- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case AskWhy Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Research problem: Everything a market researcher needs to know

A research process includes several steps that assist individuals involved in a study in conducting successful testing. Defining a research problem is an essential step in any research and can help in outlining your study’s methodology.

LEARN ABOUT: Research Process Steps

In this article, we will define a research problem and go over everything a researcher should know.

Content Index

What is a research problem?

What is the research problem statement, what is the purpose of a research problem statement, characteristics of a research problem, characteristics of a research problem statement.

- Components of a research problem?

Steps to formulate a research problem

Marketing research problem example, research problem statement example, extensive research problem software, platform, and tool, top seven benefits of using a robust research software, advantages of formulating a research problem, how questionpro helps researchers solve research problems.

A research problem is a specific question, problem, or difficulty that needs to be investigated or analyzed.

It is a concise statement that expresses the difference between what is currently known and what needs to be known or the difference between a current situation and a desired state.

Examining research problems helps to identify the key concepts and terms of research. A research problem should be clear, concise, and specific enough to guide the process and contribute to the definition of research project objectives, methods, and outcomes. It is the foundation of any research project, and a well-formulated research problem is required for any research study to be successful.

A research problem statement is a brief and precise description of the problem that a researcher wishes to investigate. It defines the research’s focus and serves as a framework for developing research questions or hypotheses.

Typically, the problem statement begins with a broad topic or research area and then narrows down to a specific research question or problem. It should explain why the research is important, what gaps in knowledge or understanding exist, and what potential implications or applications the research may have.

A good research statement keeps the researcher focused and guides the research project’s development. It also assists other researchers in comprehending the scope and significance of the research, as well as identifying potential areas for collaboration or further investigation.

LEARN ABOUT: Action Research

A problem statement in research seeks to achieve the following:

- Introduce the importance of the topic in the research proposal.

- Position the problem in an appropriate and particular context.

- Provide a framework to analyze and report results.

Create a free account

Make sure to fulfill these essential characteristics to have an effective research problem. Due to the variety of research, we conduct, it is not possible to inculcate all these characteristics. However, ensure to consider and cover most of these characteristics to enable people to look at, examine, and understand the marketing research problem.

Covers the essential needs or issues

LEARN ABOUT: Market research vs marketing research

The problem is stated logically and clearly

The research project is based on actual facts and evidence (non-hypothetical), the research problem generates and encourages research questions, it fits the budget and time frame, sufficient data can be obtained, the problem has an unsatisfactory answer, or is it a new problem.

Here are the characteristics of a research problem statement:

- It must address the gap in knowledge.

- It must be significant to the extent that it contributes positively to the research

- It must help in further research

- The collected empirical data confirm the clarity and understandability of the research problem.

- It must be in the researcher’s interest should and suit his/her time, practical knowledge, research skills , and resources

- The problem-solving approach must be ethical

- Customary research methods can be applied

LEARN ABOUT: Theoretical Research

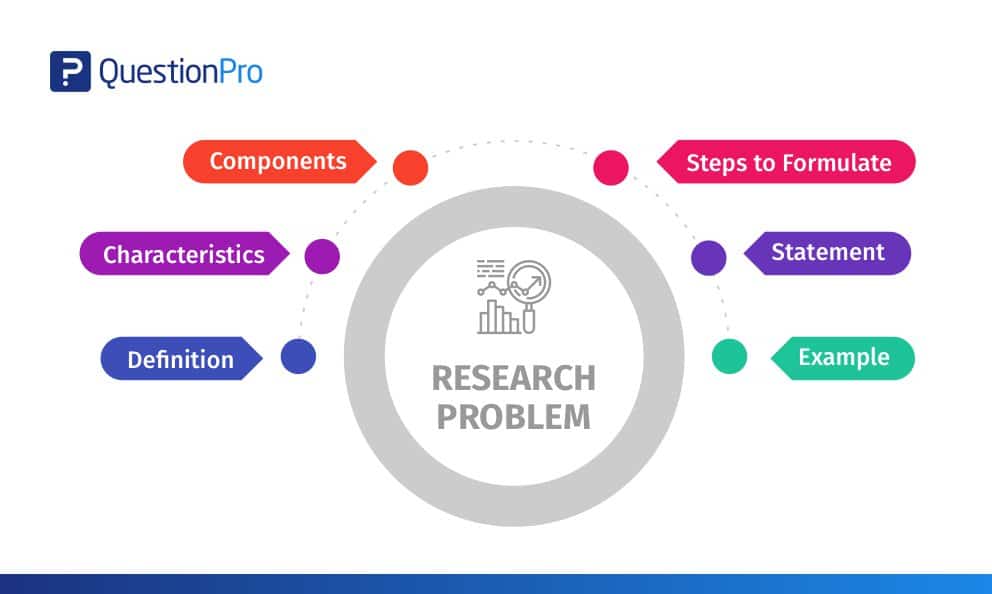

Components of a research problem

A research problem has the following components:

Research consumer

Research-consumers objective, alternative means to meet the objective, doubts in the selection of alternatives, there must be more than one environment.

Here are the five basic steps to formulate a research problem:

Identify the broad research area

Divide the broad area into sub-areas.

- Profile of soccer players

- Profile of soccer clubs

- Level of soccer clubs

- Impact of the club on the city

- Revenue generating areas

- Sponsors of the soccer clubs

Choose a sub-area

Formulate research questions, set research objectives.

Organizations and companies use marketing research problems to gauge the risks associated with launching a new product or service. They do not wish to spend money expanding a product line where research shows it will not succeed. A well-designed, well-executed marketing research study helps in identifying customer interests, consumer tastes, and preferences to help with decisions around the product or service.

A research question is the most important aspect of the research. You must spend time refining and assessing the research questions before getting started with the research activities. A research question must be straightforward, to the point, focused, and appropriately complex to capture the most relevant information.

Having difficulty writing research problems? Follow these examples to write a problem statement:

Incorrect: What are the effects of social media on people? Correct: What effect does use Facebook every day have on teenagers?

In the above example, the first research question is not specific enough to capture accurate feedback. Nobody knows what social media you’re talking about and what ‘people’ you’re referring to.

Let’s look at another marketing research problem example.

Incorrect: Who has a better healthcare system? The US or the UK? Correct: How do low-income earning people feel about the healthcare system, and how do the UK and the US compare?

The next research question is comprehensive and does not draw a definite conclusion about the healthcare systems of both countries.

The third example of how to write a problem statement is:

Incorrect: What will help political parties address the issues of low voter turnout? Correct: What communication strategies can political parties apply to increase voter turnout among people between the age of 25-30?

Again, comparing both statements, the second one is more direct and implies only a specific group of people, thus collecting actionable information.

Formulating a marketing research problem is just one crucial part of the research process. Another essential aspect of marketing research is using a robust market research software tool that aids in your research activity.

For example, The Research methods knowledge base is a comprehensive web-based textbook that covers all the topics in a typical introductory undergraduate or graduate social research methods course. It covers the research question, measurement (surveys, scaling, qualitative, unobtrusive), research design (experimental and quasi-experimental research ), data analysis, and writing the research paper.

You can do a whole lot by choosing the right research platform to solve a specific problem. By using a research repository , you can mitigate the need to think of research and a research problem as a decentralized process in your organization.

Here are the benefits of using a robust research software tool

Powerful and efficient market research

Professional grade, powerful survey logic, collect unbiased data, data analysis, advanced analysis techniques, uncover brand insights.

CREATE A FREE ACCOUNT

Here are the advantages of formulating a research problem:

Understanding the research procedure

Determining the research objective, design the research process, lays the foundation for research.

QuestionPro provides a number of tools and features to assist researchers in solving research problems, including:

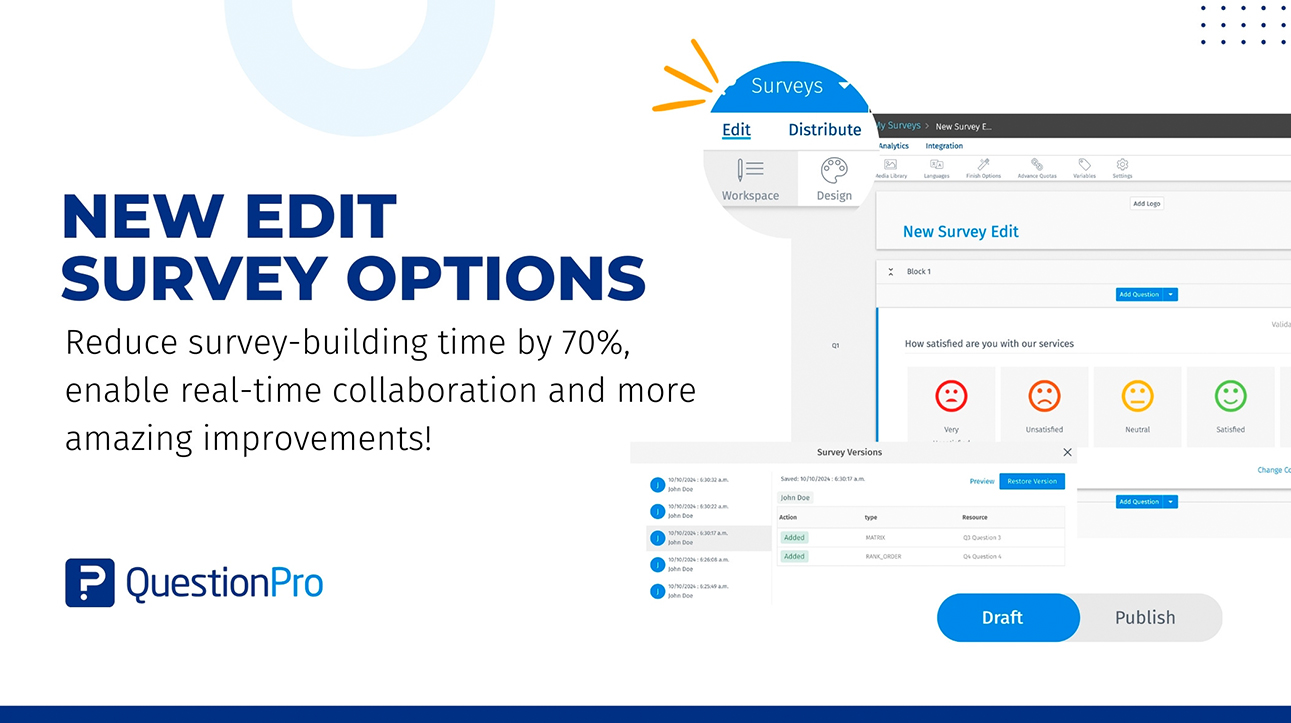

- Survey creation: QuestionPro offers to skip logic, branching, randomization, and a range of research question types.

- Data Collection: QuestionPro lets researchers collect data through email, social media, and embedded surveys on websites.

- Real-time Data Analytics: QuestionPro’s real-time data analytics solutions help researchers solve research issues. Researchers may quickly spot patterns and make data-driven decisions using the platform’s strong analytics tools.

- Collaboration: Researchers can invite team members to surveys and exchange data and analytic results, making collaboration and task completion easy with QuestionPro.

- Integration with Other Tools: QuestionPro integrates with a variety of other tools, including Salesforce, Hubspot, and Google Analytics.

QuestionPro provides a comprehensive set of research tools to assist researchers in solving research problems. QuestionPro provides a complete solution that can help researchers tackle their research problems with ease, from survey creation to data collection, real-time data analytics, collaboration, and integration with other tools. Contact QuestionPro right away to get the best value for your research process!

LEARN MORE FREE TRIAL

MORE LIKE THIS

Total Experience in Trinidad & Tobago — Tuesday CX Thoughts

Oct 29, 2024

You Can’t Please Everyone — Tuesday CX Thoughts

Oct 22, 2024

Life@QuestionPro Presents: Andrews Sekar

Oct 14, 2024

Edit survey: A new way of survey building and collaboration

Oct 10, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Tuesday CX Thoughts (TCXT)

- Uncategorized

- What’s Coming Up

- Workforce Intelligence

We've got you covered

Let us develop, create, and execute marketing campaigns to help you achieve your business goals..

- Inbound Marketing

- Website Development

- e-Commerce Services

- HubSpot Services

- Design Services

Additional Offerings

- QR Code Marketing

- Amazon Listing Services

- Vidyard Customization Services

- Project Management Tools

- ADA Compliance Services

Providing solutions to help you level up your business

Everything and the kitchen sink., why choose us.

- HubSpot Partner

Stay Connected!

Subscribe to our learning center today.

Check out the latest news

Vested marketing , hot topics of the inbound marketing industry, case studies, monthly educational content, and more.

- Learning Center

- Industry Talk

- Case Studies

- Knowledge Base

We partner with the best

Taking our performance to new heights by teaming up with outstanding companies..

Our Partners

6 steps to conducting effective marketing research.

Table of Contents

- Identify & Formulate the Problem or Opportunity

- Plan the Research Design & Gather Secondary Data

- Collect Primary Data

- Analyze the Data

- Prepare & Present the Report

Partner with an Inbound Marketing Expert

Effective market research is critical for businesses aiming to stay competitive. It provides valuable insights into customer preferences, market trends, and helps companies make data-driven decisions.

In today's fast-paced world, rapidly evolving technologies like artificial intelligence (AI) and advanced analytics have transformed how businesses approach market research, making the process faster, more accurate, and more efficient.

In this updated guide, we'll walk you through the key steps to conducting effective market research, integrating the latest tools and techniques to keep you ahead of the curve.

- Bonus Step: Partner with an Inbound Marketing Expert!

1. Identify & Formulate the Problem or Opportunity

The first step in any market research process is to clearly define the research problem or opportunity. This involves determining what information you need to gather and why it is essential to define the marketing research problem accurately.

- Marketing Research Problem: Gathering relevant data is crucial. Ask questions like: What gaps in understanding exist? What information will help solve the issue at hand?

- Marketing Research Objective: Establish clear objectives that guide the research, ensuring you're on the right path to finding actionable insights.

- Management Decision Problem: This involves understanding the broader business decision that your research will influence. It’s a higher-level issue that drives the direction of the research.

Practical Example:

Imagine a retail company that experienced a sudden drop in online sales. Defining the problem as "understanding the cause of declining sales" helped them focus their market research, leading to insights that changes in customer preferences were not being reflected in their online store layout. As a result, a website redesign led to a 20% increase in conversions .

2. Plan the Research Design & Gather Secondary Data

Secondary data is the foundation for efficient market research. It includes pre-existing information that can help shape your understanding of the market before you collect primary data.

- Internal Sources: Use internal data like website analytics, CRM data, and sales reports to get a better understanding of current performance.

- External Sources: Tap into industry reports, government databases, and other online databases to gather insights.

Updated Tools for Gathering Secondary Data:

Tools like HubSpot's analytics features offer modern ways to gather and interpret secondary data. While these tools provide valuable insights, it's essential to note that secondary data may not be entirely tailored to your specific needs, so use it wisely in conjunction with primary data.

3. Collect Primary Data

Primary data collection involves gathering information directly from your target audience for your specific research needs.

Modern Data Collection Methods: The rise of AI-powered tools has revolutionized data collection. Methods like AI-powered surveys, virtual focus groups, and social media listening offer faster and more precise insights. Social media listening, in particular, allows companies to monitor customer feedback in real time, which can shape product development or marketing strategies.

Platforms like HubSpot: HubSpot’s built-in tools streamline the entire data collection process, making it easier to organize and analyze primary data.

Best Practices for Data Collection:

Ensure your methods (surveys, interviews, etc.) are designed for accuracy, avoiding biases, and targeting the right audience to achieve relevant results.

4. Analyze the Data

Once the data is collected, the next step is to analyze it and turn it into actionable insights.

- Transforming Data into Insights: The process involves reviewing your data, identifying patterns, and making informed decisions. Modern tools like Tableau and Google Data Studio allow for effective data visualization, transforming complex data sets into easy-to-understand visual formats.

AI and Data Analytics:

AI-driven analytics are playing an increasingly prominent role in market research. AI can identify trends and patterns far more quickly and accurately than manual methods, enabling businesses to adapt in real-time.

5. Prepare & Present the Report

After analyzing the data, the next task is to present your findings in a clear and impactful way.

Creating an Impactful Report: A market research report should include:

- A Statement of Research Objectives

- A Research Design Summary

- Major Findings

- Recommendations for Action

Updated Presentation Tips:

Leverage interactive dashboards and data visualization tools when presenting to make your findings more engaging. Storytelling techniques also help connect data to actionable insights, especially when presenting to stakeholders like management or sales teams.

6. Follow Up

The final step in the market research process is ensuring that your findings lead to tangible actions.

- Why Follow-up is Critical: Simply delivering a report isn’t enough. Following up with management or key stakeholders to ensure that recommendations are adopted and implemented is crucial for success.

Examples of Effective Follow-Ups:

One company used regular follow-up meetings to ensure that research-informed changes to their marketing strategy were executed. The result was a 30% increase in customer engagement within three months.

Bonus Step: Partner with an Inbound Marketing Expert!

As the complexity of market research grows, partnering with an inbound marketing expert can help ensure that the research is not only conducted effectively but is also leveraged to fuel business growth. Here's how:

Expert Assistance in Marketing Research

Inbound marketing experts can guide businesses through the market research process, ensuring that insights are used to enhance marketing campaigns, improve customer engagement, and drive revenue. At Vested Marketing, we’ve helped numerous businesses transform data into growth. One of our clients saw a 50% increase in lead generation after optimizing their strategy based on market research.

Market research is an essential tool for making informed business decisions. As technology evolves, so does the potential to gather deeper insights faster and more accurately. By following these updated steps, you can conduct effective market research that drives results. Ready to take your market research to the next level? Schedule a consultation with Vested Marketing today to get started.

About Vested Marketing

We are inbound marketing experts , SEO gurus and top-notch website developers .

Our team of Engineers Turned Marketers can help get you noticed - for a more innovative and effective way to reach customers, or provide a more seamless way for companies to find your services. Inbound Marketing has no limit to industry, serving from Crypto & NFT , mining , oil and gas, technology & automation, engineering , technology , water saving technology , construction, healthcare , to industrial & manufacturing , food and goods , Amazon selling services, online wholesale marketplace, wholesale fashion and wholesale clothing .

Related Posts

Web 3.0 Marketing: SEO, Social Media and Blockchains

What is web 3.0 and how will it change marketing? As we move into a new era of the internet, blockchain technology is bringing about changes that...

Five Ways The Internet Changed Marketing Forever

Marketing and sales have changed drastically since the turn of the century. What are those changes, and how do we adapt? As inbound marketing gurus,...

Digital Marketing Trends 2024

In the fast-paced world of marketing, staying ahead of the curve is essential. As we move into 2024, it is crucial to explore the latest trends that...

IMAGES

VIDEO