Medical Practice Business Plan Template

Written by Dave Lavinsky

Medical Practice Business Plan

You’ve come to the right place to create your Medical Practice business plan.

We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Medical Practices.

Medical Practice Business Plan Example

Below is a template to help you create each section of your Medical Practice business plan.

Executive Summary

Business overview.

Fresno Medical is a new medical practice located in Fresno, California. Our goal is to provide affordable healthcare to individuals and families living in the area and surrounding communities. We offer general and preventative healthcare for all ages, including checkups, screening tests, and immunizations.

Our medical practitioners and supporting staff are well-trained and have a passion for improving the health and well-being of our clients. We serve our patients not just with our knowledge and skills but also with our hearts. We aim to help our patients experience the best healthcare possible while maintaining relationships that last a lifetime.

Service Offering

Fresno Medical practice will focus on providing primary care services to every family member, from infants to adults. Some of the general and primary care services we provide include:

- Immunizations: flu shots, COVID boosters, measles, mumps, polio, etc.

- Annual checkups

- Pediatrics: checkups, developmental screening, immunizations, etc.

- Health screenings: blood pressure, cholesterol, depression, diabetes, etc.

- General health counseling

Fresno Medical will work with local and national insurance companies to ensure that every patient can afford our services. If the patient’s insurance does not cover all of their medical costs, Fresno Medical will provide payment plan options so that they are not overwhelmed by their medical bills.

Customer Focus

Fresno Medical will primarily serve the community of Fresno, California. The community consists primarily of middle to lower income residents who need access to affordable medical care. Many of these residents are hesitant to go to hospitals or other medical facilities due to their costs. We will offer lower prices, flexible payment plans, and flexibility when working with insurance companies to accommodate this demographic.

Management Team

Fresno Medical is owned and operated by Jessica Wells, who has been working as a doctor at local hospitals for 15 years. Throughout her career, she has worked for hundreds of patients and families with all their general and preventative care needs. Though she has never run a medical practice herself, she has worked in the industry long enough to gain an in-depth knowledge of the business, including the operations side (e.g., running day-to-day operations) and the business management side (e.g., staffing, marketing, etc.).

Fresno Medical will also employ nurses, expert medical staff, and administrative assistants that are passionate about helping the local community.

Success Factors

Fresno Medical will be able to achieve success by offering the following competitive advantages:

- Location: Fresno Medical’s location is in a high-traffic area that is easily accessible to thousands of residents. It’s visible from the street with many people walking and driving to and from work on a daily basis.

- Patient-oriented service: Fresno Medical will have a staff that prioritizes the needs of the patients and educates them on the proper way to take care of themselves.

- Management: Jessica Wells has a genuine passion to help the community. Because of her previous experience and reputation in the medical community, she is fully equipped to open this practice.

- Relationships: Jessica Wells has developed strong connections with her patients and fellow staff throughout her career. Many patients have expressed interest in following Jessica to her new practice, and some former colleagues have shown interest in working for the clinic. Jessica also has relationships with medical equipment suppliers and insurance companies.

Financial Highlights

Fresno Medical is currently seeking $400,000 to launch. The capital will be used for funding capital expenditures, staffing, marketing expenses, and working capital.

The breakdown of the funding may be seen below:

- Clinic design/build: $100,000

- Medical supplies and equipment: $130,000

- Three months of overhead expenses (payroll, rent, utilities): $100,000

- Marketing and advertising: $50,000

- Working capital: $20,000

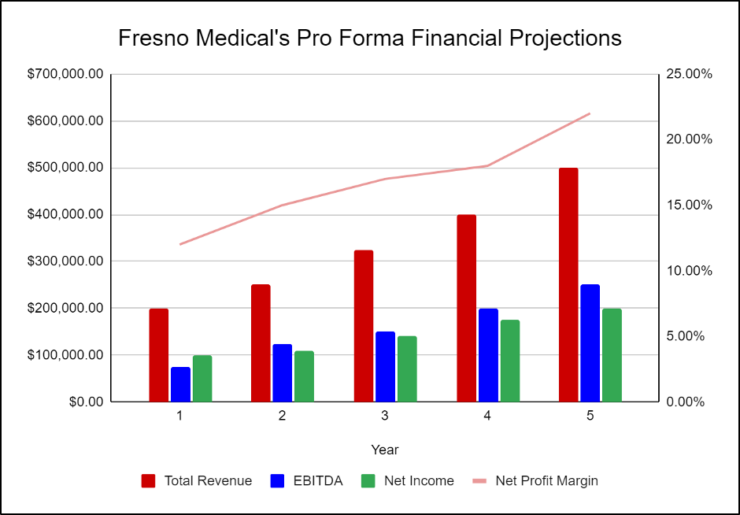

The following graph below outlines the pro forma financial projections for Fresno Medical.

Company Overview

Who is fresno medical.

Fresno Medical is a medical practice located in Fresno, California. We offer general and preventative health care for all ages. We offer immunizations, pediatrics, health screenings, and more. Our medical practitioners and supporting staff are well-trained to improve the health and well-being of our patients.

Fresno Medical is run and owned by Jessica Wells, who has been a doctor in the local medical community for 15 years. She has helped hundreds of patients and families with their general healthcare needs throughout her career. She also has gained knowledge and experience in the operations and marketing aspects of the medical business, which will prove indispensable for this private practice.

Fresno Medical’s History

After years of working with patients in hospital settings, Jessica Wells decided to establish a private practice. She wanted to develop a closer relationship with her patients, which was difficult to achieve while working in a large hospital. With this goal in mind, Jessica incorporated Fresno Medical as an S-corporation on March 15th, 2023.

Since its incorporation, the medical practice has achieved the following milestones:

- Found a clinic space and signed a Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Hired a contractor for the office build-out

- Determined equipment and fixture requirements

- Began recruiting key employees with previous healthcare experience

- Drafted marketing campaigns to promote the practice

Fresno Medical’s Services

Fresno Medical will focus on providing primary care services to every family member, from infants to adults. The costs will depend upon the materials used, the physician’s time, and the amount designated for each procedure. Some of the general and primary care services we provide include:

- Immunizations: flu shots, measles, mumps, polio, etc.

Fresno Medical will maintain privacy according to HIPAA regulations. All patients will be welcome, including those without insurance. However, we expect most patients to utilize their insurance plans to pay their costs. The medical practice will work with local and national insurance companies to ensure that every family can afford our services. After billing insurance, Fresno Medical will provide flexible payment plan options so that no patient is overwhelmed by their medical bills.

Industry Analysis

Healthcare is a human right that everyone deserves access to. The medical industry will always be a necessity as it is the industry keeping society alive and well. Therefore, the medical industry is expected to continue to grow as the population grows. This is especially true for private practices, as there is a rising demand for small, patient-focused clinics that provide top-tier medical services.

Furthermore, the demand for private physicians has been on the rise. Hospitals have been low on rooms and beds the past few years, and nurses and doctors have been overworked. This has led to an increased demand for more medical professionals and private practices that can help lessen the load of larger hospitals.

Moreover, the pandemic instilled the importance of quality healthcare and practices in the general population. We expect that people all around the world will now put in more effort towards taking care of their health and getting the care and screenings they need.

According to Facts & Factors, the global private medical market is expected to experience a compound annual growth rate (CAGR) of 12.5% over the next five years. This is enormous growth that is rarely seen in other industries. Furthermore, there is a growing demand for more primary care physicians as the general population aims to prevent developing chronic and preventable diseases. According to Grand View Research, the primary care market will experience a CAGR of 3.2% over the next 10 years, which is also moderate growth.

With such a demand for more medical practices and a greater emphasis on general health, we believe that Fresno Medical is starting at the right time and will see great success.

Customer Analysis

Demographic profile of target market.

Fresno Medical will serve the community residents of Fresno, California, and its surrounding areas. The community of Fresno, California has thousands of middle-class individuals and families seeking an affordable medical practice to take care of all their health concerns.

The demographics of Fresno, California are as follows:

| Total | Percent | |

|---|---|---|

| Total population | 1,680,988 | 100% |

| Male | 838,675 | 49.9% |

| Female | 842,313 | 50.1% |

| 20 to 24 years | 114,872 | 6.8% |

| 25 to 34 years | 273,588 | 16.3% |

| 35 to 44 years | 235,946 | 14.0% |

| 45 to 54 years | 210,256 | 12.5% |

| 55 to 59 years | 105,057 | 6.2% |

| 60 to 64 years | 87,484 | 5.2% |

| 65 to 74 years | 116,878 | 7.0% |

| 75 to 84 years | 52,524 | 3.1% |

Customer Segmentation

The company will primarily target the following customer segments:

- Middle-class individuals

- Hospital patients

Competitive Analysis

Direct and indirect competitors.

Fresno Medical will face competition from other companies with similar business profiles. A description of each competitor company is below.

City Metro Hospital

Founded in 1968, City Metro Hospital is one of the most popular hospitals in the area. Thousands of residents get all their primary care and emergency care needs taken care of with City Metro. It provides almost every service you can think of and enlists the help of thousands of doctors, nurses, and other expert medical professionals.

Though City Metro Hospital will continue to thrive, it does not foster an environment designed for long-lasting relationships. Since the pandemic, the hospital has been overwhelmed with patients and a staff shortage. This has led to doctors seeing thousands of patients and a tremendous increase in wait times. Fresno Medical will offer a more intimate setting where patients and doctors can create a long-lasting relationship that spans decades.

Quality Doctors

Quality Doctors is a private medical practice that provides highly personalized medical care. Quality Doctors includes a team of dedicated healthcare professionals with dual residency in emergency medicine and internal medicine. The practice offers same-day/next-day appointments, telemedicine, office visits, and home visits. Services offered by Quality Doctors include primary care, urgent care, and virtual visits.

Like City Metro Hospital, Quality Doctors is a large care system that cares for thousands of patients. This means that patients also do not get a close relationship with their doctor, which many crave. Furthermore, Quality Doctors has put much of its money and services toward emergency care in recent years and reduced its primary care services. Patients who want a lasting relationship with a primary care doctor will feel more welcome with Fresno Medical.

Johnson Community Care

Established in 1949, Johnson Community Care is a private medical practice with multiple locations. Patients all around the state can receive care at any location near them. Each site provides primary care services, emergency care, pharmacy services, and lab testing. Instead of heading to multiple locations to get all of these services, patients can get all their healthcare needs taken care of in one building.

Though Johnson is a highly successful medical practice, its major downfall is that it only provides services to those with its unique insurance plan. Therefore, anyone who has insurance through another company or plans provided by their employer cannot receive care at Johnson without paying out-of-network prices. Fresno Medical will partner with many insurance companies and provide flexible payment plans to help as many patients as possible.

Competitive Advantage

Fresno Medical enjoys several advantages over its competitors. These advantages include:

- Relationships: Jessica Wells has developed strong connections with her patients and fellow staff during her career. Many patients have expressed interest in following Jessica to her new practice, and some former colleagues have shown interest in working for the clinic. Jessica also has relationships with medical equipment suppliers and insurance companies.

Marketing Plan

Brand & value proposition.

The Fresno Medical brand will focus on the company’s unique value proposition:

- Client-focused healthcare services, where the company’s interests are aligned with the customer

- Service built on long-term relationships

- Big-hospital expertise in a small-clinic environment

- Moderate pricing for all preventative and general health services

Promotions Strategy

The promotions strategy for Fresno Medical is as follows:

Fresno Medical understands that the best promotion comes from satisfied patients. The clinic will encourage its patients to refer their friends and family by providing healthcare benefits for every new client produced. This strategy will increase in effectiveness after the business has already been established.

Social Media

We will maintain a social media presence to attract local clients looking for a new doctor or medical practice. We will post information about our team, services, and general health tips for better wellness. To create a genuine connection with our patients, we will also use social media to engage with them and answer any questions they may have about our practice.

Fresno Medical will have an informative and attractive website featuring all its services and referrals from other satisfied patients. The website will be highly informative and be designed in a way that is friendly and eye-catching.

Fresno Medical will invest in a high SEO presence so that the clinic is listed at the top of the Google or Bing search engine when a potential patient is researching private medical practices in Fresno, California.

Fresno Medical’s pricing will be significantly lower than big hospitals. We will partner with as many insurance companies as possible to ensure that our patients’ medical care is covered. For services not fully covered by insurance, we offer a flexible payment program so patients are not overwhelmed by their medical bills.

Operations Plan

The following will be the operations plan for Fresno Medical.

Operation Functions:

- Jessica Wells will operate as the CEO of Fresno Medical. She will run all the general operations and executive functions of the company. She will also provide basic medical care for patients until she can hire a full medical staff.

- Jessica is joined by Mindy Keller, who will serve as the Marketing Manager and run all of the marketing and advertising efforts.

- Jessica is also joined by Rhonda Smith, who will work as the Receptionist of the clinic and the Administrative Assistant for the company.

- Jessica is also joined by Cindy Nguyen who will be the company’s Head Nurse. She will manage and train incoming nurses and provide medical treatment to patients.

- Jessica will continue to hire a team of medical staff to treat the medical practice’s growing patient list. The team will consist of doctors, nurses, physicians, and other necessary medical staff.

Milestones:

Fresno Medical expects to achieve the following milestones in the following six months:

- 4/202X Finalize lease agreement

- 5/202X Design and build out Fresno Medical

- 6/202X Hire and train initial staff

- 7/202X Kickoff of promotional campaign

- 8/202X Launch Fresno Medical

- 9/202X Reach break-even

Fresno Medical is owned and operated by Jessica Wells, who has been working as a doctor at local hospitals for 15 years. Throughout her career, she has worked with hundreds of patients and families and taken care of all their general and preventative care needs. Though she has never run a private medical practice herself, she has worked in the industry long enough to gain an in-depth knowledge of the business, including the operations side (e.g., running day-to-day operations) and the business management side (e.g., staffing, marketing, etc.).

The medical practice will also employ nurses, expert medical staff, and administrative assistants that are passionate about helping the local community.

Financial Plan

Key revenue & costs.

The revenues for the medical practice will come from the fees it will charge the patients and their insurance for the health care services it provides.

The cost drivers for the company will include the payroll of the staff, lease on the office building, medical supplies and equipment, and marketing costs.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and to pay off the startup business loan.

- Year 4: 100

- Year 5: 125

- Annual lease costs: $40,000

Financial Projections

Income statement.

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Total Revenues | $360,000 | $793,728 | $875,006 | $964,606 | $1,063,382 | |

| Expenses & Costs | ||||||

| Cost of goods sold | $64,800 | $142,871 | $157,501 | $173,629 | $191,409 | |

| Lease | $50,000 | $51,250 | $52,531 | $53,845 | $55,191 | |

| Marketing | $10,000 | $8,000 | $8,000 | $8,000 | $8,000 | |

| Salaries | $157,015 | $214,030 | $235,968 | $247,766 | $260,155 | |

| Initial expenditure | $10,000 | $0 | $0 | $0 | $0 | |

| Total Expenses & Costs | $291,815 | $416,151 | $454,000 | $483,240 | $514,754 | |

| EBITDA | $68,185 | $377,577 | $421,005 | $481,366 | $548,628 | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| EBIT | $41,025 | $350,417 | $393,845 | $454,206 | $521,468 | |

| Interest | $23,462 | $20,529 | $17,596 | $14,664 | $11,731 | |

| PRETAX INCOME | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Use of Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Taxable Income | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Income Tax Expense | $6,147 | $115,461 | $131,687 | $153,840 | $178,408 | |

| NET INCOME | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 |

Balance Sheet

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| ASSETS | ||||||

| Cash | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 | |

| Accounts receivable | $0 | $0 | $0 | $0 | $0 | |

| Inventory | $30,000 | $33,072 | $36,459 | $40,192 | $44,308 | |

| Total Current Assets | $184,257 | $381,832 | $609,654 | $878,742 | $1,193,594 | |

| Fixed assets | $180,950 | $180,950 | $180,950 | $180,950 | $180,950 | |

| Depreciation | $27,160 | $54,320 | $81,480 | $108,640 | $135,800 | |

| Net fixed assets | $153,790 | $126,630 | $99,470 | $72,310 | $45,150 | |

| TOTAL ASSETS | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 | |

| LIABILITIES & EQUITY | ||||||

| Debt | $315,831 | $270,713 | $225,594 | $180,475 | $135,356 | |

| Accounts payable | $10,800 | $11,906 | $13,125 | $14,469 | $15,951 | |

| Total Liability | $326,631 | $282,618 | $238,719 | $194,944 | $151,307 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| Total Equity | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| TOTAL LIABILITIES & EQUITY | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 |

Cash Flow Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | ||||||

| Net Income (Loss) | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 | |

| Change in working capital | ($19,200) | ($1,966) | ($2,167) | ($2,389) | ($2,634) | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| Net Cash Flow from Operations | $19,376 | $239,621 | $269,554 | $310,473 | $355,855 | |

| CASH FLOW FROM INVESTMENTS | ||||||

| Investment | ($180,950) | $0 | $0 | $0 | $0 | |

| Net Cash Flow from Investments | ($180,950) | $0 | $0 | $0 | $0 | |

| CASH FLOW FROM FINANCING | ||||||

| Cash from equity | $0 | $0 | $0 | $0 | $0 | |

| Cash from debt | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow from Financing | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow | $154,257 | $194,502 | $224,436 | $265,355 | $310,736 | |

| Cash at Beginning of Period | $0 | $154,257 | $348,760 | $573,195 | $838,550 | |

| Cash at End of Period | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 |

Medical Practice Business Plan FAQs

What is a medical practice business plan.

A medical practice business plan is a plan to start and/or grow your medical practice business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Medical Practice business plan using our Medical Practice Business Plan Template here .

What are the Main Types of Medical Practices?

There are a number of different kinds of medical practices , some examples include: Group medical practice, Private medical practice, and Hospital-based medical practice.

How Do You Get Funding for Your Medical Practice Business Plan?

Medical Practice businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

A well-crafted medical practice business plan is key to securing any type of funding.

What are the Steps To Start a Medical Practice Business?

Starting a medical practice business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Medical Practice Business Plan - The first step in starting a business is to create a detailed medical practice business plan that outlines all aspects of the venture. This should include market research on the medical industry and potential target market size, information the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your medical practice business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your medical practice business is in compliance with local laws.

3. Register Your Medical Practice Business - Once you have chosen a legal structure, the next step is to register your medical practice business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your medical practice business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Medical Practice Equipment & Supplies - In order to start your medical practice business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your medical practice business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful medical practice business:

- How to Open a Medical Practice

- Sample Business Plans

- Medical & Health Care

Medical Practice Business Plan

Considering starting a new medical clinic? Great. Medical practice is one of the most rewarding and profitable entrepreneurial ventures for any medical professional.

You can easily start a medical clinic, but you need a detailed business plan when it comes to staying competitive in the market, raising funds, applying for loans, and scaling it like a pro.

Need help writing a business plan for your medical practice business? You’re at the right place. Our medical practice business plan template will help you get started.

Free Business Plan Template

Download our Free Medical Practice Business Plan Template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write a Medical Practice Business Plan?

Writing a medical practice business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

- Introduce your business: Start your executive summary section by briefly introducing your business to your readers.

- This section may include the name of your medical clinic, its location when it was founded, the type of medical practice (E.g., solo practice, group practice, multi-specialty practice.), etc.

- Market opportunity: Summarize your market research, including market size, growth potential, and marketing trends. Highlight the opportunities in the market and how your business will fit in to fill the gap.

- Mention your services: Summarize your market research, including market size, growth potential, and marketing trends. Highlight the opportunities in the market and how your business will fit in to fill the gap.

- Medical services: Highlight the medical services you offer to your patients. Mention any medical specialties you have. For instance, a pediatrician specializes in providing medical care to infants, children, and adolescents.

- Marketing & sales strategies: Outline your sales and marketing strategies—what marketing platforms you use, how you plan on acquiring patients, etc.

- Financial highlights: Briefly summarize your financial projections for the initial years of business operations. Include any capital or investment requirements, associated startup costs, projected revenues, and profit forecasts.

- Call to action: Summarize your executive summary section with a clear CTA, for example, inviting angel investors to discuss the potential business investment.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your clinic. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

- Business description: Describe your business in this section by providing all the basic information:

- Primary care practice

- Specialty practice

- Surgical practice

- Pediatrics practice

- Geriatrics practice, And more.

- Describe the legal structure of your medical practice, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

- Owners: List the founders or owners of your medical practice. Describe what shares they own and their responsibilities for efficiently managing the business.

- Mission statement: Summarize your business’ objective, core principles, and values in your mission statement. This statement needs to be memorable, clear, and brief.

- Business history: If you’re an established medical practice service provider, briefly describe your business history, like—when it was founded, how it evolved over time, etc.

- Additionally, If you have received any awards or recognition for excellent work, describe them.

- Future goals: It’s crucial to convey your aspirations and vision. Mention your short-term and long-term goals; they can be specific targets for revenue, market share, or expanding your services.

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

- Target market: Start this section by describing your target market. Define your ideal customer and explain what types of services they prefer. Creating a buyer persona will help you easily define your target market to your readers.

- For instance, a primary healthcare clinic may target individuals and families seeking routine health check-ups.

- Market size and growth potential: Describe your market size and growth potential and whether you will target a niche or a much broader market.

- Competitive analysis: Identify and analyze your direct and indirect competitors. Identify their strengths and weaknesses, and describe what differentiates your medical practice services from them. Point out how you have a competitive edge in the market.

- Market trends: Analyze emerging trends in the industry, such as technology disruptions, changes in customer behavior or preferences, etc. Explain how your business will cope with all the trends.

- For instance, Artificial Intelligence (AI) and machine learning technologies are transforming the medical industry; explain how you plan on implementing these technologies in your business operations.

- Regulatory environment: List regulations and licensing requirements that may affect your medical practice, such as medical licensure, business licensing, federal regulations, billing and coding regulations, state and local regulations, etc.

Here are a few tips for writing the market analysis section of your medical clinic business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

- General medical care

- Specialty care

- Chronic disease management

- Wellness and preventive care

- Treatment and diagnosis of illness and injuries, And more.

- Describe each service: Provide a detailed description of each service you provide, including the process involved, and physical examination needed, the time required, etc.

- For instance, the process of chronic disease management may include treatment planning, patient education, medication management, patient engagement, care coordination, regular monitoring, and follow-up appointments.

- Insurance & payment options: This section should include details about accepted payment methods and insurance plans. These options may include credit cards, cash, medical health insurance, third-party insurance, etc.

- In addition to these payment options, describe if your medical practice offers regular patients discounts or any membership plans.

- Additional services: Mention if your medical practice offers any additional services. You may include services like health education and classes, geriatric care, chronic pain management, mental health services, etc.

In short, this section of your medical practice plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

- Unique selling proposition (USP): Define your business’s USPs depending on the market you serve, the equipment you use, and the unique services you provide. Identifying USPs will help you plan your marketing strategies.

- For example, advanced technology, specialized services, and emergency medical care could be some of the great USPs for a general medical clinic.

- Pricing strategy: Describe your pricing strategy—how you plan to price your medical services and stay competitive in the local market. You can mention any discounts you plan on offering to attract new patients to your facility.

- Marketing strategies: Discuss your marketing strategies to market your medical services. You may include some of these marketing strategies in your business plan—social media marketing, Google ads, brochures, email marketing, content marketing, local business directory listing, and print marketing.

- Sales strategies: Outline your strategies to maximize your sales. Your sales strategies may include partnering with other healthcare service providers(e.g., Cardiologists, dermatologists.), offering referral programs, etc. e providers to establish referral programs that can help you generate more business. Consider offering incentives for referrals or special discounts for partnerships.

- Patient retention: Describe your patient retention strategies and how you plan to execute them. For instance, introducing patient loyalty programs, offering membership discounts, encouraging routine medical check-ups, etc.

Overall, this section of your medical practice business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your medical clinic, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

- Staffing & Training: Describe your staffing requirements, including the number of doctors, assistants, nurses, and any other support staff you will need. Include their qualifications, years of experience, and the duties they will perform.

- Operational process: Outline the processes and procedures you will use to run your medical clinic. Your operational processes may include managing patient flow, scheduling appointments, patient registration, patient treatment, record-keeping, billing, and after-treatment check-ups.

- Safety and Infection Control: Describe the safety and infection control practices and protocols you plan to implement, keeping patients, staff, and visitors’ safety in mind. These protocols may include waste management, disinfection, sterilization, infection surveillance, etc.

- Equipment & Technology: Include the list of equipment and technology that will be used in the medical practice, such as laboratory and surgical equipment, patient monitoring devices, personal protection equipment, etc.

- In addition, provide details on the sourcing and maintenance of these instruments and equipment. Explain how these technologies benefit your patients and help you stand out as a medical service provider.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your medical practice’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

- Founder/CEO: Mention the founders and CEO of your medical practice, and describe their roles and responsibilities in successfully running the business.

- Key managers: Introduce your management and key members of your team, and explain their roles and responsibilities. Business plans for solo practitioners typically don’t include key managers.

- It should include, Medical director, department/division heads, committees, and other doctors involved in the medical operations, including their education, specialization, professional background, and years of experience in the medical industry.

- Organizational structure: Explain the organizational structure of your management team. Include the reporting line and decision-making hierarchy.

- Compensation plan: Describe your compensation plan for the management and staff. Include their salaries, incentives, and other benefits.

- Advisors/consultants: Mentioning advisors or consultants in your business plans adds credibility to your business idea.

- So, if you have any advisors or consultants, include them with their names and brief information about roles and years of experience.

This section should describe the key personnel for your medical practice services, highlighting how you have the perfect team to succeed.

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

- Profit & loss statement: Describe details such as projected revenue, operational costs, and service costs in your projected profit and loss statement. Make sure to include your business’s expected net profit or loss.

- Cash flow statement: This section should estimate and describe the cash flow for the first few years of your operation. This may include billing invoices, payment receipts, loan payments, and any other cash flow statements.

- Balance sheet: Create a projected balance sheet documenting your medical practice’s assets, liabilities, and equity.

- Break-even point: Determine and mention your business’s break-even point—the point at which your business costs and revenue will be equal.

- This exercise will help you understand how much revenue you need to generate to sustain or be profitable.

- Financing needs: Calculate costs associated with starting a medical practice business, and estimate your financing needs and how much capital you need to raise to operate your business. Be specific about your short-term and long-term financing requirements, such as investment capital or loans.

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more.These statements must be the latest and offer financial projections for at least the first three or five years of business operations.

- Provide data derived from market research, including stats about the medical practice industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your medical practice business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample medical practice business plan will provide an idea for writing a successful medical practice plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our medical practice business plan pdf .

Related Posts

Medical Lab Business Plan

Medical Billing Business Plan

Write a Appendix Section for Business Plan

Telemedicine Business Plan

How to Create Business Plan

Top 10 AI Tools for Startup

Frequently asked questions, why do you need a medical practice business plan.

A business plan is an essential tool for anyone looking to start or run a successful medical practice. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your medical practice.

How to get funding for your medical practice business?

There are several ways to get funding for your medical office, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

Small Business Administration (SBA) loan

Crowdfunding, angel investors.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your medical practice business?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your general practice business plan and outline your vision as you have in your mind.

What is the easiest way to write your medical practice business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any medical practice business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

How to create a business plan for a medical practice

Starting a medical practice is no small feat. You may consider it lucrative and the right step for your career but have you considered all that it takes to start and run a medical practice? This is what a business plan is for.

A business plan is a strategic planning document that lays out in detail the objectives and goals of a company and also how the company plans to achieve its goals. A business plan can be considered a road map for any business that details a business’ profile, products and services, marketing, financials, operations and organizational structure.

Developing a business plan requires strategic planning to identify the mission and vision, target audience, operations and financials of your medical practice. This is a crucial step when starting your medical practice. In this article we will share about how to write a business plan for a new medical practice.

Why you need a business plan for a medical practice

Just like any other business, a business plan is very important before starting a medical practice. In a recent Sermo poll, 52% of respondents indicated it is important to get a business plan for your medical practice and we will share reasons why.

- A business plan helps to define the core essence of your medical practice. With a medical practice business plan, you can properly define your practice’s vision, mission, goals and target audience.

- With a medical practice business plan, one can properly estimate the financial cost of starting up as well make financial projections for a time period.

- A medical business plan can help define marketing for your practice and set SMART marketing goals.

- A medical business plan helps to strategically identify and define all the stakeholders relevant to your practice and their role in the success of your practice.

- A SWOT analysis is a core part of any business plan. This will help the medical practice understand its strengths, its competitors, opportunities and the environment where it plans to operate in.

Types of business plans for a medical practice

There are different types of business plans for different business types. For a medical practice, these two types of business plans are most common: traditional business plan and lean business plan.

A traditional business plan is a more robust type of business plan that covers a wide range of topics regarding business planning. A traditional business plan usually covers areas such as products and services, financing, marketing and organizational structure. It is often used as a guide for business operations and an effective tool for communicating the medical office business plan to investors and business partners.

A lean business plan on the other hand is a more succinct version of a traditional business plan. A lean plan is faster and easier to write. It focuses mainly on strategy, financials, important dates, milestones and activities. Think of a lean business plan as being more straight to the point. Some people use this business plan when trying to grow their business and achieve certain goals at specific timelines.

How to create a medical practice business plan

There are different medical practice business plan templates but most cover four major key areas which are company profile, sales and marketing, operations and financials.

Let’s take a look at what an ideal business plan template for medical practice should look like.

1. Executive Summary

The executive summary is usually the first section in a business plan. It should briefly describe the medical practice, products and service offerings, target audience, the organizational structure and financials.

Executive summaries should be kept short and are usually no longer than a page. However, it should have as much important information as possible. The executive summary is usually the page of interest when your business plan is being reviewed by investors and business partners.

2. Company description

This section of the business plan allows you to define your medical practice in full detail. It should include the practice’s vision and mission statements, its goals and objectives and products and offerings.

This section should detail the type of medical services your medical practice will be offering. If there are other medical experts who will be supporting your offerings, this is a good section to define that. This section should also describe your target patients.

By creating an ideal patient profile, medical practices can better describe their target patients. The ideal patient profile should describe patients best suited for the types of services you offer and who can afford to pay for your services.

3. Market Analysis

Your medical practice is most likely not the only medical practice in your location and there may be alternative options where your patients may go for treatment or medical services. The market analysis section in a medical business plan should describe the current market for your services and present competitors.

The market analysis section may require conducting a market research to understand the patient demographic and your competitors.

4. Marketing and Sales

The importance of marketing in a business cannot be overemphasized. In a Sermo poll, 64% of physicians indicated attracting and retaining patients as the biggest factor in the success of a new practice. The marketing and sales section of a medical business plan should describe how the medical practice intends to attract and retain its target patients. It should describe the marketing plan, marketing activities and the marketing goals of the medical practice.

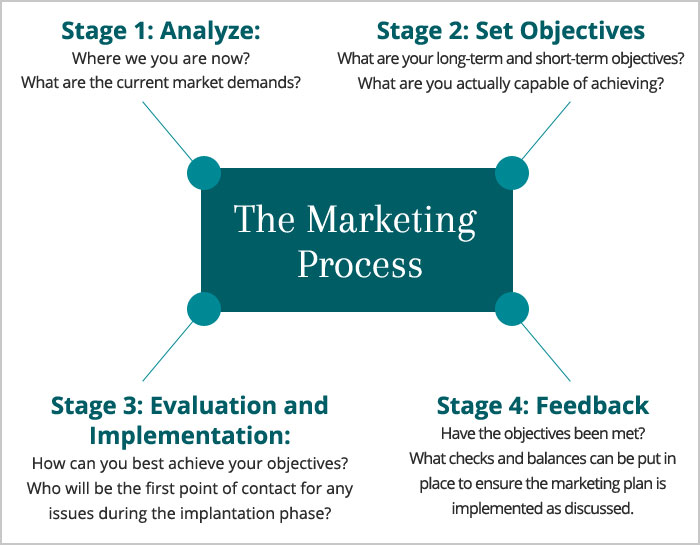

When describing this section, keep in mind the 7Ps of marketing. This includes the product, people, price, promotion, place, packaging and positioning. Each of these must be considered when developing a successful marketing strategy.

The marketing and sales section is also a good place to include a SWOT analysis. A SWOT analysis is a critical analysis of the Strength, Weakness, Opportunities and Threats of the medical practice.

5. Operations

The Operations section is a very important part of the business plan. It describes how the medical practice will work. Things to cover include, working hours, staff strength, location, technology, outsourcing and logistics.

The operations of a medical practice is very sensitive and it would help if a lot of things are defined before starting the business. For instance, the location and layout of your medical practice should be well captured and defined in the medical business plan. You should also consider outsourcing. Are you handling medical billing in-house or will it be outsourced? Will you be handling recruitment or it will be outsourced to a staffing agency?

Also supplies and logistics of medical materials should be considered and defined. If your medical practice will have a pharmacy, how will the drugs be sourced? These are some of the important questions that should be answered in this section.

6. Milestones and Timelines

This section involves setting and defining achievable milestones and corresponding deadlines. This way it is clear what needs to be done and by when it needs to be completed.

For setting up a medical practice, milestones can include major events like renting a place, purchase of medical equipment, recruitment of staff and set up of medical devices.

7. Organizational structure

A business plan is not complete without defining the organizational structure and/or team that will carry out business operations. In this section, define the management team and their required qualifications. It is also important to define roles of the management team and projected salaries.

At this point, one can also add in the hiring plan for other members of the organization. Define the other roles, how they will be recruited, skill set of interest and how much they will earn.

8. Financial plan

A solid financial plan must be included in every business plan. For a start up medical practice, the financial plan should include start up costs. The financial plan should also include a cash flow forecast that shows projections of cash inflow and outflow over a time period. This is usually broken down on a monthly basis.

A good financial plan should tell a story of how the business will grow income-wise. If your medical practice has already been established, other financial statements like income statements, balance sheets and cash flow statements will help give a better picture of the financial stability of your medical practice.

9. Appendix

This is a section reserved for miscellaneous topics. Other supporting documents such as pictures, charts, reference letters that may be of interest can be added in this section.

Building a successful medical practice starts with writing a good medical business plan. Start by strategically thinking about your medical practice. Using the guide above of a private practice business plan template, you can think through all the important aspects of starting your medical practice and write an effective business plan that will help the process.

Don’t do it alone, get help from other physicians

For more useful tips that will help you start up your medical practice, sign up on Sermo today. Engaging with more than 1 million physicians across 90 specialties and 150 countries, Sermo offers a unique physician-first online community that allows clinicians to communicate about issues that are important to them and their patients.

More physician resources

A complete guide to paid physician surveys

Maximizing your survey earnings: Tips for physician survey participants

Side gigs for physicians: The best ways to earn passive & active income

How physician surveys impact healthcare issues

Discover the latest physician survey trends: How to stay ahead in 2024

10 best medical specialties for physicians needing a change of pace

Get the newsletter

Insights for those starting, managing, and growing independent healthcare practices

Get expert tips, guides, and valuable insights for your medical practice

July 26, 2023

10 min read

Practice Growth

Starting a Practice

Free template: How to create a business plan for your new practice

Your medical practice business plan is a living document that evolves as your practice grows. Here’s how to build it from scratch.

Most Popular

At a glance.

- A medical practice business plan is crucial for establishing direction, estimating finances, and evaluating competition.

- Creating an effective business plan involves gathering relevant data, making conservative financial projections, seeking expert input, and planning for risks.

- The 8 essential sections of a thorough medical practice business plan include the executive summary, business model details, market research, staffing model, 12-month budget, and more.

Medical schools and residencies prepare doctors to provide quality patient care but not to create a medical practice business plan. Yet a business plan is a key part of reaching new patients and supporting existing ones.

An effective medical practice business plan will:

- Establish a roadmap for your practice

- Estimate your revenue and expenses

- Evaluate the competition

Creating a thorough business plan may feel like an onerous roadblock to moving forward. However, plotting your direction in advance will keep you on track later on, and will set you up to effectively serve your patients.

Why you need a business plan for your medical practice

Whether you plan to start your own practice or take over someone else’s, a robust business plan is necessary. When you develop a comprehensive business plan full of intention, clear thought processes, and fine details, you demonstrate your commitment to your practice, community, and discipline.

A solid business plan effectively positions you to prevent surprises that could completely derail your practice and reputation.

“ A solid business plan effectively positions you to prevent surprises that could completely derail your practice and reputation. ”

If you plan to seek investors or business partners for your practice, a thorough business plan demonstrates that you have both a vision and the empirical data and financial goals required to back it up. It also establishes and communicates the direction you intend to take your practice.

If you do not plan to seek outside investors, your medical practice business plan is still a key tool for the most important investor: you. Working through the 8 parts of a plan will help you evaluate the landscape, establish your foundation, and move forward with your practice.

That said, writing your business plan is not the same as establishing your budget. However, you will need to create a detailed budget so you can incorporate some of that information into your comprehensive business plan.

What is involved in developing a healthcare business plan?

As you develop your medical practice business plan, think of how you approach diagnosing a patient: a systematic process. While it may vary by practitioner, you typically:

- Get to know your patient

- Ask about symptoms and history

- Dig deeper into factors that are relevant to the current issue

- Collect data from tests

- Develop an initial diagnosis

- Seek additional counsel when appropriate

- Revisit the diagnosis if needed

- Discuss the findings and prognosis with your patient

- Schedule treatment and follow-up

The business plan creation process is similar.

Translating the process to your medical practice’s business plan

Getting to know your patient translates into defining your mission and vision. What do you want to accomplish? What is your role in your community?

Asking about symptoms and history will lead you to gather relevant documents, certifications, and professional memberships; research other local practitioners; and investigate why your practice’s focus is needed. Just as you need to know how the body’s systems fit together, you need to know how your practice will fit into the market.

Digging deeper into factors relevant to the current issue involves getting into the numbers. Evaluate:

- Your selected location

- Fee structure

- Insurance company partners, if any

- Target patient volume

- Staffing needs

- Services, whether legal, financial, or practice growth

- Equipment, medical, and office

- Maintenance and upkeep cost estimates

- Ongoing costs, including rent or property taxes

Collecting data requires gathering facts. Avoid using more lucrative or optimistic numbers. Build your plan based on conservative estimates to set your practice up for success. Determine what benchmarks to establish and measure success.

Develop an initial diagnosis by evaluating whether you’ve made inaccurate assumptions or missed key components. Revisit areas you need to and gather new information.

Seek additional counsel in this process. Your legal and financial advisors are an important resource as you create your plan, not just as you execute it. You may also consult your staff about parts of your plan in which they have expertise. Finally, partnering practitioners should agree with the plan’s approach and direction.

“ Your legal and financial advisors are an important resource as you create your plan, not just as you execute it. ”

Revisit the diagnosis. Consider the input and adjust your assumptions, numbers, and benchmarks.

Discuss the diagnosis and prognosis with your investor(s). In this step, share your completed business plan with the individual(s) with whom you are working.

Set a follow-up plan to evaluate your progress after certain periods of time.

How to build your medical practice business plan document

It’s one thing to theoretically know how to approach your medical practice business plan and another to sit down and create it. This 8-section outline will give you an idea of the crucial parts of your document.

Make a copy of this sample business plan template that you can customize and use for your practice.

1. Executive summary

In the executive summary, summarize your business model. Incorporate the information you developed while getting to know your practice.

Include an overview of information such as the practice location, services, target patient, local demographics overview, any relevant business history associated with the practice, and your mission and vision for your practice and its community impact. This is also where you will define any existing barriers to moving forward.

“ Your executive summary is an understanding and compelling argument for why the community needs your services. ”

Your executive summary is an understanding and compelling argument for why the community needs your services. It will highlight how you will fill a need that is not met in the current environment.

This is the section that will get you invited to the investor’s table, as it were. It is the bait on the hook of your argument.

Pro tip: Save the executive summary for last. Once you have the information from the other areas you will research and develop, it will quickly come together.

2. Detailed business model

Define your services and how you’ll manage prospects who fall within and outside those services. Specify your hours of operation. Define and describe your physical office space.

If you intend to offer telehealth , describe how. Define the number of staff you’ll employ, their roles, and how you plan to add staff as your practice grows. Detail the equipment you’ll use and why it’s essential.

Determine which vendors you’ll use for a variety of functions, including office cleaning; non-office hours emergency call management; office, medical, and exam equipment and furniture; office and medical supplies, software; marketing; and physical and digital security .

3. Comprehensive market research and positioning

Provide hard data on the demographics of your local geographic area and how they support your practice. For example, do enough people in your area need your services? What is the median income in the area, and how has that influenced your target fee structure?

“ Define your insurance partners, how their fee structures align with yours, and how competitive your proposed fees are. ”

Define your insurance partners , how their fee structures align with yours, and how competitive your proposed fees are.

Outline your local competition, the reasons you can be sure there is enough market availability for your new practice, and why your practice is positioned for success above your competition.

4. Detailed staffing model

Even if you plan to be the only provider in your practice, you will still need a plan to answer calls, file insurance claims, maintain files, manage billing , process payroll, and order supplies, among a host of other tasks to keep your practice running smoothly.

In this section of your medical practice business plan, list what positions you will fill and how many people you will need in each. Include compensation, along with any budgeted overtime, as well as benefits and tax considerations. Also, note when you will target hiring each throughout the year.

5. Projected 12-month income and budget

Show the math regarding how many patients you will serve for each service you will offer, your projected fee for each service, and your anticipated overhead expenses.

Your overhead will include items such as:

- Staffing expenses based on the total number of staff and projected salaries.

- All office-related expenses for equipment, supplies, maintenance, utilities, software, marketing, staff recruitment, and temporary services.

- Anticipated vendor expenses such as off-hours call service, telehealth subscriptions, lab processing fees, janitorial services, etc.

- Maintaining licensure, subscribing to professional journals, and attending conferences to stay current.

Make sure to account for one-time or short-term expenses, such as an extra administrative position to cover a known busy month, as well as for ongoing expenses.

6. Potential risks and mitigation

What risks can you anticipate as you open your practice? This is the section where you will think of worst-case scenarios and what you would do were they to become a reality.

Consider scenarios such as:

- A patient sues you. The United States is a very litigious society. What sort of malpractice insurance or bonds do you need to obtain?

- A staff member gets injured at work. In addition to the mandatory worker’s comp, how else would you support them? And what does your insurance cover?

- You get injured at work. How can you protect the longevity of your well-being and that of your practice?

- Another global pandemic hits. How will you staff and maintain patient treatment protocols, what specialized supplies will you need to purchase, what type of insurance rate hikes could you anticipate based on the last pandemic’s model, etc.

- A natural disaster hits. Depending on your geography, are you likely to experience a flood, fire, earthquake, tornado, hurricane, or blizzard? Are there emergency supplies you can keep on hand? Are there specific ways you can shore up your facility to make it more stable — and when would you make those changes? What specialized insurance do you need to purchase?

Talk to a seasoned physician who can provide some mentorship. Ask what they’ve faced during their years of practice and what you need to know to be prepared. Then take that information into meetings with your lawyer and insurance broker.

7. Implementation plan

In your project implementation plan, outline the steps you need to take to open your practice, what milestones you will hit, and an associated date for each major and sub-task. Whether you use formal project management software or create a project plan in a spreadsheet or other document, include that detailed information in this section.

8. Exit strategy

You’re just opening or growing your practice — why would you plan to leave it? Plans change, retirement becomes attractive, large conglomerates buy smaller practices, or a host of other scenarios could happen.

“ Just as you worked through the risks section, there is value in thinking ahead to determine your plan when you are ready for something different. ”

Just as you worked through the risks section, there is value in thinking ahead to determine your plan when you are ready for something different. Will you sell your practice? How will you transition your patients? What will happen with valuable equipment and supplies?

Identifying these items and addressing what you feel will be the best way to step away from what you are currently creating will make the process more manageable later.

How detailed is an effective business plan?

You know what process to use and the broad sections to include in your business plan, but how detailed should you get?

While you don’t want your business plan development goal to be a target length, a solid business plan typically ends up being somewhere between 30 to 40 pages. This information will include graphs and charts that demonstrate your demographic research, specific equipment needs for positive community impact, budget numbers, etc.

Your business summary and exit strategy sections should not exceed 20% of your overall business plan. Both will provide a high-level overview; neither is the section where you will get into excruciating details.

However, the other 6 sections of your business plan will get into the fine details. Each section should provide narrative information as well as specific numbers that are itemized by topic and category.

Keep your business plan alive

Even though your medical practice business plan can provide information for potential investors, partners, and financiers, it is ultimately the mirror of what you want your business to become. This should be a living document you update and change as your priorities and focus evolve.

“ As you move forward and grow your practice, set yourself up for a larger vision. ”

As you move forward and grow your practice, set yourself up for a larger vision. Adding 3- and 5-year projections to your 12-month business plan will help refine your sense of your purpose and direction.

By creating a medical practice business plan, you create confidence in not only your ability to attract patients, but also your ability to run the business that serves them long term.

Further Reading

You Might Also Be Interested In

Optimize your independent practice for growth. Get actionable strategies to create a superior patient experience, retain patients, and support your staff while growing your medical practice sustainably and profitably.

Subscribe to The Intake: A weekly check-up for your independent practice

Karmin Gentili

Karmin Gentili has been a freelance writer and editor since 2016. She has over 25 years of experience in corporate HR and compliance consulting. She has worked to further elevate her skills by pursuing and receiving multiple certifications, including copywriting, video scriptwriting, effective content positioning, case study writing, and SEO. Her love of writing motivates her to use those skills to develop content for the medical field that ensures others can work toward achieving their goals.

Reviewed by

Lauren Wheeler, BCPA, MD

Dr. Lauren Wheeler, MD, BCPA, is a former family medicine physician who currently works as an independent healthcare advocate as well as a medical editor and writer. You can get in touch with her about anything writing or advocacy at her website www.lostcoastadvocacy.com .

Suggested for you

Licenses you need to start your own medical practice

How choosing a location for your medical office can ensure practice growth

Strategic tips for naming your healthcare practice

Securing funding for a new medical practice

Get expert tips, guides, and valuable insights for your healthcare practice, subscribe to the intake.

A weekly check-up for your independent practice — right in your inbox

Medical Practice Business Plans

Chiropractic business plan.

Betcher Chiropractic is a start-up business that treats every patient with the philosophical approaches of individualism and holistic medicine.

Chiropractic Clinic Business Plan

Accurate Chiropractic is the second start-up by a business-savvy chiropractor in Florida. The owner will leverage his medical acumen and financial know-how to produce high profits.

Chiropractic Services Business Plan

Sports Chiropractic Center will provide quality care to athletes with sports-related injuries.

Family Chiropractic Business Plan

Advanced Chiropractic Clinic will provide quality chiropractic services to people of all ages. The clinic will utilize new equipment and a trained staff, able to care for the individual needs of every

Family Medicine Clinic Business Plan

The mission of Park Square Family Medicine is to promote the health and well-being of the local population by providing accessible, high-quality medical care for people of all ages.

Occupational Health Business Plan

Workwell is a nonprofit, occupational medicine program designed to reduce health care costs.

Physical Therapy Massage Business Plan

Healing Touch Massage, an established in-home business, will open an office downtown, seeking to acquire clients in the medically-required, insurance-paid massage market niche.

Psychological Health Center Business Plan

Amesbury Psychological Center is a multidisciplinary behavioral health care facility that offers mental health and substance abuse services to the communities of the Merrimack Valley in Massachusetts.

Sports Therapy Business Plan

Cyclist Repair Center is a start-up sports therapy clinic, offering massage therapy, physical therapy, and personal training, specifically geared for competitive and recreational bicyclists.

Home Health Care Business Plan

CaringCompanion provides high-quality, personalized home health care services to seniors and individuals with disabilities, letting them maintain independence and comfort within their own homes.

What do you get when you take your dedication to helping people and combine it with a good business plan? Success! Here’s a collection of sample business plans for medical practices, dental offices, and clinics, that should help you on your way.

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

10 Steps to Create Your Medical Practice Business Plan

- September 2, 2021

Starting a medical practice can be a tough row to hoe. Especially because it needs a big investment, administration takes up a good chunk of your time, and the income isn’t constant. But being your own boss has its merits that no hospital employment can give you. Once you are ready to take this path, having a business plan can help you steer in the clear direction.

In this article, we will simplify medical practice business planning along with insights from some of our amazing clients who are successfully running their practice.

What Is a Medical Practice Business Plan?

A medical practice business plan is a living document for launching and operating a medical practice. It has strategies that give you more clarity and helps you avoid wasteful efforts. You not only write the “to-dos” for your practice but also the “what-ifs” in case something doesn’t work out the way you planned. Instead of being a cookie-cutter document, the plan can help you be agile enough to thrive in today’s fast-changing landscape.

So let’s go through the steps in our medical practice business plan. Shall we?

#1. Set the Practice Philosophy

A practice philosophy is mission, vision, values, goals, code of ethics, and culture. These are mostly based on your beliefs as the founder of the practice. And forms DNA of the practice that can guide you in decision making, patient relationship, and hiring.

The practice philosophy must be short, simple, and inspirational. Here’s an example from Mayo Clinic, one of the top-rated practices in the US:

Mission: Inspiring hope and promoting health through integrated clinical practice, education and research.

Vision: Transforming medicine to connect and cure as the global authority in the care of serious or complex disease.

Primary Value: The needs of the patient come first.

You can read the full version of Mayo Clinic’s mission and values here .

While writing down your company philosophies is not an imperative, following them does lead to seeking continuous improvements in the practice.

#2. Research Business Models

A business model shows the functioning of a business to gain profits. If a business plan is the body, a business model is the CNS of the practice. Business models can be innovative without changing the type of service.

For example, mobile pop-up clinics are an innovative healthcare business model. Kind Body and AskTia are two famous pop-up clinics where women can go for regular checkups and issues related to fertility, IUDs, etc. It favors densely populated cities where healthcare is quickly accessible to patients. The payments are subscription based or fixed for each service.

Similarly, medical practices can have a business model where service is fully online; or deliver services with low-cost high-volume; or can even be as minimal as starting from your home as a part-time venture. Likewise, can explore business models with various delivery modes of service, payments, healthcare niche and so on.

A single change in the model can result in the difference of night and day. So your practice business model is the most important step in planning.

#3. Shortlist Locations

Your practice location is a strategic decision. A good location is one where you are accessible to potential customers. But a great location can give you monopoly in an area.

Parking, building aesthetics, and accessibility for the physically challenged are some important things to consider while selecting your practice location. If you are going to hire staff, you would want to make sure that the location has good access to public transportation.

#4. Perfect Your Business Operations