su. 2022. The mediating effect of financial literacy and the moderating role of social capital in the relationship between financial inclusion and sustainable development in Cameroon. Sustainability (switzerland) 14 (22): 15093. https://doi.org/10.3390/su142215093 .

Manzilati, A., and S.A. Prestianawati. 2022. Informal financing or debt traps: Are the UN sustainable development goals being met in emerging economies? Review of International Business and Strategy 32 (1): 132–145. https://doi.org/10.1108/RIBS-01-2021-0011 .

Ma, Q., X. Han, R.A. Badeeb, and Z. Khan. 2022. On the sustainable trade development: Do financial inclusion and eco-innovation matter? Evidence from method of moments quantile regression. Sustainable Development 30 (5): 1044–1055. https://doi.org/10.1002/sd.2298 .

Mavilia, R., and R. Pisani. 2020. Blockchain and catching-up in developing countries: The case of financial inclusion in Africa. African Journal of Science, Technology, Innovation and Development 12 (2): 151–163. https://doi.org/10.1080/20421338.2019.1624009 .

Mavlutova, I., A. Spilbergs, A. Verdenhofs, A. Natrins, I. Arefjevs, and T. Volkova. 2023. Digital transformation as a driver of the financial sector sustainable development: An impact on financial inclusion and operational efficiency. Sustainability (switzerland) 15 (1): 207. https://doi.org/10.3390/su15010207 .

Menyelim, C.M., A.A. Babajide, A.E. Omankhanlen, and B.I. Ehikioya. 2021. Financial inclusion, income inequality and sustainable economic growth in Sub-Saharan African countries. Sustainability (switzerland) 13 (4): 1–15. https://doi.org/10.3390/su13041780 .

Mhlanga, D. 2021. Artificial intelligence in the industry 4.0, and its impact on poverty, innovation, infrastructure development, and the sustainable development goals: Lessons from emerging economies? Sustainability (switzerland) 13 (11): 5788. https://doi.org/10.3390/su13115788 .

Mia, M.A., and H.-A. Lee. 2017. Mission drift and ethical crisis in microfinance institutions: What matters? Journal of Cleaner Production 164: 102–114. https://doi.org/10.1016/j.jclepro.2017.06.176 .

Mukherjee, D., W.M. Lim, S. Kumar, and N. Donthu. 2022. Guidelines for advancing theory and practice through bibliometric research. Journal of Business Research 148: 101–115.

Murshed, M., U. Khan, A.M. Khan, and I. Ozturk. 2022. Can energy productivity gains harness the carbon dioxide-inhibiting agenda of the Next 11 countries? Implications for achieving sustainable development. Sustainable Development . https://doi.org/10.1002/sd.2393 .

Niaz, M.U. 2022. Socio-economic development and sustainable development goals: A roadmap from vulnerability to sustainability through financial inclusion. Economic Research-Ekonomska Istrazivanja 35 (1): 3243–3275. https://doi.org/10.1080/1331677X.2021.1989319 .

Nizam, R., Z.A. Karim, A.A. Rahman, and T. Sarmidi. 2020. Financial inclusiveness and economic growth: New evidence using a threshold regression analysis. Economic Research-Ekonomska Istrazivanja 33 (1): 1465–1484. https://doi.org/10.1080/1331677X.2020.1748508 .

Nourani, M., N.A.K. Malim, and M.A. Mia. 2021. Revisiting efficiency of microfinance institutions (MFIs): An application of network data envelopment analysis. Economic Research-Ekonomska Istrazivanja 34 (1): 1146–1169. https://doi.org/10.1080/1331677X.2020.1819853 .

Odugbesan, J.A., G. Ike, G. Olowu, and B.N. Adeleye. 2022. Investigating the causality between financial inclusion, financial development and sustainable development in Sub-Saharan Africa economies: The mediating role of foreign direct investment. Journal of Public Affairs 22 (3): e2569. https://doi.org/10.1002/pa.2569 .

Ozturk, I., and S. Ullah. 2022. Does digital financial inclusion matter for economic growth and environmental sustainability in OBRI economies? An empirical analysis. Resources, Conservation and Recycling 185: 106489. https://doi.org/10.1016/j.resconrec.2022.106489 .

Pandey, A., R. Kiran, and R.K. Sharma. 2022. Investigating the impact of financial inclusion drivers, financial literacy and financial initiatives in fostering sustainable growth in North India. Sustainability (switzerland) 14 (17): 11061. https://doi.org/10.3390/su141711061 .

Paul, J., W.M. Lim, A. O’Cass, A.W. Hao, and S. Bresciani. 2021. Scientific procedures and rationales for systematic literature reviews (SPAR-4-SLR). International Journal of Consumer Studies 45 (4): 1–16.

Rizwan, A., and F. Mustafa. 2022. Fintech attaining sustainable development: An investor perspective of crowdfunding platforms in a developing country. Sustainability (switzerland) 14 (12): 7114. https://doi.org/10.3390/su14127114 .

Sadorsky, P. 2010. The impact of financial development on energy consumption in emerging economies. Energy Policy 38 (5): 2528–2535.

Sakyi-Nyarko, C., A.H. Ahmad, and C. Green. 2022a. Investigating the well-being implications of mobile money access and usage from a multidimensional perspective. Review of Development Economics 26 (2): 985–1009. https://doi.org/10.1111/rode.12848 .

Sakyi-Nyarko, C., A.H. Ahmad, and C.J. Green. 2022b. The role of financial inclusion in improving household well-being. Journal of International Development 34 (8): 1606–1632. https://doi.org/10.1002/jid.3661 .

Sarma, M., and J. Pais. 2011. Financial inclusion and development. Journal of International Development 23 (5): 613–628. https://doi.org/10.1002/jid.1698 .

Saviano, M., L. Nenci, and F. Caputo. 2017. The financial gap for women in the MENA region: A systemic perspective. Gender in Management 32 (3): 203–217. https://doi.org/10.1108/GM-07-2016-0138 .

She, L., H. Waheed, W.M. Lim, and S.E. Vahdati. 2023. Young adults. Financial well-being: Current insights and future directions. International Journal of Bank Marketing 41 (2): 333–368. https://doi.org/10.1108/IJBM-04-2022-0147 .

Shihadeh, F.H. 2022. Individual’s behavior and access to finance: Evidence from Palestine. Singapore Economic Review 67 (1): 113–133. https://doi.org/10.1142/S0217590819420025 .

Sierra, J., and M.-J. Rodríguez-Conde. 2021. The microfinance game: Experiencing the dynamics of financial inclusion in developing contexts. International Journal of Management Education 19 (3): 100540. https://doi.org/10.1016/j.ijme.2021.100540 .

Sun, T., and X. Wang. 2023. Adoption of financial inclusion in a world of depleting natural resources: The importance of information and communication technology in emerging economies. Resources Policy . https://doi.org/10.1016/j.resourpol.2023.103901 .

Tang, J. 2022. Combing effects of economic development and globalization towards energy efficiency and environmental degradation: Fresh analysis from energy efficient resources. Frontiers in Energy Research . https://doi.org/10.3389/fenrg.2022.847235 .

Thathsarani, U., J. Wei, and G. Samaraweera. 2021. Financial inclusion’s role in economic growth and human capital in South Asia: An econometric approach. Sustainability (switzerland) 13 (8): 4303. https://doi.org/10.3390/su13084303 .

Tok, M.E., and B. O’Bright. 2017. Reproducing spaces of embeddedness through Islamic NGOs in sub-Saharan Africa: Reflections on the post-2015 development agenda. African Geographical Review 36 (1): 85–99. https://doi.org/10.1080/19376812.2015.1130637 .

Truby, J. 2020. Governing artificial intelligence to benefit the UN sustainable development goals. Sustainable Development 28 (4): 946–959. https://doi.org/10.1002/sd.2048 .

Úbeda, F., A. Mendez, and F.J. Forcadell. 2023. The sustainable practices of multinational banks as drivers of financial inclusion in developing countries. Finance Research Letters 51: 103278. https://doi.org/10.1016/j.frl.2022.103278 .

Uzoma, A.B., K.A. Adetiloye, A.O. Esther, P.O. Eke, and G.O. Osuma. 2020. Social integration and financial inclusion of forcibly displaced persons in sub-Saharan African countries. Problems and Perspectives in Management 18 (3): 170–181.

Wang, H., and J. Guo. 2022. Impacts of digital inclusive finance on CO2 emissions from a spatial perspective: Evidence from 272 cities in China. Journal of Cleaner Production 355: 131618. https://doi.org/10.1016/j.jclepro.2022.131618 .

Article CAS Google Scholar

Wong, Z.Z.A., R.A. Badeeb, and A.P. Philip. 2023. Financial inclusion, poverty, and income inequality in ASEAN countries: Does financial innovation matter? Social Indicators Research 169 (1–2): 471–503. https://doi.org/10.1007/s11205-023-03169-8 .

World Bank. 2022. Financial inclusion is a key enabler to reducing poverty and boosting prosperity. Accessible at: https://www.worldbank.org/en/topic/financialinclusion/overview

World Bank. 2018. The Global Findex Database 2017: Measuring financial inclusion and the fintech revolution. Accessible at: https://openknowledge.worldbank.org/handle/10986/29510

Yang, L., and Y. Zhang. 2020. Digital financial inclusion and sustainable growth of small and micro enterprises-evidence based on China’s new third board market listed companies. Sustainability (switzerland) 12 (9): 3733. https://doi.org/10.3390/su12093733 .

Yap, S., H.S. Lee, and P.X. Liew. 2023. The role of financial inclusion in achieving finance-related sustainable development goals (SDGs): A cross-country analysis. Economic Research-Ekonomska Istrazivanja . https://doi.org/10.1080/1331677X.2023.2212028 .

Yazdanfar, D., and P. Öhman. 2015. Debt financing and firm performance: An empirical study based on Swedish data. Journal of Risk Finance 16 (1): 102–118. https://doi.org/10.1108/JRF-06-2014-0085 .

Yeo, K.H.K., W.M. Lim, and K.J. Yii. 2023. Financial planning behaviour: A systematic literature review and new theory development. Journal of Financial Services Marketing . https://doi.org/10.1057/s41264-023-00249-1 .

Zhao, T. 2023. The impact of financial inclusion and natural resource endowment on China’s carbon emissions in the post-covid-19 period. Resources Policy . https://doi.org/10.1016/j.resourpol.2023.104198 .

Article PubMed PubMed Central Google Scholar

Zhu, B., S. Zhai, and J. He. 2018. Is the development of China’s financial inclusion sustainable? Evidence from a perspective of balance. Sustainability (switzerland) 10 (4): 1200. https://doi.org/10.3390/su10041200 .

Download references

This study was not financed by any funding source.

Author information

Authors and affiliations.

College of Business, Abu Dhabi University, P.O. Box 59911, Abu Dhabi, United Arab Emirates

Nejla Ould Daoud Ellili

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Nejla Ould Daoud Ellili .

Ethics declarations

Conflict of interest.

The author declares no conflicts of interest.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Ellili, N.O.D. Financial inclusion and sustainable development: A review and research agenda. J Financ Serv Mark (2024). https://doi.org/10.1057/s41264-024-00269-5

Download citation

Received : 31 August 2023

Revised : 18 January 2024

Accepted : 19 January 2024

Published : 14 February 2024

DOI : https://doi.org/10.1057/s41264-024-00269-5

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Financial inclusion

- Sustainable development

- Bibliometric analysis

- Content analysis

JEL Classification

- Find a journal

- Publish with us

- Track your research

Information

- Author Services

Initiatives

You are accessing a machine-readable page. In order to be human-readable, please install an RSS reader.

All articles published by MDPI are made immediately available worldwide under an open access license. No special permission is required to reuse all or part of the article published by MDPI, including figures and tables. For articles published under an open access Creative Common CC BY license, any part of the article may be reused without permission provided that the original article is clearly cited. For more information, please refer to https://www.mdpi.com/openaccess .

Feature papers represent the most advanced research with significant potential for high impact in the field. A Feature Paper should be a substantial original Article that involves several techniques or approaches, provides an outlook for future research directions and describes possible research applications.

Feature papers are submitted upon individual invitation or recommendation by the scientific editors and must receive positive feedback from the reviewers.

Editor’s Choice articles are based on recommendations by the scientific editors of MDPI journals from around the world. Editors select a small number of articles recently published in the journal that they believe will be particularly interesting to readers, or important in the respective research area. The aim is to provide a snapshot of some of the most exciting work published in the various research areas of the journal.

Original Submission Date Received: .

- Active Journals

- Find a Journal

- Journal Proposal

- Proceedings Series

- For Authors

- For Reviewers

- For Editors

- For Librarians

- For Publishers

- For Societies

- For Conference Organizers

- Open Access Policy

- Institutional Open Access Program

- Special Issues Guidelines

- Editorial Process

- Research and Publication Ethics

- Article Processing Charges

- Testimonials

- Preprints.org

- SciProfiles

- Encyclopedia

Article Menu

- Subscribe SciFeed

- Recommended Articles

- Author Biographies

- Google Scholar

- on Google Scholar

- Table of Contents

Find support for a specific problem in the support section of our website.

Please let us know what you think of our products and services.

Visit our dedicated information section to learn more about MDPI.

JSmol Viewer

Financial inclusion and its ripple effects on socio-economic development: a comprehensive review.

1. Introduction

2. research methods, 2.1. journal selection criteria, 2.2. article selection criteria, 3. theoretical perspective, 3.1. socioeconomic development theory, 3.2. theory of planned behavior: understanding behavioral predictions, 3.3. technology acceptance model: understanding consumer adoption of technology, 4. discussion, 4.1. financial inclusion, fintech, and artificial intelligence, 4.2. financial and digital literacy of consumers and financial inclusion, 4.3. shgs, women empowerment and financial inclusion, 4.4. intensifying access to financial services to consumers, 4.5. financial inclusion and economic growth, 4.6. consumers’ financial inclusion and financial capability, 4.7. socioeconomic determinants of financial inclusion.

- Socioeconomic Determinants of Financial Inclusion

- Income Levels and Employment Status

- Education and Financial Literacy

- Demographic Factors: Age, Gender, and Ethnicity

- Technological Factors and Geographic Location (Urban vs. Rural): Enhancing Financial Inclusion

- Cultural and Social Norms

- Government Policies and Regulation

5. Conclusions

5.1. financial inclusion, fintech, and artificial intelligence, 5.2. financial literacy of consumers, financial capacity, and financial inclusion, 5.3. shgs, women empowerment, gender issues, and financial inclusion, 5.4. intensifying and inclusivity of access to financial services for consumers.

- Policy Implications and Frameworks for Financial Inclusion

6. Sustainable Financial Inclusion Theory and Future Research Agenda

6.1. sustainable financial inclusion theory, 6.2. future research agenda, author contributions, data availability statement, conflicts of interest.

- Abakah, Emmanuel Joel Aikins, Aviral Kumar Tiwari, Sudeshna Ghosh, and Buhari Doğan. 2023. Dynamic Effect of Bitcoin, Fintech and Artificial Intelligence Stocks on Eco-Friendly Assets, Islamic Stocks and Conventional Financial Markets: Another Look Using Quantile-Based Approaches. Technological Forecasting and Social Change 192: 122566. [ Google Scholar ] [ CrossRef ]

- Adams, Deborah, and Stacia West. 2015. Asset Building among Low Income Adults: An Exploratory Study with Participants in an Emergency Savings Program. Journal of Community Practice 23: 436–61. [ Google Scholar ] [ CrossRef ]

- Adetunji, Olubanjo Michael, and Olayinka David-West. 2019. The Relative Impact of Income and Financial Literacy on Financial Inclusion in Nigeria. Journal of International Development 31: 312–35. [ Google Scholar ] [ CrossRef ]

- Agarwal, Sumit, and Yeow Hwee Chua. 2020. FinTech and Household Finance: A Review of the Empirical Literature. China Finance Review International 10: 361–76. [ Google Scholar ] [ CrossRef ]

- Ajzen, Icek. 1991. The Theory of Planned Behavior. Organizational Behavior and Human Decision Processes 50: 179–211. [ Google Scholar ] [ CrossRef ]

- Allen, Franklin, Asli Demirguc-Kunt, Leora Klapper, and Maria Martinez Peria. 2016. The Foundations of Financial Inclusion: Understanding Ownership and Use of Formal Accounts. Journal of Financial Intermediation 27: 1–30. [ Google Scholar ] [ CrossRef ]

- Alliance for Financial Inclusion. 2019. Alliance for Financial Inclusion Policy Model: AFi Core Set of Financial Inclusion Indicators. Bringing Smart Policies to Life , 1–26. Available online: www.afi-global.org (accessed on 14 March 2022).

- Almansour, Mohammed. 2023. Artificial Intelligence and Resource Optimization: A Study of Fintech Start-Ups. Resources Policy 80: 103250. [ Google Scholar ] [ CrossRef ]

- Alnemer, Hashem Abdullah. 2022. Determinants of Digital Banking Adoption in the Kingdom of Saudi Arabia: A Technology Acceptance Model Approach. Digital Business 2: 100037. [ Google Scholar ] [ CrossRef ]

- An, Chaofan, Xiaoxia He, and Lin Zhang. 2023. The Coordinated Impacts of Agricultural Insurance and Digital Financial Inclusion on Agricultural Output: Evidence from China. Heliyon 9: e13546. [ Google Scholar ] [ CrossRef ] [ PubMed ]

- Andreou, Panayiotis C., and Sofia Anyfantaki. 2021. Financial Literacy and Its Influence on Internet Banking Behavior. European Management Journal 39: 658–74. [ Google Scholar ] [ CrossRef ]

- Ardic, Oya Pinar, Kathryn Imboden, and Alexia Latortue. 2013. Financial Access 2012 Getting to a More Comprehensive Picture. Available online: https://www.cgap.org/sites/default/files/cgap_forum_FAS2012.pdf (accessed on 14 March 2022).

- Arner, Douglas W., Dirk A. Zetzsche, Ross P. Buckley, and Janos N. Barberis. 2019. The Identity Challenge in Finance: From Analogue Identity to Digitized Identification to Digital KYC Utilities. European Business Organization Law Review 20: 55–80. [ Google Scholar ] [ CrossRef ]

- Arner, Douglas W., Ross P. Buckley, Dirk A. Zetzsche, and Robin Veidt. 2020. Sustainability, FinTech and Financial Inclusion. European Business Organization Law Review 21: 7–35. [ Google Scholar ] [ CrossRef ]

- Asongu, Simplice A., Joseph Nnanna, and Paul N. Acha-Anyi. 2020. Inequality and Gender Economic Inclusion: The Moderating Role of Financial Access in Sub-Saharan Africa. Economic Analysis and Policy 65: 173–85. [ Google Scholar ] [ CrossRef ]

- Babajide, Abiola A., Folasade B. Adegboye, and Alexander E. Omankhanlen. 2015. Financial Inclusion and Economic Growth in Nigeria. International Journal of Economics and Financial Issues 5: 629–37. [ Google Scholar ]

- Baidoo, Samuel Tawiah, Elliot Boateng, and Mary Amponsah. 2018. Understanding the Determinants of Saving in Ghana: Does Financial Literacy Matter? Journal of International Development 30: 886–903. [ Google Scholar ] [ CrossRef ]

- Bajunaied, Kholoud, Nazimah Hussin, and Suzilawat Kamarudin. 2023. Behavioral Intention to Adopt FinTech Services: An Extension of Unified Theory of Acceptance and Use of Technology. Journal of Open Innovation: Technology, Market, and Complexity 9: 100010. [ Google Scholar ] [ CrossRef ]

- Banerjee, Sayantani, and Greeshma Francis. 2014. Financial Inclusion and Social Development. International Journal of Scientific Research and Management 2321: 13–18. [ Google Scholar ]

- Bansal, Harvir S., and Shirley F. Taylor. 2002. Investigating Interactive Effects in the Theory of Planned Behavior in a Service-Provider Switching Context. Psychology & Marketing 19: 407–25. [ Google Scholar ] [ CrossRef ]

- Barik, Rajesh, and Pritee Sharma. 2019. Analyzing the Progress and Prospects of Financial Inclusion in India. Journal of Public Affairs 19: e1948. [ Google Scholar ] [ CrossRef ]

- Beck, Thorsten, Asli Demirguc-Kunt, and Maria Soledad Martinez Peria. 2007. Reaching out: Access to and Use of Banking Services across Countries. Journal of Financial Economics 85: 234–66. [ Google Scholar ] [ CrossRef ]

- Bhanot, Disha, Varadraj Bapat, and Bera Sasadhar. 2012. Studying Financial Inclusion in North-East India. International Journal of Bank Marketing 30: 465–84. [ Google Scholar ] [ CrossRef ]

- Campero, Alejandra, and Karen Kaiser. 2013. Access to Credit: Awareness and Use of Formal and Informal Credit Institutions . Working Papers, No. 2013-07. Ciudad de México: Banco deMéxico. Available online: https://econpapers.repec.org/RePEc:bdm:wpaper:2013-07 (accessed on 10 February 2021).

- Cao, Ting, Wade D. Cook, and M. Murat Kristal. 2022. Has the Technological Investment Been Worth It? Assessing the Aggregate Efficiency of Non-Homogeneous Bank Holding Companies in the Digital Age. Technological Forecasting and Social Change 178: 121576. [ Google Scholar ] [ CrossRef ]

- Chukhrova, Nataliya, and Arne Johannssen. 2021. Stochastic Claims Reserving Methods with State Space Representations: A Review. Risks 9: 198. [ Google Scholar ] [ CrossRef ]

- Claessens, Stijn, and Enrico Perotti. 2007. Finance and Inequality: Channels and Evidence. Journal of Comparative Economics 35: 748–73. [ Google Scholar ]

- Clámara, Noelia, Ximena Peña, and Tuesta David. 2014. Factors That Matter for Financial Inclusion: Evidence from Peru. In BBVA Research, Working Paper No. 14/09 . Madrid: BBVA Research, pp. 1–26. [ Google Scholar ] [ CrossRef ]

- Cude, Brenda J., Swarn Chatterjee, and Jamal Tavosi. 2019. Financial Knowledge among Iranian Investors. International Journal of Consumer Studies 43: 503–13. [ Google Scholar ] [ CrossRef ]

- Demirguc-Kunt, Asli, Leora Klapper, and Dorothe Singer. 2013. Financial Inclusion and Legal Discrimination against Women Evidence from Developing Countries. Policy Research Working Paper 6416. Available online: https://www.mfw4a.org/sites/default/files/resources/Financial Inclusion and Legal Discrimination Against Women Evidence from Developing Countries.pdf (accessed on 10 February 2021).

- Demirguc-Kunt, Asli, Leora Klapper, Dorothe Singer, and Peter Van Oudheusden. 2015. The Global Findex Database 2014 Measuring Financial Inclusion around the World. Policy Research Working Paper 7255. Available online: https://documents1.worldbank.org/curated/en/187761468179367706/pdf/WPS7255.pdf (accessed on 10 February 2021).

- Demirguc-Kunt, Asli, Leora Klapper, Dorothe Singer, Saniya Ansar, and Jake Hess. 2018. The Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution . Washington, DC: International Bank for Reconstruction and Development/The World Bank. [ Google Scholar ] [ CrossRef ]

- Denyer, David, and David Tranfield. 2009. Producing a Systematic Review. In The Sage Handbook of Organizational Research Methods . Thousand Oaks: Sage Publications Ltd. [ Google Scholar ]

- Didenko, Iryna, Jolanta Paucz-Olszewska, Serhiy Lyeonov, Anna Ostrowska-Dankiewicz, and Zbigniew Ciekanowski. 2020. Social Safety and Behavioral Aspects of Populations Financial Inclusion: A Multicountry Analysis. Journal of International Studies 13: 347–59. [ Google Scholar ] [ CrossRef ]

- Diniz, Eduardo, Rene Birochi, and Marlei Pozzebon. 2012. Triggers and Barriers to Financial Inclusion: The Use of ICT-Based Branchless Banking in an Amazon County. Electronic Commerce Research and Applications 11: 484–94. [ Google Scholar ] [ CrossRef ]

- Duvendack, Maren, and Philip Mader. 2020. Impact of Financial Inclusion in Low- and Middle-Income Countries: A Systematic Review of Reviews. Journal of Economic Surveys 34: 594–629. [ Google Scholar ] [ CrossRef ]

- East, Robert. 1993. Investment Decisions and the Theory of Planned Behaviour. Journal of Economic Psychology 14: 337–75. [ Google Scholar ] [ CrossRef ]

- Erlando, Angga, Feri Dwi Riyanto, and Someya Masakazu. 2020. Financial Inclusion, Economic Growth, and Poverty Alleviation: Evidence from Eastern Indonesia. Heliyon 6: e05235. [ Google Scholar ] [ CrossRef ]

- Ferrari, Ms Valeria. 2022. The Platformisation of Digital Payments: The Fabrication of Consumer Interest in the EU FinTech Agenda. Computer Law and Security Review 45: 105687. [ Google Scholar ] [ CrossRef ]

- Friedline, Terri, and Stacia West. 2016. Financial Education Is Not Enough: Millennials May Need Financial Capability to Demonstrate Healthier Financial Behaviors. Journal of Family and Economic Issues 37: 649–71. [ Google Scholar ] [ CrossRef ]

- Garikipati, Supriya. 2008. The Impact of Lending to Women on Household Vulnerability and Women’s Empowerment: Evidence from India. World Development 36: 2620–42. [ Google Scholar ] [ CrossRef ]

- George, Okello Candiya Bongomin, and Ntayi Joseph Mpeera. 2020. Mobile Money Adoption and Usage and Financial Inclusion: Mediating Effect of Digital Consumer Protection. Digital Policy, Regulation and Governance 22: 157–76. [ Google Scholar ] [ CrossRef ]

- Goodell, John, Satish Kumar, Weng Marc Lim, and Debidutta Pattnaik. 2021. Artificial Intelligence and Machine Learning in Finance: Identifying Foundations, Themes, and Research Clusters from Bibliometric Analysis. Journal of Behavioral and Experimental Finance 32: 100577. [ Google Scholar ] [ CrossRef ]

- Goyal, Kirti, and Satish Kumar. 2020. Financial Literacy: A Systematic Review and Bibliometric Analysis. International Journal of Consumer Studies 45: 80–105. [ Google Scholar ] [ CrossRef ]

- Goyal, Sandeep, Amit Kapoor, and Bruno Sergi. 2020. Empowering Rural Women through Shared Value Approach Study of GNFC Neem Project in India. World Review of Entrepreneurship Management and Sustainable Development 16: 359–79. [ Google Scholar ] [ CrossRef ]

- Grohmann, Antonia, Theres Klühs, and Lukas Menkhoff. 2018. Does Financial Literacy Improve Financial Inclusion? Cross Country Evidence. World Development 111: 84–96. [ Google Scholar ] [ CrossRef ]

- Grohs-Müller, Stefan, and Bettina Greimel-Fuhrmann. 2018. Students’ Money Attitudes and Financial Behaviour: A Study on the Relationship between Two Components of Financial Literacy. Empirische Pädagogik 32: 369–86. [ Google Scholar ]

- Gutiérrez-Nieto, Begoña, and Carlos Serrano-Cinca. 2019. 20 Years of Research in Microfinance: An Information Management Approach. International Journal of Information Management 47: 183–97. [ Google Scholar ] [ CrossRef ]

- Han, Rui, and Maring Melecky. 2013. Financial Inclusion for Stability: Access to Bank Deposits and the Deposit Growth during the Global Financial Crisis. Policy Research Working Paper 6577. Available online: https://mpra.ub.uni-muenchen.de/48339/ (accessed on 10 February 2021).

- Hanafizadeh, Payam, and Ahad Zare Ravasan. 2018. A Model for Selecting IT Outsourcing Strategy: The Case of e-Banking Channels. Journal of Global Information Technology Management 21: 111–38. [ Google Scholar ] [ CrossRef ]

- Hassan, Md Sharif, Md Aminul Islam, Mohd Faizal Yusof, and Hussen Nasir. 2023. Users’ Fintech Services Acceptance: A Cross-Sectional Study on Malaysian Insurance & Takaful Industry. Heliyon 9: e21130. [ Google Scholar ] [ CrossRef ]

- Hogarth, Jeanne M., and Chris E. Anguelov. 2003. Can the Poor Save? Journal of Financial Counseling and Planning 14: 1–18. [ Google Scholar ]

- Hsu, Tsuen-ho, Yi-sheng Wang, and Su-chan Wen. 2006. Using the Decomposed Theory of Planning Behavioural to Analyse Consumer Behavioural Intention towards Mobile Text Message Coupons. Journal of Targeting, Measurement and Analysis for Marketing 14: 309–24. [ Google Scholar ] [ CrossRef ]

- Hussain, Shahzad, Raazia Gul, and Sabeeh Ullah. 2023. Role of Financial Inclusion and ICT for Sustainable Economic Development in Developing Countries. Technological Forecasting and Social Change 194: 122725. [ Google Scholar ] [ CrossRef ]

- Iqbal, Badar Alam, and Shaista Sami. 2017. Papel de Los Bancos En La Inclusión Financiera En La India. Contaduria y Administracion 62: 644–56. [ Google Scholar ] [ CrossRef ]

- Jappelli, Tullio, and Mario Padula. 2013. Investment in Financial Literacy and Saving Decisions. Journal of Banking & Finance 37: 2779–92. [ Google Scholar ] [ CrossRef ]

- Karlan, Dean, and Jonathan Zinman. 2010. Expanding Credit Access: Using Randomized Supply Decisions to Estimate the Impacts. Review of Financial Studies 23: 433–64. [ Google Scholar ] [ CrossRef ]

- Kass-Hanna, Josephine, Angela C. Lyons, and Fan Liu. 2022. Building Financial Resilience through Financial and Digital Literacy in South Asia and Sub-Saharan Africa. Emerging Markets Review 51: 100846. [ Google Scholar ] [ CrossRef ]

- Kawimbe, Sidney. 2020. An Assessment of the Impact of Mobile Financial Services on Financial Inclusion and Economic Development in Zambia. International Journal of Current Research 12: 10122–31. [ Google Scholar ] [ CrossRef ]

- Kempson, Elaine, Sharon Collard, and Nick Moore. 2005. Measuring Financial Capability: An Exploratory Study. Consumer Research 37, Financial Services Authority. Available online: http://www.fsa.gov.uk/pubs/consumer-research/crpr37.pdf (accessed on 18 March 2021).

- Kempson, Elaine, Andrea Finney, and Christian Poppe. 2017. Financial Well-Being A Conceptual Model and Preliminary Analysis. Available online: https://www.researchgate.net/publication/318852257_Financial_Well Being_A_Conceptual_Model_and_Preliminary_Analysis (accessed on 18 March 2021).

- Kim, Dai Won, Jung Suk Yu, and M. Kabir Hassan. 2018. Financial Inclusion and Economic Growth in OIC Countries. Research in International Business and Finance 43: 1–14. [ Google Scholar ] [ CrossRef ]

- Kitchenham, Barbara, O. Pearl Brereton, David Budgen, Mark Turner, John Bailey, and Stephen Linkman. 2009. Systematic Literature Reviews in Software Engineering—A Systematic Literature Review. Information and Software Technology 51: 7–15. [ Google Scholar ] [ CrossRef ]

- Klapper, Leora, Mayada El-Zoghbi, and Jake Hess. 2016. Achieving the Sustainable Development Goals The Role of Financial Inclusion. CGAP 23: 2016. [ Google Scholar ]

- Kochar, Anjini, Closepet Nagabhushana, Ritwik Sarkar, Rohan Shah, and Geeta Singh. 2022. Financial Access and Women’s Role in Household Decisions: Empirical Evidence from India’s National Rural Livelihoods Project. Journal of Development Economics 155: 102821. [ Google Scholar ] [ CrossRef ]

- Koh, Francis, Kok Fai Phoon, and Cao Duy Ha. 2018. Digital Financial Inclusion in South East Asia. In Handbook of Blockchain, Digital Finance, and Inclusion , 1st ed. Amsterdam: Elsevier Inc., vol. 2. [ Google Scholar ] [ CrossRef ]

- Koomson, Isaac, and Muazu Ibrahim. 2018. Financial Inclusion and Growth of Non-Farm Enterprises in Ghana. In Financing Sustainable Development in Africa . Edited by Uchenna R. Efobi and Simplice Asongu. Cham: Springer International Publishing, pp. 369–96. [ Google Scholar ] [ CrossRef ]

- Koomson, Isaac, Renato A. Villano, and David Hadley. 2020. Intensifying Financial Inclusion through the Provision of Financial Literacy Training: A Gendered Perspective. Applied Economics 52: 375–87. [ Google Scholar ] [ CrossRef ]

- Kraus, Sascha, Matthias Breier, and Sonia Dasí-Rodríguez. 2020. The Art of Crafting a Systematic Literature Review in Entrepreneurship Research. International Entrepreneurship and Management Journal 16: 1023–42. [ Google Scholar ] [ CrossRef ]

- Kumar, Nitin. 2013. Financial Inclusion and Its Determinants: Evidence from India. Journal of Financial Economic Policy 5: 4–19. [ Google Scholar ] [ CrossRef ]

- Lauer, Kate, and Timothy Lyman. 2015. Digital Financial Inclusion: Implications for Customers, Regulators, Supervisors, and Standard-Setting Bodies . Cgap Brief. Washington, DC: The World Bank. [ Google Scholar ]

- Levine, Ross. 2005. Finance and Growth: Theory and Evidence. Handbook of Economic Growth 1: 865–934. [ Google Scholar ] [ CrossRef ]

- Lusardi, Annamaria, and Olivia Mitchell. 2014. The Economic Importance of Financial Literacy: Theory and Evidence. Journal of Economic Literature 52: 5–44. [ Google Scholar ] [ CrossRef ]

- Lusardi, Annamaria, and Peter Tufano. 2015. Debt Literacy, Financial Experiences, and Over Indebtedness. Journal of Pension Economics and Finance 14: 332–68. [ Google Scholar ] [ CrossRef ]

- Lusardi, Annamaria, Olivia S. Mitchell, and Vilsa Curto. 2014. Financial Literacy and Financial Sophistication in the Older Population. Journal of Pension Economics and Finance 13: 347–66. [ Google Scholar ] [ CrossRef ]

- Mahmud, Khaled, Md. Mahbubul Alam Joarder, and Kazi Sakib. 2023. Customer Fintech Readiness (CFR): Assessing Customer Readiness for Fintech in Bangladesh. Journal of Open Innovation: Technology, Market, and Complexity 9: 100032. [ Google Scholar ] [ CrossRef ]

- Maity, Shrabanti. 2023. Self Help Groups, Microfinance, Financial Inclusion and Social Exclusion: Insight from Assam. Heliyon 9: e16477. [ Google Scholar ] [ CrossRef ]

- Malik, Shruti, Girish Chandra Maheshwari, and Archana Singh. 2020. Formal vs. Informal Demand for Credit by Women in Urban India: A Comparative Study in Slums of Delhi and Mumbai. Gender in Management 36: 131–48. [ Google Scholar ] [ CrossRef ]

- Manyika, James, Susan Lund, Marc Singer, Olivia White, and Chris Berry. 2016. Digital Finance for All: Powering Inclusive Growth in Emerging Economies . New York: McKinsey Global Institute. Available online: https://www.mckinsey.com/~/media/McKinsey/Featured Insights/Employment and Growth/How digital finance could boost growth in emerging economies/MGI-Digital-Finance-For-All-Executive-summary-September-2016.ashx (accessed on 20 February 2022).

- Marangunić, Nikola, and Andrina Granić. 2015. Technology Acceptance Model: A Literature Review from 1986 to 2013. Universal Access in the Information Society 14: 81–95. [ Google Scholar ] [ CrossRef ]

- Mi Alnaser, Feras, Samar Rahi, Mahmoud Alghizzawi, and Abdul Hafaz Ngah. 2023. Does Artificial Intelligence (AI) Boost Digital Banking User Satisfaction? Integration of Expectation Confirmation Model and Antecedents of Artificial Intelligence Enabled Digital Banking. Heliyon 9: e18930. [ Google Scholar ] [ CrossRef ]

- Morgan, Peter J., and Trinh Quang Long. 2020. Financial Literacy, Financial Inclusion, and Savings Behavior in Laos. Journal of Asian Economics 68: 101197. [ Google Scholar ] [ CrossRef ]

- Morgan, Peter, and Long Trinh. 2019. Determinants and Impacts of Financial Literacy in Cambodia and Viet Nam. Journal of Risk and Financial Management 12: 19. [ Google Scholar ] [ CrossRef ]

- Mouna, Amari, and Anis Jarboui. 2016. Financial Literacy in Tunisia: Its Determinants and Its Implications on Investment Behavior. Research in International Business and Finance 39: 568–77. [ Google Scholar ] [ CrossRef ]

- Moutinho, Luiz, and Anne Smith. 2000. Modelling Bank Customer Satisfaction through Mediation of Attitudes towards Human and Automated Banking. International Journal of Bank Marketing 18: 124–34. [ Google Scholar ] [ CrossRef ]

- Muqtada, Muhammed. 2020. Macroeconomic Policy, Price Stability and Inclusive Growth BT—Quest for Inclusive Growth in Bangladesh: An Employment-Focused Strategy . Edited by Muhammed Muqtada. Singapore: Springer, pp. 93–135. [ Google Scholar ] [ CrossRef ]

- Nanda, Kajole, and Mandeep Kaur. 2016. Financial Inclusion and Human Development: A Cross-Country Evidence. Management and Labour Studies 41: 127–53. [ Google Scholar ] [ CrossRef ]

- Náñez Alonso, Sergio L., Javier Jorge-Vazquez, Miguel Ángel Echarte Fernández, Konrad Kolegowicz, and Wojciech Szymla. 2022. Financial Exclusion in Rural and Urban Contexts in Poland: A Threat to Achieving SDG Eight? Land 11: 539. [ Google Scholar ] [ CrossRef ]

- Ozili, Peterson K. 2020. Contesting Digital Finance for the Poor. Digital Policy, Regulation and Governance 22: 135–51. [ Google Scholar ] [ CrossRef ]

- Paramasivan, Chelliah, and V. Ganeshkumar. 2013. Overview of Financial Inclusion in India. International Journal of Management and Development Studies 2: 45–49. [ Google Scholar ]

- Park, Cyn-Young, and Rogelio Mercado. 2018. Financial inclusion, poverty, and income inequality. The Singapore Economic Review 63: 185–206. [ Google Scholar ] [ CrossRef ]

- Pasali, Selahattin Selsah. 2013. Where Is the Cheese? Synthesizing a Giant Literature on Causes and Consequences of Financial Sector Development. In Policy Research Working Paper No. 6655, The World Bank Finance and Private Sector Development . Geneva: Graduate Institute of International Studies. [ Google Scholar ]

- Pattnaik, Debidutta, Sougata Ray, and Raghu Raman. 2024. Applications of Artificial Intelligence and Machine Learning in the Financial Services Industry: A Bibliometric Review. Heliyon 10: e23492. [ Google Scholar ] [ CrossRef ]

- Paul, Justin, and Alexander Rosado-Serrano. 2019. Gradual Internationalization vs. Born-Global/International New Venture Models: A Review and Research Agenda. International Marketing Review 36: 830–58. [ Google Scholar ] [ CrossRef ]

- Paul, Justin, Arun Mittal, and Garima Srivastav. 2016. Impact of Service Quality on Customer Satisfaction in Private and Public Sector Banks. International Journal of Bank Marketing 34: 606–22. [ Google Scholar ] [ CrossRef ]

- Paul, Justin, Sundar Parthasarathy, and Parul Gupta. 2017. Exporting Challenges of SMEs: A Review and Future Research Agenda. Journal of World Business 27: 327–42. [ Google Scholar ] [ CrossRef ]

- Pnevmatikakis, Aristodemos, Stathis Kanavos, George Matikas, Konstantina Kostopoulou, Alfredo Cesario, and Sofoklis Kyriazakos. 2021. Risk Assessment for Personalized Health Insurance Based on Real-World Data. Risks 9: 46. [ Google Scholar ] [ CrossRef ]

- Polychroniou, Panagiotis V., and Ioannis Giannikos. 2009. A Fuzzy Multicriteria Decision-making Methodology for Selection of Human Resources in a Greek Private Bank. Career Development International 14: 372–87. [ Google Scholar ] [ CrossRef ]

- Potocki, Tomasz, and Marek Cierpiał-Wolan. 2019. Factors Shaping the Financial Capability of Low-Income Consumers from Rural Regions of Poland. International Journal of Consumer Studies 43: 187–98. [ Google Scholar ] [ CrossRef ]

- Rastogi, Shailesh, and E. Ragabiruntha. 2018. Financial Inclusion and Socioeconomic Development: Gaps and Solution. International Journal of Social Economics 45: 1122–40. [ Google Scholar ] [ CrossRef ]

- Reserve Bank of India. 2015. Report of the Committee on Medium-Term Path on Financial Inclusion . Kolkata: Reserve Bank of India. [ Google Scholar ]

- Reyers, Michelle. 2019. Financial Capability and Emergency Savings among South Africans Living above and below the Poverty Line. International Journal of Consumer Studies 43: 335–47. [ Google Scholar ] [ CrossRef ]

- Sapre, Nikhil. 2023. Financial Inclusion: Philosophical and Methodological Underpinnings. Qualitative Research in Financial Markets 15: 445–52. [ Google Scholar ] [ CrossRef ]

- Sarma, Mandira, and Jesim Pais. 2011. Financial Inclusion and Development. Journal of International Development 23: 613–28. [ Google Scholar ] [ CrossRef ]

- Sharma, Dipasha. 2016. Nexus between Financial Inclusion and Economic Growth: Evidence from the Emerging Indian Economy. Journal of Financial Economic Policy 8: 13–36. [ Google Scholar ] [ CrossRef ]

- Sharma, Dipasha, Sonali Bhattacharya, and Shagun Thukral. 2018. Assessment of Financial Inclusive Policy in Indian Economy. International Journal of Ethics and Systems 34: 304–20. [ Google Scholar ] [ CrossRef ]

- Söderberg, Inga Lill. 2016. Gender Stereotyping in Financial Advisors’ Assessment of Customers. Journal of Financial Services Marketing 17: 259–72. [ Google Scholar ] [ CrossRef ]

- Swamy, Vighneswara. 2014. Financial Inclusion, Gender Dimension, and Economic Impact on Poor Households. World Development 56: 1–15. [ Google Scholar ] [ CrossRef ]

- Tappi, Marco, Gianluca Nardone, and Fabio Gaetano Santeramo. 2022. On the Relationships among Durum Wheat Yields and Weather Conditions: Evidence from Apulia Region, Southern Italy. Bio-Based and Applied Economics 11: 123–30. [ Google Scholar ] [ CrossRef ]

- Taylor, Mark. 2011. Measuring Financial Capability and Its Determinants Using Survey Data. Social Indicators Research 102: 297–314. [ Google Scholar ] [ CrossRef ]

- Tinker, I. 2001. Poverty and Gender in Developing Nations. In International Encyclopedia of the Social & Behavioral Sciences . Heights: Waveland Press, pp. 11904–7. [ Google Scholar ] [ CrossRef ]

- Tranfield, David, David Denyer, and Palminder Smart. 2003. Towards a Methodology for Developing Evidence-Informed Management Knowledge by Means of Systematic Review. British Journal of Management 14: 207–22. [ Google Scholar ] [ CrossRef ]

- Vorobyev, Ivan, and Anna Krivitskaya. 2022. Reducing False Positives in Bank Anti-Fraud Systems Based on Rule Induction in Distributed Tree-Based Models. Computers & Security 120: 102786. [ Google Scholar ] [ CrossRef ]

- Wang, Jen Sheng. 2022. Verification Techniques in FinTech Compared from User Perspectives. Social Science Computer Review 41: 1438–55. [ Google Scholar ] [ CrossRef ]

- Wang, Jen Sheng. 2023. Reconfigure and Evaluate Consumer Satisfaction for Open API in Advancing FinTech. Journal of King Saud University—Computer and Information Sciences 35: 101738. [ Google Scholar ] [ CrossRef ]

- Wann, Christi R. 2017. The Impact of Teaching Financial Literacy to College Students. Journal of Economics and Finance Education 16: 98–109. [ Google Scholar ]

- World Bank. 2018. Financial Inclusion Financial Inclusion Is a Key Enabler to Reducing Poverty and Boosting Prosperity. Available online: https://www.worldbank.org/en/topic/financialinclusion/overview (accessed on 18 December 2022).

- Xi, Wenzhi, and Yingdong Wang. 2023. Digital Financial Inclusion and Quality of Economic Growth. Heliyon 9: e19731. [ Google Scholar ] [ CrossRef ]

- Xi, Haomeng, and Jizhou Wang. 2024. Social Governance, Family Happiness, and Financial Inclusion. Finance Research Letters 61: 104946. [ Google Scholar ] [ CrossRef ]

- Xiao, Jing Jian. 2008. Applying Behavior Theories to Financial Behavior. In Handbook of Consumer Finance Research . Edited by Jing Jian Xiao. New York: Springer, pp. 69–81. [ Google Scholar ] [ CrossRef ]

- Xiao, Jing Jian, Cheng Chen, and Lei Sun. 2015. Age Differences in Consumer Financial Capability. International Journal of Consumer Studies 39: 387–95. [ Google Scholar ] [ CrossRef ]

- Yadav, Priyanka, and Anil Kumar Sharma. 2016. Financial Inclusion in India: An Application of TOPSIS. Humanomics 32: 328–51. [ Google Scholar ] [ CrossRef ]

- Yanting, Zou, and Muhammad Ali. 2023. Artificial Intelligence, Digital Finance, and Financial Inclusion: A Conceptual Framework. In Financial Inclusion across Asia: Bringing Opportunities for Businesses . Edited by Choi-Meng Leong, Muhammad Ali, Syed Ali Raza, Chin-Hong Puah and Ibrahim Halil Eksi. Bradford: Emerald Publishing Limited, pp. 77–85. [ Google Scholar ] [ CrossRef ]

- Zeinalizadeh, Nooshin, Amir Abbas Shojaie, and Mohammad Shariatmadari. 2015. Modeling and Analysis of Bank Customer Satisfaction Using Neural Networks Approach. International Journal of Bank Marketing 33: 717–32. [ Google Scholar ] [ CrossRef ]

| The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

Share and Cite

Mishra, D.; Kandpal, V.; Agarwal, N.; Srivastava, B. Financial Inclusion and Its Ripple Effects on Socio-Economic Development: A Comprehensive Review. J. Risk Financial Manag. 2024 , 17 , 105. https://doi.org/10.3390/jrfm17030105

Mishra D, Kandpal V, Agarwal N, Srivastava B. Financial Inclusion and Its Ripple Effects on Socio-Economic Development: A Comprehensive Review. Journal of Risk and Financial Management . 2024; 17(3):105. https://doi.org/10.3390/jrfm17030105

Mishra, Deepak, Vinay Kandpal, Naveen Agarwal, and Barun Srivastava. 2024. "Financial Inclusion and Its Ripple Effects on Socio-Economic Development: A Comprehensive Review" Journal of Risk and Financial Management 17, no. 3: 105. https://doi.org/10.3390/jrfm17030105

Article Metrics

Article access statistics, further information, mdpi initiatives, follow mdpi.

Subscribe to receive issue release notifications and newsletters from MDPI journals

IMAGES

COMMENTS

This study re-examines the construct of financial inclusion, through a literature review and confirmatory factor analysis (CFA). First, we conduct a systematic review of definitions, measures and data sources. Second, we apply CFA to test two prominent financial inclusion indices.

Financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable way.

This paper provides a comprehensive review of the recent evidence on financial inclusion from all regions of the World. It identifies the emerging themes in the financial inclusion literature...

An impressive array of research has tallied the many benefits of financial inclusion, including enabling greater investments in businesses, increasing control over money (especially for women), reducing fees and increasing the security of money, and helping households cope with shocks through savings and insurance.

The past two decades have seen a rapid increase in interest in financial inclusion, both from policymakers and researchers. This paper surveys the main findings from the literature, documenting the trends over time and gaps that have arisen across regions, income levels, and gender, among others.

This paper provides a systematic review of the theoretical literature on financial inclusion and financial stability as well as empirical research initiatives examining the relationship between the two concepts.

At CFI, we believe that women’s financial inclusion is powerfully shaped by broader societal norms. We focus on building evidence for what works to address the systemic barriers contributing to gender inequality and on how to scale successful norms-transformative initiatives.