Equity Research Analyst

Equity research analysts closely analyze small groups of stocks in order to provide insightful investment ideas and recommendations to the firm. We’ve compiled a list of the most common and frequently asked Equity Research interview questions.

Get Govt. Certified

Certified Equity Research Analyst

Are you an expert ?

Report this question.

Investment Banking Resources

- Career Guides

- Interview Prep Guides

- Free Practice Tests

- Excel Cheatsheets

💡 Expert-Led Sessions 📊 Build Financial Models ⏳ 60+ Hours Learning

Equity Research Interview Questions (with Answers)

Publication Date :

18 Jul, 2018

Blog Author :

WallStreetMojo Team

Edited by :

Ashish Kumar Srivastav

Reviewed by :

Dheeraj Vaidya, CFA, FRM

Table Of Contents

Equity Research Interview Questions

If you are called for an equity research interview, you can be asked any question from anywhere. However, you should not take this lightly as this can change your Finance career. Equity Research interview questions are a mix of technical and tricky questions. So, you need to have a thorough knowledge of financial analysis , valuation, financial modeling, the stock market, current events, and stress interview questions.

Let's find below the top 20 Equity Research interview questions that are repeatedly asked for the positions of equity research analysts .

Table of contents

Recommended articles.

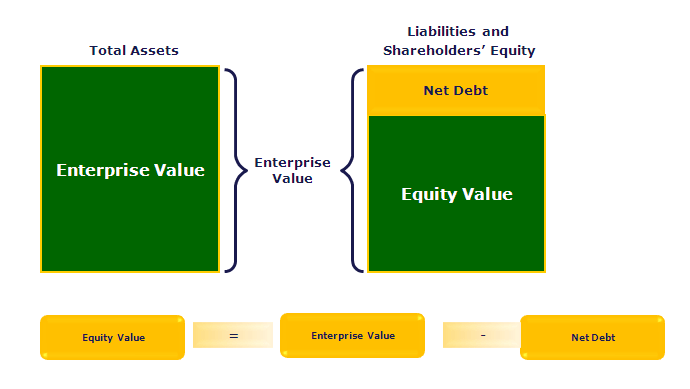

Question #1 – Do you know the difference between equity and enterprise values? How are they different?

This is a simple conceptual equity research interview question, and you need first to mention the definition of enterprise value and equity value and then tell the differences between them.

Enterprise value can be expressed as follows –

- Enterprise Value = Market Value of Common Stock + Market Value of Preferred Stock + Market Value of Debt + Minority Interest – Cash & Investments.

Whereas, the equity value formula can be expressed as follows –

- Equity Value = Market Capitalization + Stock Options + Value of equity issued from convertible securities – Proceeds from converting convertible securities.

The basic difference between enterprise value and equity value is enterprise value helps investors get a complete picture of a company's current financial affairs. In contrast, equity value helps them shape future decisions.

Question # 2- What are the most common ratios used to analyze a company?

It can be classified as the most common equity research interview question. Here is the list of common ratios for financial analysis that can be divided into seven parts –

#1 - Solvency Ratio Analysis

- Current Ratio

- Quick Ratio

#2 - Turnover Ratios

- Receivables Turnover

- Days Receivables

- Inventory Turnover

- Days Inventory

- Accounts Payable Turnover

- Days Payable

- Cash Conversion Cycle

#3 - Operating Efficiency Ratio Analysis

- Asset Turnover Ratio

- Net Fixed Asset Turnover

- Equity Turnover

#4 - Operating Profitability Ratio Analysis

- Gross Profit Margin

- Operating Profit Margin

- Return on Total Assets

- Return on Equity

#5 - Business Risk

- Operating Leverage

- Financial Leverage

- Total Leverage

#6 - Financial Risk

- Leverage Ratio

- Debt to Equity Ratio

- Interest Coverage Ratio

- Debt Service Coverage Ratio

#7 - External Liquidity Risk

- Bid-Ask Spread Formula

Question #3 What is Financial Modeling, and how is it useful in Equity Research?

- This is again one of the most common equity research interview questions. Financial modeling is nothing but projecting the company's finances in a very organized manner. As the companies that you evaluate only provide historical financial statements, this financial model helps equity analysts understand the fundamentals of the company – ratios, debt, earnings per share , and other important valuation parameters.

- In financial modeling, you forecast the company's balance sheet, cash flows, and income statement for the future years.

- You may refer to examples like the Box IPO Financial Model and Alibaba Financial Model to understand more about Financial Modeling.

Question #4 – How do you do a Discounted Cash Flow analysis in Equity Research?

If you are new to the valuation model, please go through this Free training on Financial Modeling.

- Financial modeling starts with populating the company's historical financial statements in a standard format.

- After that, we project these three statements using a step-by-step financial modeling technique .

- The three statements are supported by other schedules like the Debt and Interest Schedule, Plant and Machinery & Depreciation Schedule, Working Capital, Shareholders Equity , Intangible and Amortization Schedules, etc.

- Once the forecast is done, you move to valuations of the firm using the DCF approach,

- Here you are required to calculate Free Cash Flow to Firm or Free Cash Flow to Equity and find the present value of these cash flows to find the fair valuation of the stock.

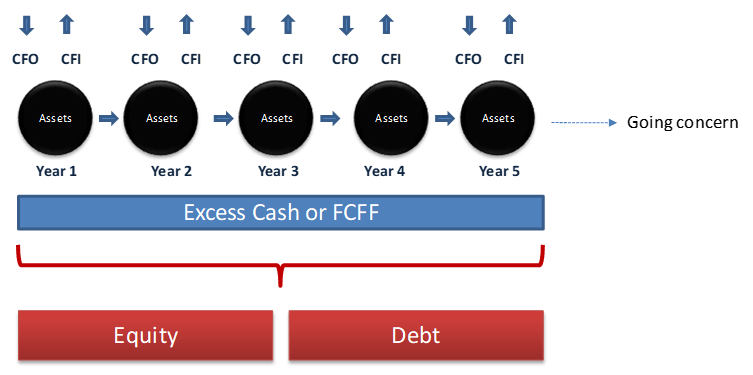

Question #5 – What is Free Cash Flow to a Firm ?

This is a classic equity research interview question. Free cash flow to the firm is the excess cash that is generated after considering the working capital requirements and the cost associated with maintaining and renewing the fixed assets. The firm's free cash flow goes to the debt holders and the equity holders.

Free Cash Flow to Firm or FCFF Calculation = EBIT x (1-tax rate) + Non Cash Charges + Changes in Working capital – Capital Expenditure

You can learn more about FCFF here.

Question #6 – What is Free Cash Flow to Equity?

Though this question is frequently asked in valuation interviews, this can be an expected equity research question. FCFE measures how much "cash" a firm can return to its shareholders and is calculated after taking care of the taxes, capital expenditure , and debt cash flows.

The FCFE model has certain limitations. For example, it is useful only in cases where the company's leverage is not volatile and cannot be applied to companies with changing debt leverage.

FCFE Formula = Net Income + Depreciation & Amortization + Changes in WC + Capex + Net Borrowings

You can learn more about FCFE here .

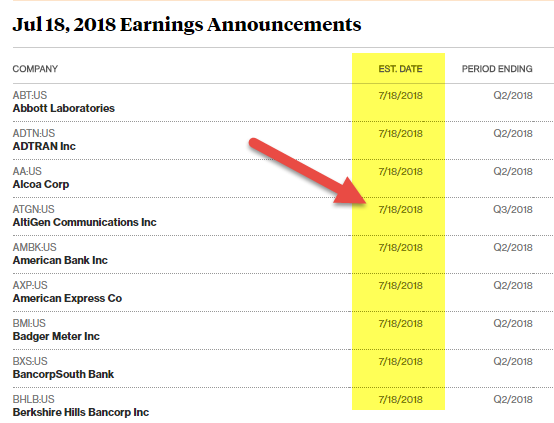

Question #7 – What's the earning season? How would you define it?

Appearing for an equity research interview? – Be sure to know this equity research interview question.

source: Bloomberg.com

In our industry, companies will announce a specific date when they declare their quarterly or annual results. These companies will also offer a dial-in number using which we can discuss the results.

- One week before that specific date, the job is to update a spreadsheet, reflecting the analyst's estimates and key metrics like EBITDA, EPS, Free Cash Flow, etc.

- On the day of the declaration, the job is to print the press release and swiftly summarize the key points.

You can refer to this article to learn more about the earning season .

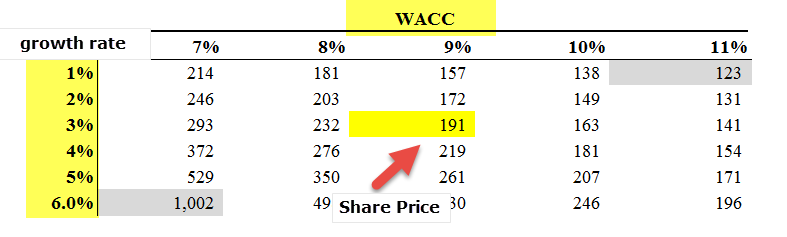

Question #8 – How do you do a Sensitivity Analysis in Equity Research?

One of the technology equity research interview questions.

- Sensitivity analysis using excel is one of the most important tasks after you have calculated the fair value of the stock.

- Generally, we use the base case assumptions of growth rates, WACC, and other inputs, which result in the base valuation of the firm.

- However, to provide the clients with a better understanding of the assumptions and their impact on valuations, you must prepare a sensitivity table.

- The sensitivity table is prepared using DATA TABLES in Excel.

- Sensitivity analysis is popularly done to measure the effect of changes in WACC and the company's growth rate on Share Price.

- As we see above, in the base case assumption of a Growth rate of 3% and WACC of 9%, Alibaba's Enterprise Value is $191 billion.

- However, when we can make our assumptions to say a 5% growth rate and WACC of 8%, we get the valuation of $350 billion!

Question #9 – What is the "restricted list," and how does it affect your work?

This is a nontechnical equity research interview question. To ensure that there is no conflict of interest, a "restricted list" is being created.

When the investment banking team is working on closing a deal that our team has covered, we're not allowed to share any reports with the clients, and we will not be able to share any estimates. Our team will also be restricted from sending any models and research reports to clients. We will also not be able to comment on the merits or demerits of the deal.

Question #10 – What are the most common multiples used in valuation?

Expect this expected equity research interview question. There are a few common multiples that are frequently used in valuation –

- Price to Cash Flow

Question #11 – How do you find the Weighted Average Cost of Capital of a company?

WACC is commonly referred to as the Firm's Cost of Capital. This is because the cost to the company for borrowing the capital is dictated by the external sources in the market and not by the company's management. Its components are Debt, Common Equity, and Preferred Equity.

The formula of WACC = (Wd*Kd*(1-tax)) + (We*Ke) + (Wps*Kps).

- Wd = Weight of Debt

- Kd = Cost of Debt

- tax - Tax Rate

- We = Weight of Equity

- Ke = Cost of Equity

- Wps = Weight of Preferred Shares

- Kps = Cost of Preferred Shares

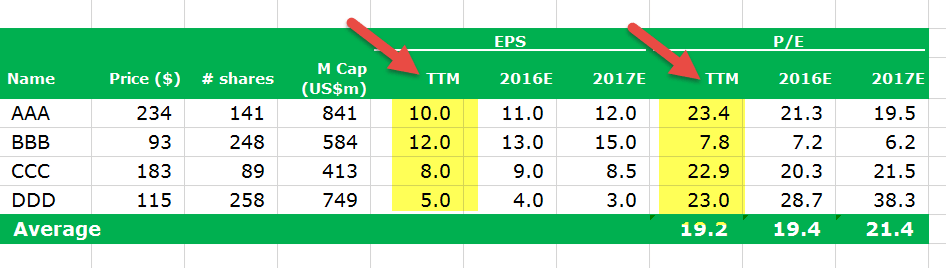

Question #12 – What is the difference between Trailing PE and Forward PE?

Trailing PE Ratio is calculated using the earnings per share of the past; however, Forward PE Ratio is calculated using the forecast earnings per share. Please see below an example of Trailing PE vs. forwarding PE Ratio.

- Trailing Price Earning Ratio formula = $234 / $10 = $23.4x

- Forward Price Earning Ratio formula = $234 / $11 = $21.3x

For more details, have a look at Trailing PE vs. Forward PE

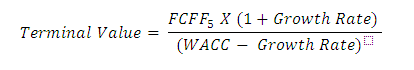

Question #13 – Can Terminal value be Negative?

This is a tricky equity research interview question. Please note that it can happen but only in theory. Please see the formula below for Terminal Value.

If for some reason, WACC is less than the growth rate, then Terminal Value can be negative. High growth companies may get negative terminal values only due to misuse of this formula. Please note that no company can sustain growth at a high pace for an infinite period. The growth rate used here is a steady growth rate that the company can generate over a long period. For more details, please look at this detailed Guide to Terminal value .

Question #14 – If you were a portfolio manager with $10 million to invest, how would you do it?

This equity research interview question is asked repetitively.

The ideal way to answer this question is to pick a few good stocks large cap , mid-cap stock , & small cap, etc.) and pitch the interviewer about the same. You would tell the interviewer that you would invest $10 million in these stocks. You need to know about the key management executives, a few valuation metrics (PE multiples, EV/EBITDA, etc.), and a few operational statistics of these stocks to use the information to support your argument.

Similar types of questions where you would give similar answers are –

- What makes a company attractive to you?

- Pitch me a stock etc.

Question #15 – What PE ratio of a high-tech company is higher than the PE of a mature company?

The basic reason for which the high tech company's PE is higher is that the high tech company may have higher growth expectations.

- Why is it relevant? Because the expected growth rate is a PE multiplier –

- Here, g = growth rate; ROE = Return on Equity & r = cost of equity.

It would help if you used a PEG Ratio for high-growth companies instead of a PE Ratio.

Question #16 – What is BETA?

This is among the top 5 most expected equity research interview questions. Beta is a historical measure representing a tendency of a stock's return compared to the change in the market. Beta is usually calculated by using regression analysis .

A beta of 1 would represent that a company's stock would be equally proportionate to the change in the market. A beta of 0.5 means the stock is less volatile than the market. And a beta of 1.5 means the stock is more volatile than the market. Beta is a useful measure, but it's a historical one. So, beta can't accurately predict what the future holds. That's why investors often find unpredictable results using beta as a measure.

Let us now look at Starbucks Beta Trends over the past few years. The beta of Starbucks has decreased over the past five years. This means that Starbucks stocks are less volatile than the stock market. We note that the Beta of Starbucks is at 0.805x.

Question #17 – Between EBIT and EBITDA, which is better?

Another tricky equity research interview question. EBITDA stands for Earnings before interest, taxes, depreciation, and amortization. And EBIT stands for Earnings before interest and taxes. Many companies use EBITDA multiples in their financial statements. The issue with EBITDA is that it considers the depreciation and amortization as they are "non-cash expenses." So even if EBITDA is used to understand how much a company can earn, it still doesn't account for the cost of debt and its tax effects.

For the above reasons, even Warren Buffett dislikes EBITDA multiples and never likes companies that use it. According to him, EBITDA can be used where there is no need to spend on "capital expenditure," but it rarely happens. So every company should use EBIT, not EBITDA. He also gives examples of Microsoft, Wal-Mart & GE, which never use EBITDA.

Question #18 – What are the weaknesses of PE valuation?

This equity research interview question should be very simple to answer. However, there are a few weaknesses of PE valuation, even if PE is an important ratio for investors.

- Firstly, the PE ratio is too simplistic. Just take the current price of the share and then divide it by the company's recent earnings. But does it take other things into account? No.

- Secondly, PE needs context to be relevant. If you look at only the PE ratio, there is no meaning.

- Thirdly, PE doesn't take growth/any growth into account. Many investors always take growth into account.

- Fourthly, P (the price of share) doesn't consider debt. As the market price is not a great measurement of market value, debt is an integral part of it.

Question #19 Let's say that you run a Donut franchise. You have two options. The first is to increase the price of each of your existing products by 10% (imagining that there is price inelasticity). And the second option would be to increase the total volume by 10% due to a new product. Which one should you do and why?

This equity research interview question is purely based on economics. So you need to think through and then answer the question.

First of all, let's examine the first option.

- In the first option, the price of each product is increased by 10%. As the price is inelastic, there would be a meager change in the quantity demanded , even if the price of each product gets increased. So that means it would generate more revenue and better profits.

- The second option is to increase the volume by 10% by introducing a new product. In this case, introducing a new product needs more overhead and production costs. And no one knows how this new product would do. So even if the volume increases, there would be two downsides – one, there would be uncertainty about the sales of the new product, and two, the cost of production would increase.

After examining these two options, the first option would be more profitable for you as a franchise owner of KFC.

Question #20 – How would you analyze a chemical company (chemical company – WHAT?)?

Even if you don't know anything about this equity research interview question, it's common sense that chemical companies spend a lot of their money on research & development. So, if one can look at their D/E (Debt/Equity) ratio, it would be easier for the analyst to understand how well the chemical company utilizes its capital. A lower D/E ratio always indicates that the chemical company has strong financial health. Along with D/E, we can also look at Net Profit margin and P/E ratio.

This article has been a guide to Equity Research Interview Questions. Here we provide you with the list of most common techniques and nontechnical equity research interview questions with answers. You may have a look at these other recommended resources to learn more –

- Top Financial Modeling Interview Questions (With Answers)

- Valuation Interview Questions

- Private Equity Interview

- Corporate Finance Interview Questions (with Answers)

Prepare well and give your best shot. All the best for your Equity Research interview!

- You don't have any recent items yet.

- You don't have any courses yet.

- Add Courses

- You don't have any books yet.

- You don't have any Studylists yet.

Quiz : equity reasearh and valuation questions with answers

Which of the following is not a type(s) of equity research?

In which type of research analysis are past prices and volumes considered?

Which techniques are used in Technical Analysis?

Which class of ownership in a company has a higher claim on the assets and earnings of the company?

How many categories does Bombay Stock Exchange classify equity shares into?

Which categories of shares are not present on Bombay Stock Exchange (BSE)?

Which category of shares is highly liquid on BSE?

In which year was the Security Lending and Borrowing Scheme introduced?

How many companies are included in the SLBS List?

Quiz questions

Question 1 of 9 Which of the following is not a type(s) of equity research? A Technical Analysis B Quantitative Analysis C None of these D Fundamental Analysis Explanation Equity research includes Fundamental Analysis, Technical Analysis, and Quantitative Analysis.

Question 2 of 9 In which type of research analysis are past prices and volumes considered? A Technical Analysis B All of these C Industry Analysis D Fundamental Analysis Explanation Technical Analysis involves considering past prices and volumes for analysis.

Question 3 of 9 Which techniques are used in Technical Analysis? A Fundamental Analysis B Technical Analysis C Quantitative Analysis D All of the above Analysis Explanation Stochastic Processing and Artificial Neural Network techniques are utilized in Technical Analysis.

Question 4 of 9 Which class of ownership in a company has a higher claim on the assets and earnings of the company? A Equity Ownership B Preference Ownership Explanation Equity Ownership holds a higher claim on the assets and earnings of a company compared to Preference Ownership.

Question 5 of 9 How many categories does Bombay Stock Exchange classify equity shares into? A Four B Six C Five D Seven Explanation Bombay Stock Exchange classifies equity shares into four categories.

Question 6 of 9 Which categories of shares are not present on Bombay Stock Exchange (BSE)? A I and II B All are categories of shares on BSE C I and IV D II and III Explanation Categories I and II are not present on BSE.

Question 7 of 9 Which category of shares is highly liquid on BSE? A B B S C A D T Explanation Category A shares are highly liquid on Bombay Stock Exchange.

Question 8 of 9 In which year was the Security Lending and Borrowing Scheme introduced? A 2001 B 2007 C 2010 D 2009 Explanation The Security Lending and Borrowing Scheme was introduced in the year 2007.

Question 9 of 9 How many companies are included in the SLBS List? A 189 B 207 C 159 D 209 Explanation The SLBS List includes 159 companies.

Free NISM Series XV Research Analyst Mock Test

About NISM Series XV Research Analyst Exam

Access the Free NISM Series XV Research Analyst Mock Test here.

The NISM Series XV Research Analyst Certification Examination (also known as Equity Research Analyst Certification) is a moderately difficult certification examination of NISM. This certification is required to work as a equity research analyst or equity analyst in a brokerage firm or similar entity. Personnel possessing the NISM Research Analyst Certification is eligible to work as an equity analyst or equity research analyst.

An equity analyst or equity research analyst generally makes stock recommendations to the general public either individually or on behalf of an organization. Although the research analyst function covers both fundamental and technical analysis, a major part of the NISM Series XV Research Analyst exam covers fundamental analysis and very little part of technical analysis. This examination is conducted by NISM in more than 150 cities in India and thousands of people take this NISM Exam.

About NISM Series XV Mock Test

Since the NISM Research Analyst Certification is a difficult examination to pass in the first attempt for most of the exam takers, PrepCafe assists candidates interested in obtaining the certification by providing Free NISM Series XV Research Analyst Mock Test Model Questions in the form of Free NISM Series XV Research Analyst Mock Test Series as well as Premium Quality Paid NISM Mock Test at just Rs. 399/-.

PrepCafe’s Paid NISM Mock Test for Research Analyst Certification Examination consists of premium quality, real-like NISM Question Bank which helps in assessing your exam preparation, get exam exposure, obtain nism practice questions and thereby pass NISM exam easily with flying colors.

This NISM Series XV Research Analyst Mock Test or NISM Research Analyst Mock Test consists of 10 questions which need to be attempted in 10 minutes. If you like this free NISM Mock Tests, you would like to consider our Premium NISM Research Analyst Mock Test @ Rs. 399/-

Dear Candidate,

- This is a Mock Examination of NISM Series XV : Research Analyst Certification Examination.

- This mock test has 10 questions of 1 marks each.

- You are alloted 120 minutes for this mock test. There is no negative marking in this mock test. However, please note that actual examination has 25% negative marking per question.

- The passing score on the examination is 60%

- This mock examination is only to give the candidates an experience of NISM testing system.

- Please note that passing this mock test would not make you eligible for claiming a certificate for NISM Series XV : Research Analyst Certification Examination

All the best for your examination!

Quiz Summary

0 of 10 Questions completed

Information

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You must first complete the following:

Quiz complete. Results are being recorded.

0 of 10 Questions answered correctly

Time has elapsed

You have reached 0 of 0 point(s), ( 0 )

Earned Point(s): 0 of 0 , ( 0 ) 0 Essay(s) Pending (Possible Point(s): 0 )

- Research Analyst 0%

Thank you for taking the quiz.You can now review the questions and answers.

You have scored above 60% which is above the passing marks required for this examination.

However, please note that negative marking of 25% is not factored in your score.

1 . Question

Asset turnover ratio indicates the efficiency of the assets created by the company in generating revenues.

2 . Question

A company with healthy profits is facing a cash shortage. Which of the following events could account for this?

- The shortening of the credit period granted to debtors

- An increase in dividends proposed by the directors

- The recent acquisition of equipment

- Delaying payments to creditors

3 . Question

What is the immediate effect of making a capital repayment on a loan on cash flow and profits?

- On profit - Decrease; On cash - None

- On profit - Increase; On cash - Decrease

- On profit - None; On cash - Decrease

- On profit - Decrease; On cash

4 . Question

Which of the following is a cash flow from a "financing" activity?

- cash outflow to the government for taxes.

- cash outflow to shareholders as dividends.

- cash outflow to lenders as interest.

- cash outflow to purchase bonds issued by another company.

5 . Question

Corporate profits, computed after deducting business expenses and other specified items, are taxed at the _______ rate for Indian companies.

6 . Question

Delisting of shares refers to the ________ removal of the shares of a company from being listed on a stock exchange.

- None of the above

7 . Question

A company cannot make bonus issue if it has defaulted on:

- Payment of interest

- Principal on any debt security issued

- Any fixed deposit raised

- All of the above

8 . Question

If an investor holds 100 shares of a company with a face value of Rs. 10 each, a stock split in the ratio of 1:2 will increase the number of shares held by him to ____

- 500; go down to Rs. 5.

- 200; go down to Rs. 2.

- 200; go down to Rs. 5.

- 500; go down to Rs. 2.

9 . Question

In what type of action the acquiring company acquires all or a substantial portion of the stock of the target company and both entities typically continue to exist?

- Acquisition

- Consolidation

10 . Question

A company can buy back its shares out of:

- Reserves which are availablefor distribution as dividend

- Securities premium account

- Proceeds of fresh issue of shares or other specified securities

How to attempt the Free NISM Mock Test?

Please login or register to access the free NISM XV mock test. Registration is free and takes only 2 minutes. You can visit this page again after logging in to access the free NISM mock test.

PrepCafe Academy assists candidates interested in becoming Equity Research Analyst to pass this NISM examination by providing Free NISM Mock Tests as well as premium quality Paid NISM Mock Tests in online mode.

PrepCafe Academy’s Premium NISM Mock Tests consists of premium quality, real-like NISM Question Bank which helps in assessing your exam preparation, get exam exposure, practice nism questions and thereby pass NISM exam easily with flying colors.

All our Premium NISM Mock Tests are as per latest syllabus prescribed by NISM .

Tags: nism research analyst, research analyst certification, equity research analyst, equity analyst, nism series xv

Read our latest blogs

Ace the NISM Series VA: Mutual Fund Distributors Certification Exam with PrepCafe Academy

Introduction to the NISM Series VA: Mutual Fund Distributors Certification The NISM Series VA: Mutual Fund Distributors Certification is a pivotal credential mandated by the Securities and Exchange Board of India (SEBI) for those aspiring to become mutual fund distributors. This certification serves as a foundational benchmark for the industry, aimed at ensuring that professionals

The Ultimate Guide to Choosing the Right NISM Training Institute

Choosing the right NISM training institute can be a game-changer in your financial market career. This comprehensive guide highlights the importance of NISM certification and the benefits of enrolling in a professional training program. Learn how to evaluate institutes based on reputation, faculty experience, curriculum, study materials, and more. Discover why structured learning, expert guidance, and practice exams are crucial for your success. At PrepCafe Academy, we offer top-notch NISM Live Zoom Training batches to help you excel. Join us and take a significant step towards achieving your certification and career goals.

National Financial Literacy Quiz (NFLQ) 2024: A Comprehensive Guide

The NFLQ 2024 is open for all candidates from UG and PG course. Prizes worth ₹10 lakh are up for grabs

Importance of NISM Certifications in the Indian Securities Market Landscape in 2024

NISM Certifications have become increasingly important in the Indian securities market landscape in 2024. With the rapid growth and evolution of the market, it has become essential for professionals to possess the necessary knowledge and skills to navigate the complexities and challenges that arise.

Or Register

IMAGES

VIDEO

COMMENTS

Practice hundreds of MCQs in Equity Research test from Vskills to assess your skills for advanced learning and superoir opportunities Now!

Equity research modelling is a critical aspect of financial analysis, involving techniques like Discounted Cash Flow (DCF) analysis, Comparable Company Analysis, Sensitivity Analysis, and more. In this guide, we delve into 10 distinct domains, each featuring multiple-choice questions, detailed answers, and explanations.

Question # 1 What is equity research? Answer:-Desired information availability and consumption spurned a whole new industry, popularly known as Equity Research. Equity research is the study of equities or stocks for the purpose of investments. Equity research is what an equity research analyst does.

Equity Research (ER) attracts seasoned professionals and new hires with a variety of talents and diversified skill sets across the world for a fulfilling career. New hires starting right out of school will start as research associates and move up the chain to becoming research analysts after gaining experience in the industry.

Our NISM Research Analyst Mock Tests are specially designed to help prepare for Research Analyst examination. Research Analyst examination is intended for professionals seeking to build a career as an equity research analyst. It is also mandatory for any individual who participates and is engaged in preparation or analysis of research reports and for partners of equity research firms.

An equity research report refers to a recommendation to clients which convinces them to either BUY, SELL or HOLD equity securities. The preparer must justify each recommendation. This includes the components like: Industry Overview that gives the reader a summary of the trends affecting the industry covering the company Company Financials and ...

What are the Most Common Equity Research Interview Questions? Based on our first-hand experience, as well discussions with equity research professionals, we've compiled a list of the top questions to be asked by a research analyst when interviewing an associate.We've also added what we think are the best answers to these challenging interview questions.

This equity research interview question is asked repetitively. The ideal way to answer this question is to pick a few good stocks large cap, mid-cap stock, & small cap, etc.) and pitch the interviewer about the same. You would tell the interviewer that you would invest $10 million in these stocks.

Quiz: equity reasearh and valuation questions with answers Share. Created with AI from the Document. Uploaded by. Mansi gandhi. Question 1 of 9. Report. Question 1 of 9. Question. Easy. ... Equity research includes Fundamental Analysis, Technical Analysis, and Quantitative Analysis. Question.

Since the NISM Research Analyst Certification is a difficult examination to pass in the first attempt for most of the exam takers, PrepCafe assists candidates interested in obtaining the certification by providing Free NISM Series XV Research Analyst Mock Test Model Questions in the form of Free NISM Series XV Research Analyst Mock Test Series ...