- Case Studies

- Free Coaching Session

Production Plan in Business Plan: A Comprehensive Guide to Success

Last Updated:

October 29, 2024

In any business venture, a solid production plan is crucial for success. A production plan serves as a roadmap that outlines the steps, resources, and strategies required to manufacture products or deliver services efficiently. By carefully crafting a production plan within a business plan, entrepreneurs can ensure optimal utilisation of resources, timely delivery, cost efficiency, and customer satisfaction. In this article, we will delve into the intricacies of creating an effective production plan in a business plan , exploring its key components, strategies, and the importance of aligning it with overall business objectives .

Key Takeaways on Production Plans in Business Planning

- A production plan : a detailed outline that guides efficient product manufacturing or service delivery.

- Importance of a production plan : provides a roadmap for operations, optimises resource utilisation, and aligns with customer demand.

- Key components : demand forecasting, capacity planning, inventory management, resource allocation, and quality assurance.

- Strategies : lean manufacturing, JIT inventory, automation and technology integration, supplier relationship management, and continuous improvement.

- Benefits of a well-executed production plan : improved efficiency, reduced costs, enhanced product quality, and increased profitability.

What is a Production Plan?

A production Seamless Searches plan is a detailed outline that specifies the processes, resources, timelines, and strategies required to convert raw materials into finished goods or deliver services. It serves as a blueprint for the entire production cycle, guiding decision-making and resource allocation. The production plan considers factors such as demand forecasting, capacity planning, inventory management, and quality assurance to ensure efficient operations and optimal customer satisfaction.

Why is a Production Plan Important in a Business Plan?

The inclusion of a production plan in a business plan is vital for several reasons. First and foremost, it provides a clear roadmap for business operations, helping entrepreneurs and managers make informed decisions related to production processes. A well-developed production plan ensures that resources are utilised efficiently, minimising wastage and optimising productivity. This is particularly important for any startup platform aiming to streamline its production processes and achieve sustainable growth.

Additionally, a production plan allows businesses to align their production capabilities with customer demand. By forecasting market trends and analysing customer needs, businesses can develop a production plan that caters to current and future demands, thus avoiding overstocking or understocking situations. For those interested in property development, understanding the dynamics of the real estate market can provide valuable insights into aligning production capabilities with demand, ensuring successful projects and investments.

Furthermore, a production plan helps businesses enhance their competitive advantage. By implementing strategies such as lean manufacturing and invoice automation , companies can streamline their production processes, reduce costs, improve product quality, and ultimately outperform competitors.

Key Components of a Production Plan

To create an effective production plan, it is crucial to consider several key components. These components work together to ensure efficient operations and successful fulfilment of customer demands. Let's explore each component in detail.

Demand Forecasting

Demand forecasting is a critical aspect of production planning. By analysing historical data, market trends, and customer behaviour, businesses can predict future demand for their products or services. Accurate demand forecasting allows companies to optimise inventory levels, plan production capacity, and ensure timely delivery to customers.

One approach to demand forecasting is quantitative analysis, which involves analysing historical sales data to identify patterns and make predictions. Another approach is qualitative analysis, which incorporates market research, customer surveys, and expert opinions to gauge demand fluctuations. By combining both methods, businesses can develop a robust demand forecast, minimising the risk of underproduction or overproduction. Utilising a free notion template for demand forecasting can further streamline this process, allowing businesses to organise and analyse both quantitative and qualitative data efficiently in one centralised location.

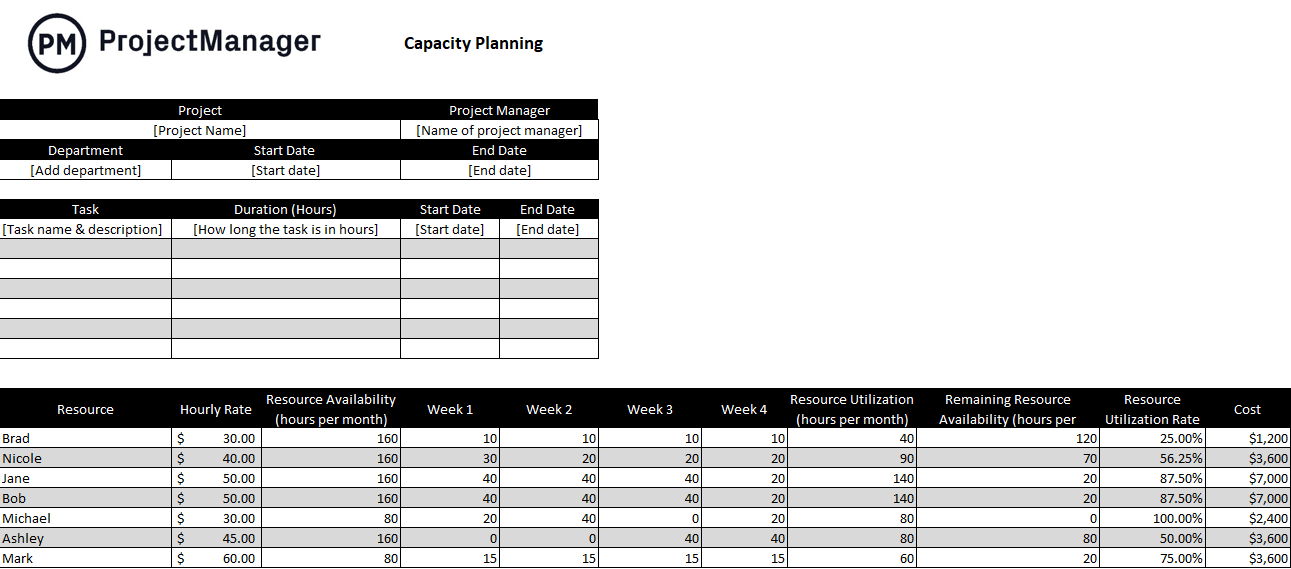

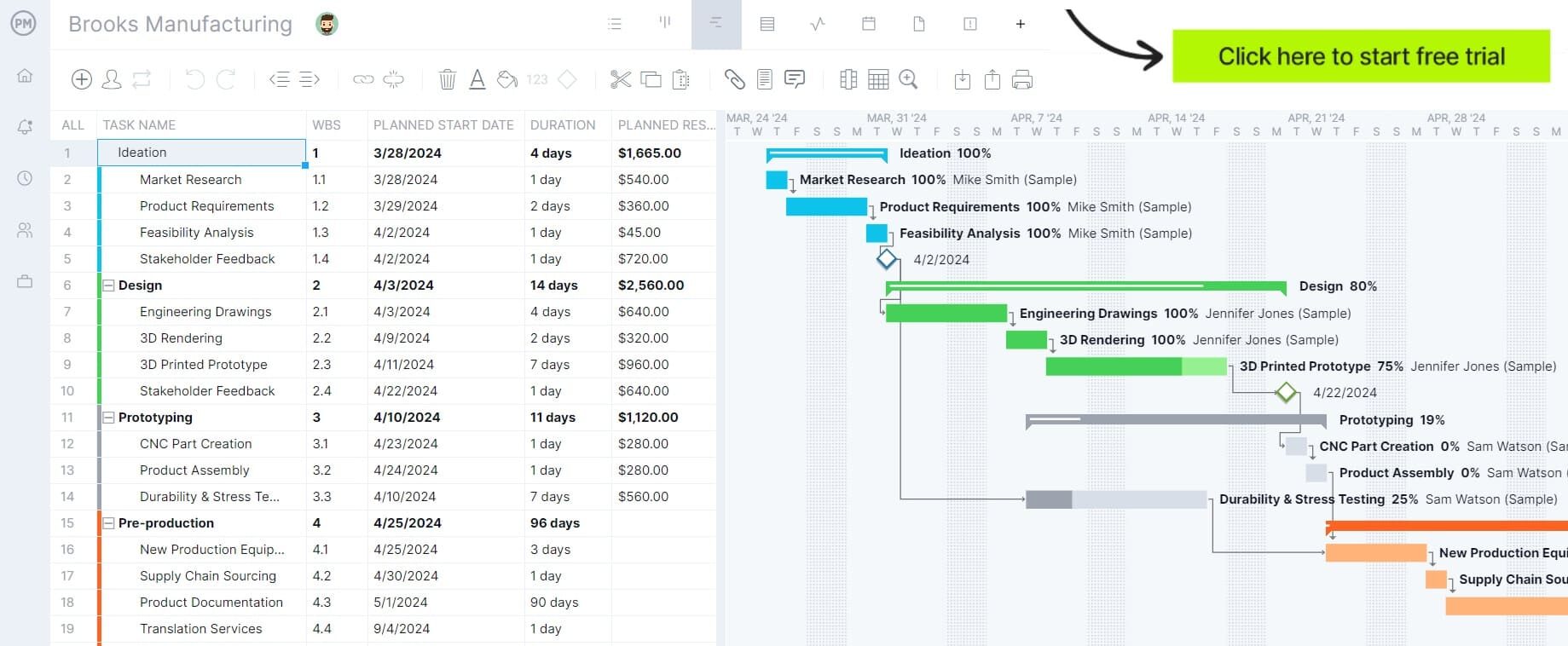

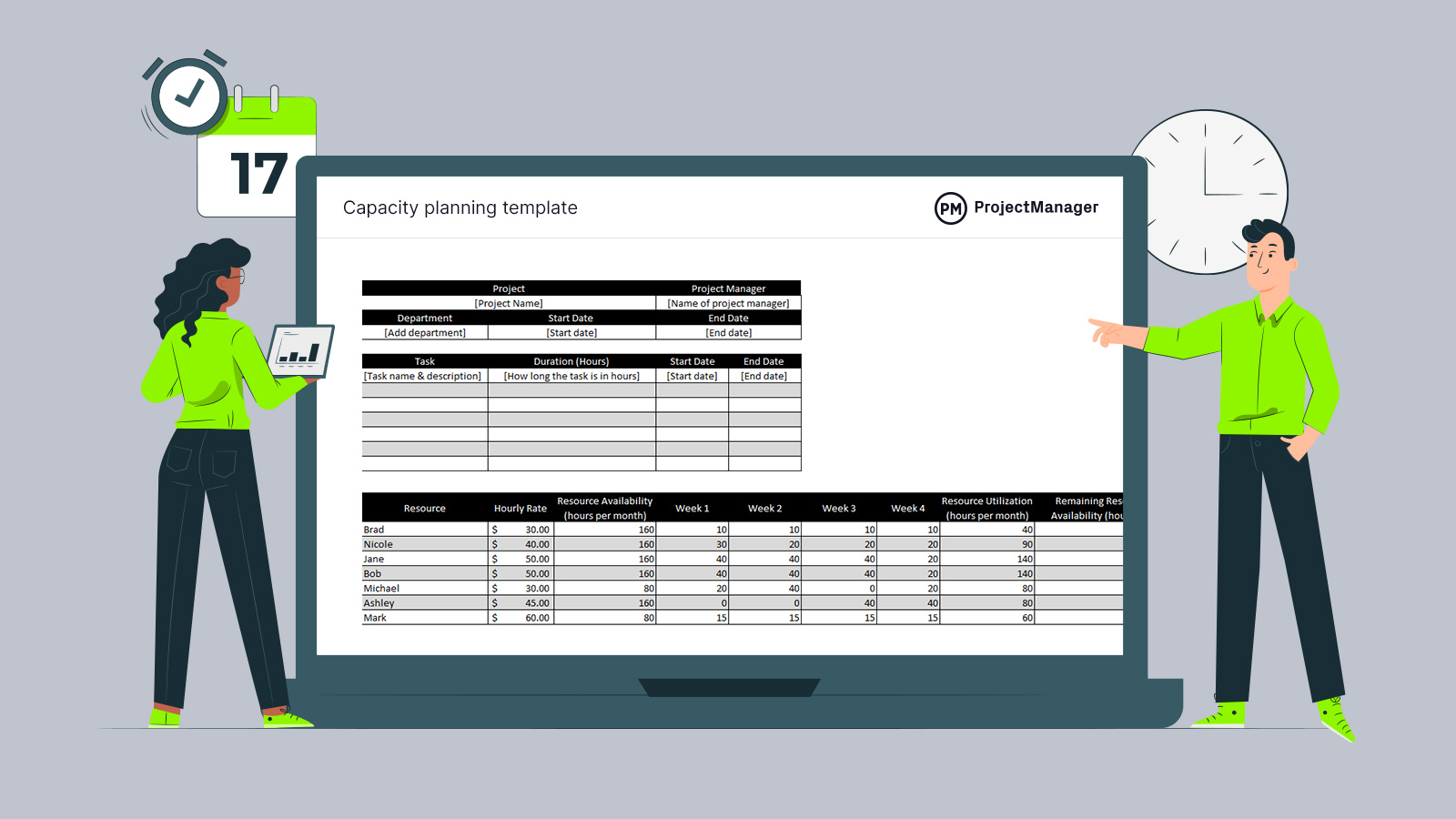

Capacity Planning

Capacity planning involves determining the optimal production capacity required to meet projected demand. This includes assessing the production capabilities of existing resources, such as machinery, equipment, and labour, and identifying any gaps that need to be addressed. By conducting a thorough capacity analysis, businesses can ensure that their production capacity aligns with customer demand, avoiding bottlenecks or excess capacity.

An effective capacity plan takes into account factors such as production cycle times, labour availability, equipment maintenance, and production lead times.

Inventory Management

Efficient inventory management is crucial for a successful production plan. It involves balancing the cost of holding inventory with the risk of stockouts. By maintaining optimal inventory levels, businesses can reduce carrying costs while ensuring that sufficient stock is available to fulfil customer orders.

Inventory management techniques, such as the Economic Order Quantity (EOQ) model and Just-in-Time (JIT) inventory system, help businesses strike the right balance between inventory investment and customer demand. These methods consider factors such as order frequency, lead time, and carrying costs to optimise inventory levels and minimise the risk of excess or insufficient stock.

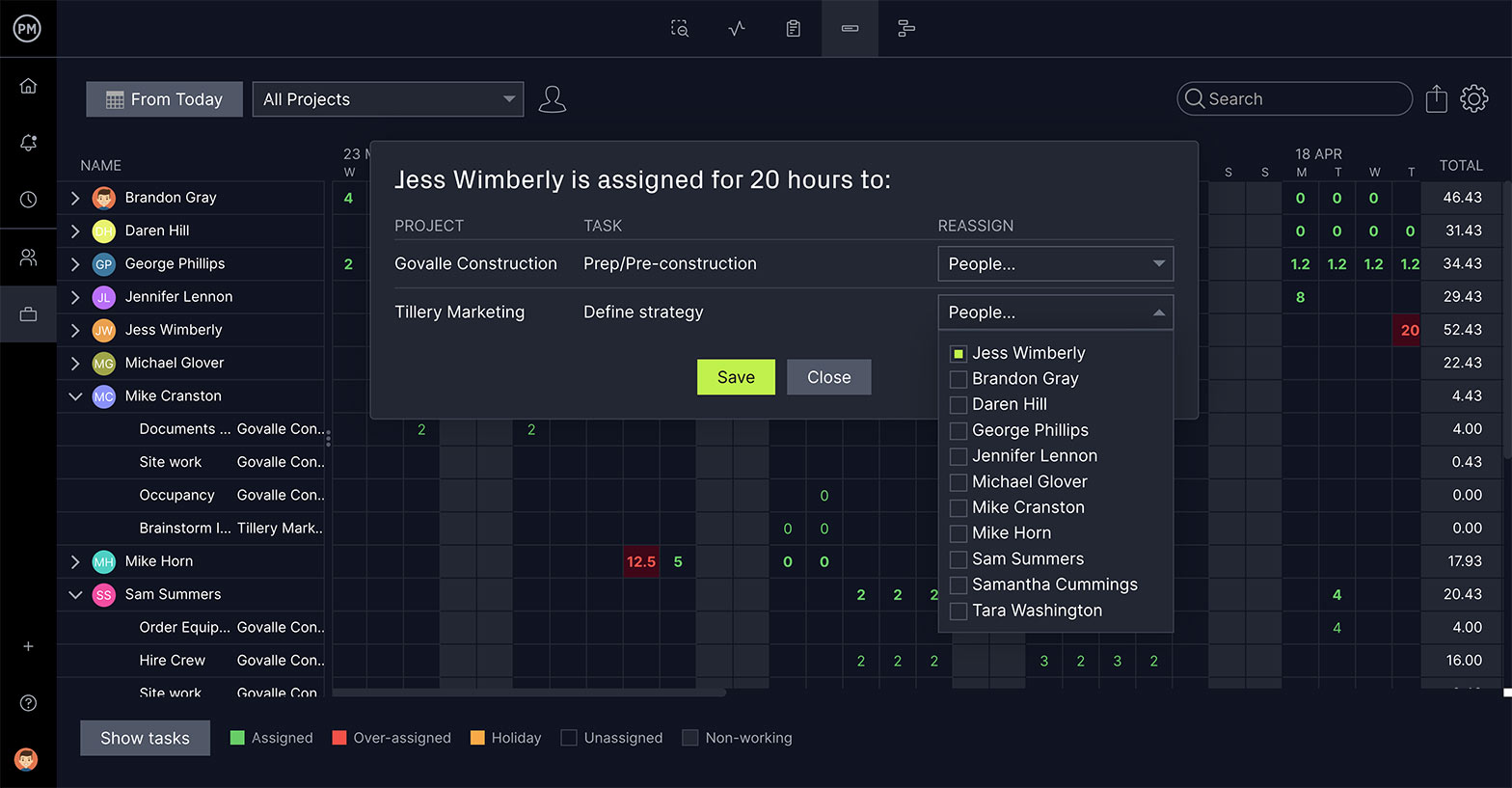

Resource Allocation

Resource allocation plays a pivotal role in a production plan. It involves assigning available resources, such as labour, materials, and equipment, to specific production tasks or projects. Effective resource allocation ensures that resources are utilised optimally, avoiding underutilisation or over-utilisation.

To allocate resources efficiently, businesses must consider factors such as skill requirements, resource availability, project timelines, and cost constraints. By conducting a thorough resource analysis and implementing resource allocation strategies, businesses can streamline production processes, minimise bottlenecks, and maximise productivity .

Quality Assurance

Maintaining high-quality standards is essential for any production plan. Quality assurance involves implementing measures to monitor and control the quality of products or services throughout the production process. By adhering to quality standards and conducting regular inspections, businesses can minimise defects, ensure customer satisfaction, and build a positive brand reputation.

Quality assurance techniques, such as Total Quality Management (TQM) and Six Sigma , help businesses identify and rectify any quality-related issues. These methodologies involve continuous monitoring, process improvement, and employee training to enhance product quality and overall operational efficiency.

In addition to the core components of a production plan, it's also important for businesses to consider the broader aspects of their business strategy, including marketing and advertising. Understanding the costs and returns of different marketing approaches is crucial for comprehensive business planning . For instance, direct response advertising costs can vary significantly, but they offer the advantage of measurable responses from potential customers. This type of advertising can be a valuable strategy for businesses looking to directly engage with their target audience and track the effectiveness of their marketing efforts.

Strategies for Developing an Effective Production Plan

Developing an effective production plan requires implementing various strategies and best practices. By incorporating these strategies into the production planning process, businesses can optimise operations and drive success. Let's explore some key strategies in detail.

Lean Manufacturing

Lean manufacturing is a systematic Seamless Searches approach aimed at eliminating waste and improving efficiency in production processes. It emphasises the concept of continuous improvement and focuses on creating value for the customer while minimising non-value-added activities.

By adopting lean manufacturing principles, such as just-in-time production, standardised work processes, and visual management, businesses can streamline operations, reduce lead times, and eliminate unnecessary costs. Lean manufacturing not only improves productivity but also enhances product quality and customer satisfaction.

Just-in-Time (JIT) Inventory

Just-in-Time (JIT) inventory is a strategy that aims to minimise inventory levels by receiving goods or materials just when they are needed for production. This strategy eliminates the need for excess inventory storage, reducing carrying costs and the risk of obsolete inventory.

By implementing a JIT inventory system, businesses can optimise cash flow, reduce storage space requirements, and improve overall supply chain efficiency. However, it requires robust coordination with suppliers, accurate demand forecasting, and efficient logistics management to ensure timely delivery of materials.

Automation and Technology Integration

Automation and technology integration play a crucial role in modern production planning, as well as mobile app development . By leveraging technology, businesses can streamline processes, enhance productivity, and reduce human error. Automation can be implemented in various aspects of production, including material handling, assembly, testing, and quality control.

Continuous Improvement

Continuous improvement is a fundamental principle of effective production planning. It involves regularly evaluating production processes, identifying areas for improvement, and implementing changes to enhance efficiency and quality.

By fostering a culture of continuous improvement, businesses can drive innovation, optimise resource utilisation, and stay ahead of competitors. Techniques such as Kaizen, Six Sigma, and value stream mapping can help businesses identify inefficiencies, eliminate waste, and streamline production workflows.

Frequently Asked Questions (FAQs)

What is the role of a production plan in business planning.

A1: A production plan plays a crucial role in business planning by providing a roadmap for efficient production processes. It helps align production capabilities with customer demand, optimise resource utilisation, and ensure timely delivery of products or services.

How does a production plan affect overall business profitability?

A2: A well-developed production plan can significantly impact business profitability. By optimising production processes, reducing costs, and enhancing product quality, businesses can improve their profit margins and gain a competitive edge in the market.

What are the common challenges faced in production planning?

A3: Production planning can present various challenges, such as inaccurate demand forecasting, capacity constraints, supply chain disruptions, and quality control issues. Overcoming these challenges requires robust planning, effective communication, and the implementation of appropriate strategies and technologies.

What is the difference between short-term and long-term production planning?

A4: Short-term production planning focuses on immediate production requirements, such as daily or weekly schedules. Long-term production planning, on the other hand, involves strategic decisions related to capacity expansion, technology investments, and market expansion, spanning months or even years.

How can a production plan be adjusted to accommodate changes in demand?

A5: To accommodate changes in demand, businesses can adopt flexible production strategies such as agile manufacturing or dynamic scheduling. These approaches allow for quick adjustments to production levels, resource allocation, and inventory management based on fluctuating customer demand.

In conclusion, a well-crafted production plan is essential for business success. By incorporating a production plan into a comprehensive business plan, entrepreneurs can optimise resource utilisation, meet customer demands, enhance product quality, and drive profitability. Through effective demand forecasting, capacity planning, inventory management, resource allocation, and quality assurance, businesses can streamline production processes and gain a competitive edge in the market.

People Also Like to Read...

Are You Ready For Your Expansion Plans?

How To Build Your Digital Marketing Plan

© 2016 - 2024 Robin Waite. All rights reserved.

Cost of Production: How to Calculate and Report the Cost of Producing Your Goods or Services

1. understanding the importance of calculating and reporting production costs, 2. key components and factors to consider, 3. analyzing materials, labor, and overhead expenses, 4. exploring administrative and support expenses, 5. determining how to assign costs to products or services, 6. comparing job order costing and process costing, 7. presenting production costs in financial statements, 8. evaluating cost efficiency and identifying areas for improvement, 9. harnessing the power of accurate cost calculation and reporting.

One of the most important aspects of running a successful business is knowing how much it costs to produce your goods or services. Production costs are the expenses incurred by a business in the process of transforming raw materials, labor, and overhead into finished products that can be sold to customers. By calculating and reporting production costs, you can:

- Track your profitability and performance over time

- identify areas of improvement and optimization

- Make informed decisions about pricing , marketing, and budgeting

- communicate effectively with your stakeholders , investors, and customers

In this section, we will explore the concept of production costs, the different types of production costs, and the methods of calculating and reporting them. We will also look at some examples of how production costs are used in various industries and scenarios. By the end of this section, you will have a better understanding of why production costs are important and how to use them for your business.

To calculate and report production costs, you need to consider the following steps:

1. Define the scope and period of your analysis. Depending on your business model and objectives, you may want to calculate and report production costs for a single product, a product line, a department, a plant, or the entire business. You also need to decide the time frame of your analysis , such as a month, a quarter, a year, or a specific project duration.

2. Identify the relevant cost categories and elements . Production costs can be classified into two main categories: variable costs and fixed costs . Variable costs are the costs that change in proportion to the level of production, such as raw materials, direct labor, and utilities. Fixed costs are the costs that remain constant regardless of the level of production, such as rent, depreciation, and salaries. Within each category, you need to identify the specific cost elements that are applicable to your business, such as materials, labor, overhead, marketing, etc.

3. allocate the costs to the products or services . Once you have identified the cost categories and elements, you need to assign them to the products or services that you produce. This can be done using different methods, such as direct tracing , driver tracing , or allocation . Direct tracing is the method of assigning costs that can be directly traced to a specific product or service , such as raw materials or direct labor. Driver tracing is the method of assigning costs that can be indirectly traced to a specific product or service, using a cost driver that reflects the consumption of resources, such as machine hours or labor hours. allocation is the method of assigning costs that cannot be traced to a specific product or service, using a predetermined basis, such as sales revenue or production volume.

4. Calculate the total production costs and the unit production costs. The total production costs are the sum of all the costs allocated to the products or services. The unit production costs are the average costs per unit of output, obtained by dividing the total production costs by the number of units produced. These are the key indicators of your production efficiency and profitability .

5. Report the production costs and analyze the results. The production costs can be reported using different formats, such as cost of goods sold statement , cost of goods manufactured statement , or cost sheet . These are the documents that summarize the production costs and show how they are related to the sales revenue and the inventory. By analyzing the production costs , you can identify the sources of variance, the trends and patterns, the areas of improvement, and the implications for your business strategy .

Let's look at some examples of how production costs are calculated and reported in different industries and scenarios:

- A bakery produces bread, cakes, and pastries. The bakery uses flour, sugar, eggs, butter, and other ingredients as raw materials. The bakery also employs bakers, packers, and delivery staff as direct labor. The bakery pays rent, electricity, water, and gas as overhead. The bakery sells its products to customers directly or through distributors. The bakery wants to calculate and report its production costs for the month of January 2024. The bakery uses the following data:

| cost Category | cost Element | Amount |

| Variable Costs | Raw Materials | $10,000 |

| | Direct Labor | $15,000 |

| | Utilities | $2,000 |

| Fixed Costs | Rent | $5,000 |

| | Depreciation | $1,000 |

| | Salaries | $8,000 |

The bakery produces 10,000 units of bread, 5,000 units of cakes, and 3,000 units of pastries in January 2024. The bakery uses the following methods to allocate the costs to the products:

- Raw materials are allocated based on direct tracing. The bakery uses $4,000 of flour, $2,000 of sugar, $1,500 of eggs, $1,500 of butter, and $1,000 of other ingredients in January 2024. The bakery estimates that 40% of the flour, 20% of the sugar, 30% of the eggs, 10% of the butter, and 50% of the other ingredients are used for bread. 30% of the flour, 40% of the sugar, 40% of the eggs, 60% of the butter, and 30% of the other ingredients are used for cakes. 30% of the flour, 40% of the sugar, 30% of the eggs, 30% of the butter, and 20% of the other ingredients are used for pastries.

- Direct labor is allocated based on driver tracing. The bakery uses labor hours as the cost driver . The bakery records that it spends 1,000 labor hours in January 2024. The bakery estimates that 50% of the labor hours are spent on bread, 30% on cakes, and 20% on pastries.

- Utilities are allocated based on driver tracing. The bakery uses machine hours as the cost driver . The bakery records that it uses 500 machine hours in January 2024. The bakery estimates that 40% of the machine hours are used for bread, 30% for cakes, and 30% for pastries.

- Rent is allocated based on allocation. The bakery uses production volume as the basis. The bakery produces 18,000 units of output in January 2024. The bakery allocates the rent proportionally to the output of each product.

- Depreciation is allocated based on allocation. The bakery uses production volume as the basis. The bakery produces 18,000 units of output in January 2024. The bakery allocates the depreciation proportionally to the output of each product.

- Salaries are allocated based on allocation. The bakery uses sales revenue as the basis. The bakery generates $50,000 of sales revenue in January 2024. The bakery estimates that 40% of the sales revenue comes from bread, 35% from cakes, and 25% from pastries.

The bakery calculates the total production costs and the unit production costs for each product as follows:

| Product | Total Production Costs | Unit Production Costs |

| Bread | $16,000 | $1.60 |

| Cakes | $14,000 | $2.80 |

| Pastries | $11,000 | $3.67 |

The bakery reports its production costs using a cost of goods sold statement as follows:

| Cost of Goods Sold Statement for January 2024 |

| Sales Revenue | $50,000 |

| Less: Cost of Goods Sold | |

| Variable Costs | |

| Raw Materials | $10,000 |

| Direct Labor | $15,000 |

| Utilities | $2,000 |

| Subtotal | $27,000 |

| Fixed Costs | |

| Rent | $5,000 |

| Depreciation | $1,000 |

| Salaries | $8,000 |

| Subtotal | $14,000 |

| Total Cost of Goods Sold | $41,000 |

| Gross Profit | $9,000 |

By analyzing the production costs, the bakery can see that:

- The bread has the lowest unit production cost and the highest sales revenue, making it the most profitable product.

- The pastries have the highest unit production cost and the lowest sales revenue, making it the least profitable product.

- The cakes have a moderate unit production cost and sales revenue, making it a stable product.

- The bakery can improve its profitability by increasing the production and sales of bread, reducing the production and sales of pastries, and optimizing the production and sales of cakes.

- The bakery can also look for ways to reduce its variable costs , such as finding cheaper or more efficient raw materials, labor, and utilities.

- The bakery can also look for ways to reduce its fixed costs , such as negotiating a lower rent, using less depreciating equipment, or streamlining its salaries.

- A software company develops and sells a mobile app that helps users track their fitness goals. The software company uses cloud services, software licenses, and online advertising as variable costs. The software company also pays salaries, rent, and insurance as fixed costs. The software company charges users a monthly subscription fee to access the app. The software company wants to calculate and report its production costs for the year 2024. The software company uses the following data:

| Cost Category | Cost Element | Amount |

| Variable Costs | Cloud Services | $0.10 per user per month |

| | Software Licenses | $1,000 per month |

| | Online Advertising | $0.05 per user per month |

| Fixed Costs | Salaries | $120,

Fund your startup even if it is in the pre-seed stage

FasterCapital matches your startup with early-stage investors and helps you prepare for your pitching!

One of the most important aspects of running a successful business is knowing how much it costs to produce your goods or services. Production costs are the expenses incurred by a firm in the process of transforming inputs into outputs . These costs can vary depending on the type, quantity, and quality of the products or services , as well as the production methods, technologies, and efficiency of the firm. Understanding the different components and factors that affect production costs can help you optimize your operations, improve your profitability, and gain a competitive edge in the market . In this section, we will define production costs and discuss the key components and factors to consider when calculating and reporting them.

Production costs can be classified into two main categories: fixed costs and variable costs. fixed costs are the costs that do not change with the level of output, such as rent, salaries, depreciation, insurance, and interest. Variable costs are the costs that vary with the level of output, such as raw materials, labor, utilities, and transportation. The total production cost is the sum of fixed and variable costs. For example, suppose a firm produces 100 units of a product with a fixed cost of $10,000 and a variable cost of $5 per unit . The total production cost is $10,000 + ($5 x 100) = $10,500.

There are several factors that can affect the production costs of a firm, such as:

1. The production function : The production function describes the relationship between the inputs and the outputs of a firm. It shows how much output can be produced with a given amount of inputs, such as labor, capital, and technology. The production function can be affected by the productivity and efficiency of the inputs, as well as the returns to scale. Productivity is the amount of output produced per unit of input, while efficiency is the ratio of output to input. Returns to scale refer to how the output changes when all the inputs are increased by the same proportion. For example, if a firm doubles its inputs and its output also doubles, it has constant returns to scale . If its output more than doubles, it has increasing returns to scale . If its output less than doubles, it has decreasing returns to scale . A firm can reduce its production costs by increasing its productivity and efficiency, and by operating at the optimal level of returns to scale.

2. The market conditions : The market conditions refer to the supply and demand of the products or services , as well as the prices and competition in the market. The market conditions can affect the production costs of a firm by influencing the availability and cost of the inputs, as well as the revenue and profit of the outputs. For example, if the demand for a product increases, the firm may need to increase its production, which may require more inputs and incur higher costs. However, the firm may also be able to charge a higher price and earn more revenue and profit. On the other hand, if the supply of a product increases, the firm may face more competition and lower prices, which may reduce its revenue and profit. The firm may need to lower its production, which may reduce its costs, but also its output. A firm can adapt to the market conditions by adjusting its production level, price, and quality, as well as by innovating and differentiating its products or services .

3. The government policies : The government policies refer to the laws, regulations, taxes, subsidies, and incentives that affect the production and consumption of goods and services. The government policies can affect the production costs of a firm by imposing costs or benefits on the inputs or outputs of the firm. For example, if the government imposes a tax on the raw materials used by the firm, the firm's variable costs will increase . If the government provides a subsidy for the products or services offered by the firm, the firm's revenue will increase. A firm can comply with the government policies by paying the taxes, following the regulations, and claiming the subsidies and incentives. A firm can also lobby or advocate for favorable policies that can reduce its costs or increase its revenue .

Key Components and Factors to Consider - Cost of Production: How to Calculate and Report the Cost of Producing Your Goods or Services

One of the most important aspects of running a business is understanding the cost of production. This is the total amount of money that it takes to produce the goods or services that you sell to your customers. The cost of production can be divided into two main categories: direct costs and indirect costs. In this section, we will focus on the direct costs, which are the expenses that can be directly traced to a specific product or service. These include materials, labor, and overhead expenses. We will analyze each of these components and how they affect the cost of production. We will also provide some tips and examples on how to reduce or optimize your direct costs.

- Materials are the raw materials or supplies that you need to create your product or service. For example, if you are a baker, your materials would include flour, sugar, eggs, butter, etc. The cost of materials depends on the quantity and quality of the materials that you use, as well as the market price and availability of the materials. To calculate the cost of materials, you need to multiply the unit cost of each material by the number of units that you use. For example, if you use 10 kg of flour at $2 per kg, your cost of flour would be $20. To reduce the cost of materials, you can try to find cheaper or alternative sources of materials, buy in bulk or negotiate discounts, use less or more efficient materials, or recycle or reuse materials.

- Labor is the work that you or your employees do to produce your product or service. For example, if you are a baker, your labor would include mixing, kneading, baking, decorating, etc. The cost of labor depends on the number and skill level of the workers that you employ, as well as the wages and benefits that you pay them. To calculate the cost of labor , you need to multiply the hourly rate of each worker by the number of hours that they work. For example, if you pay your baker $15 per hour and they work 8 hours a day, your cost of labor for that baker would be $120. To reduce the cost of labor , you can try to hire fewer or more qualified workers, train or motivate your workers to improve their productivity, outsource or automate some tasks, or offer incentives or rewards for performance.

- Overhead is the indirect expenses that are related to the production process, but not directly attributable to a specific product or service. For example, if you are a baker, your overhead would include rent, utilities, equipment, insurance, taxes, etc. The cost of overhead depends on the fixed and variable costs that you incur, as well as the volume and efficiency of your production. To calculate the cost of overhead, you need to add up all the overhead expenses that you incur in a given period. For example, if your rent is $1000 per month, your utilities are $200 per month, your equipment is $500 per month, your insurance is $100 per month, and your taxes are $300 per month, your total overhead cost would be $2100 per month. To reduce the cost of overhead, you can try to find cheaper or more suitable locations, lower your utility consumption, upgrade or maintain your equipment, reduce your insurance or tax liabilities, or eliminate unnecessary or wasteful expenses .

By analyzing your direct costs , you can gain a better understanding of how much it costs you to produce your goods or services, and how you can improve your profitability and competitiveness. You can also use your direct costs to calculate your contribution margin , which is the difference between your sales revenue and your direct costs. This is an important indicator of how much money you make from each unit of your product or service , and how much money you have left to cover your indirect costs and generate profit . To calculate your contribution margin, you need to subtract your direct costs from your sales revenue. For example, if you sell a cake for $50 and your direct costs are $30, your contribution margin would be $20. This means that you make $20 from each cake that you sell, and you have $20 to cover your indirect costs and profit. To increase your contribution margin, you can try to increase your sales price, decrease your direct costs, or sell more units.

Increase your startup’s sales and generate more revenues

FasterCapital provides full sales services for startups, helps you find more customers, and contacts them on your behalf!

One of the most challenging aspects of calculating the cost of production is accounting for the indirect costs , also known as overheads. These are the expenses that are not directly related to the production of goods or services, but are necessary for the operation of the business. Examples of indirect costs include rent, utilities, insurance, salaries of administrative and support staff, depreciation, and taxes. Indirect costs can vary widely depending on the type, size, and industry of the business, and they can have a significant impact on the profitability and competitiveness of the products or services offered. In this section, we will explore the following topics related to indirect costs:

1. How to identify and classify indirect costs. Not all indirect costs are the same, and different methods of classification can affect how they are allocated and reported. Some common ways of classifying indirect costs are by function, behavior, traceability, and controllability. We will explain what each of these terms mean and how they can help you manage your indirect costs more effectively.

2. How to allocate indirect costs to products or services . Since indirect costs are not directly attributable to a specific product or service, they need to be allocated using a reasonable and consistent basis. This can be done using either a single or a multiple overhead rate, depending on the complexity and diversity of the production process. We will discuss the advantages and disadvantages of each method and how to choose the best one for your business.

3. How to report indirect costs in financial statements . Indirect costs are usually reported as part of the cost of goods sold (COGS) or the operating expenses (OPEX) in the income statement, depending on whether they are related to the production or the selling and administrative activities of the business. We will show you how to calculate and report these costs using the absorption costing or the variable costing method , and how they can affect your net income and tax liability.

4. How to reduce and control indirect costs . Indirect costs can be a major source of inefficiency and waste in the production process , and they can erode the profit margin and the competitive edge of the products or services offered. We will share some tips and best practices on how to reduce and control your indirect costs, such as budgeting, benchmarking, outsourcing, automation, and lean management.

By the end of this section, you will have a better understanding of the nature and importance of indirect costs, and how to calculate and report them accurately and effectively. You will also learn how to optimize your indirect costs and improve your production efficiency and profitability. Let's get started!

Exploring Administrative and Support Expenses - Cost of Production: How to Calculate and Report the Cost of Producing Your Goods or Services

One of the most important aspects of cost of production is how to allocate costs to the products or services that are being produced. Cost allocation methods are the techniques that are used to assign costs to different cost objects , such as products, departments, customers, or projects. cost allocation methods can have a significant impact on the profitability, pricing, and performance evaluation of a business . Therefore, it is essential to understand the different cost allocation methods, their advantages and disadvantages, and how to apply them in various situations. In this section, we will discuss the following cost allocation methods:

1. Direct Costing : This is the simplest and most straightforward method of cost allocation . It involves assigning only the direct costs to the products or services that cause them. Direct costs are the costs that can be easily traced and measured to a specific cost object, such as materials, labor, or equipment. For example, if a company produces two types of widgets, A and B, and each widget requires $10 of materials and $5 of labor, then the direct costs of each widget are $15. Direct costing is easy to implement and understand, and it provides a clear picture of the contribution margin of each product or service . However, direct costing ignores the indirect costs, which are the costs that cannot be easily traced or measured to a specific cost object, such as rent, utilities, or depreciation. indirect costs are also known as overhead costs, and they are usually allocated to products or services using a predetermined rate based on some activity or output measure, such as direct labor hours , machine hours, or units produced. This leads us to the next method of cost allocation, which is called absorption costing.

2. Absorption Costing : This is the most common and widely used method of cost allocation. It involves assigning both the direct and indirect costs to the products or services that are being produced. Absorption costing ensures that all the costs of production are recovered from the products or services, and it provides a more accurate picture of the total cost and profit of each product or service. However, absorption costing can also have some drawbacks, such as the difficulty of determining the appropriate overhead rate, the possibility of over- or under-allocating the overhead costs, and the potential distortion of the product or service profitability due to changes in the production volume or the product mix. For example, if a company produces two types of widgets, A and B, and each widget requires $10 of materials, $5 of labor, and $20 of overhead (allocated based on direct labor hours), then the total cost of each widget is $35. However, if the company produces more widgets A than widgets B, then the overhead rate per direct labor hour will increase, and the cost of widgets B will also increase, even though the actual amount of overhead used by widgets B has not changed. This can make widgets B appear less profitable than they really are, and it can affect the pricing and production decisions of the company. To avoid this problem, some companies use a different method of cost allocation, which is called variable costing.

3. Variable Costing : This is a method of cost allocation that involves assigning only the variable costs to the products or services that are being produced. Variable costs are the costs that change in proportion to the level of activity or output, such as materials, labor, or electricity. Fixed costs are the costs that do not change in relation to the level of activity or output, such as rent, insurance, or depreciation. Variable costing separates the fixed and variable costs, and it treats the fixed costs as period costs, which are expensed in the period in which they are incurred , rather than as product costs, which are capitalized and allocated to the products or services. Variable costing is useful for decision making , as it shows the marginal cost and contribution margin of each product or service , and it eliminates the distortion caused by changes in the production volume or the product mix. However, variable costing is not acceptable for external reporting, as it violates the matching principle, which states that the costs and revenues of a period should be matched and reported in the same period. Therefore, most companies use absorption costing for external reporting and variable costing for internal decision making. However, there are also other methods of cost allocation that can be used for specific purposes, such as activity-based costing and joint costing.

4. Activity-Based Costing (ABC) : This is a method of cost allocation that involves identifying the activities that drive the overhead costs, and assigning the overhead costs to the products or services based on their consumption of those activities. ABC recognizes that different products or services may use different amounts and types of resources, and it attempts to allocate the overhead costs more accurately and fairly based on the actual usage of the resources. ABC can improve the product or service profitability analysis, the pricing and production decisions, and the performance evaluation of the business units. However, ABC can also be complex and costly to implement and maintain, as it requires a detailed analysis of the activities, the cost drivers, and the cost pools, and it may require a significant amount of data collection and processing . ABC is most suitable for companies that have a large number of products or services, a high proportion of overhead costs, and a high degree of diversity and complexity in their operations. For example, a company that produces customized products for different customers may benefit from using ABC, as it can better capture the differences in the resource consumption and the cost behavior of each product or customer.

5. Joint Costing : This is a method of cost allocation that involves assigning the common costs of producing two or more products or services that are jointly produced from the same input or process. Joint products or services are the products or services that are produced simultaneously from the same input or process, and they have a relatively high sales value. By-products or services are the products or services that are produced incidentally from the same input or process, and they have a relatively low sales value. Joint costing is necessary when the joint products or services cannot be identified or separated until a certain point in the production process, which is called the split-off point. Joint costing can be challenging, as there is no clear or objective way of allocating the joint costs to the joint products or services. Different methods of joint costing can result in different costs and profits for the joint products or services , and they can affect the pricing and production decisions of the company. Some of the common methods of joint costing are the physical measure method, the sales value at split-off method, the net realizable value method, and the constant gross margin percentage method. For example, a company that produces gasoline and diesel from crude oil may use joint costing, as the gasoline and diesel are joint products that are produced from the same input and process, and they cannot be separated until the refining stage.

Determining How to Assign Costs to Products or Services - Cost of Production: How to Calculate and Report the Cost of Producing Your Goods or Services

In this section, we will delve into the two primary costing systems used in manufacturing and service industries: job Order Costing and process Costing. These systems play a crucial role in determining the cost of production and help businesses make informed decisions regarding pricing, budgeting, and profitability.

1. Job Order Costing:

Job Order Costing is commonly employed in industries where products or services are customized or produced in small batches. It involves allocating costs to specific jobs or orders . Here, costs are tracked individually for each job, allowing for accurate cost estimation and control. For example, a custom furniture manufacturer would use Job Order costing to determine the cost of producing each unique piece of furniture.

2. Process Costing:

Process Costing, on the other hand, is utilized in industries where products are produced in a continuous or repetitive manner. It involves allocating costs to production processes or departments. This method is suitable for industries such as food processing, oil refining, or chemical manufacturing. process Costing provides an average cost per unit by spreading the total costs across the units produced during a specific period.

Now, let's explore some key insights from different perspectives:

- Cost Allocation: Job Order Costing focuses on allocating costs to specific jobs , while Process Costing allocates costs to processes or departments.

- Cost Accuracy: Job Order Costing provides a higher level of cost accuracy as costs are tracked individually for each job. Process Costing, on the other hand, provides an average cost per unit , which may be less precise but more practical for mass production scenarios.

- Customization vs. Standardization: Job Order Costing is suitable for industries that offer customized products or services , while Process Costing is more appropriate for standardized or repetitive production.

- Examples: In a Job Order Costing scenario, a construction company would allocate costs to each specific construction project. In Process Costing, a soft drink manufacturer would allocate costs to different production stages like mixing, bottling, and packaging.

By understanding the differences between Job order costing and Process Costing, businesses can choose the most suitable costing system based on their industry, production methods, and cost tracking requirements. This enables them to accurately calculate and report the cost of producing goods or services, facilitating effective decision-making and financial management.

Comparing Job Order Costing and Process Costing - Cost of Production: How to Calculate and Report the Cost of Producing Your Goods or Services

One of the most important aspects of cost of production is how to report it in the financial statements. cost reporting is the process of presenting the production costs in a way that reflects the true value of the goods or services produced and the profitability of the business. Cost reporting can be done in different ways, depending on the type of production, the accounting standards, and the purpose of the report. In this section, we will explore some of the common methods of cost reporting , their advantages and disadvantages, and some examples of how they are applied in practice.

Some of the common methods of cost reporting are:

1. Absorption costing : This method allocates all the production costs, both fixed and variable, to the units of output. This means that the cost of each unit includes not only the direct materials, labor, and overheads, but also a portion of the indirect costs, such as rent, depreciation, and administration. Absorption costing is often used for external reporting, as it complies with the generally accepted accounting principles (GAAP) and shows the full cost of production. However, absorption costing can also distort the profitability of the products, as it does not separate the fixed costs from the variable costs . For example, if the production volume increases, the fixed costs per unit will decrease, making the products appear more profitable, even though the total fixed costs remain the same.

2. Variable costing : This method only allocates the variable production costs to the units of output. This means that the cost of each unit includes only the direct materials, labor, and overheads, but not the fixed costs. Variable costing is often used for internal reporting, as it helps managers to make decisions based on the contribution margin of the products, which is the difference between the selling price and the variable cost . Variable costing also shows the impact of changes in production volume on the total costs and profits. However, variable costing does not comply with the GAAP and cannot be used for external reporting. Moreover, variable costing can also underestimate the cost of production, as it ignores the fixed costs that are necessary to maintain the production capacity.

3. Activity-based costing : This method assigns the production costs to the activities that cause them, rather than to the units of output. This means that the cost of each unit includes the direct materials, labor, and overheads, as well as the indirect costs that are driven by the activities performed for each product. activity-based costing is a more refined and accurate method of cost reporting, as it reflects the complexity and diversity of the production processes and the products. Activity-based costing can be used for both internal and external reporting, as it provides more relevant and reliable information for decision making and performance evaluation. However, activity-based costing can also be costly and time-consuming to implement, as it requires a detailed analysis of the activities, the cost drivers, and the cost pools. Additionally, activity-based costing can also be difficult to reconcile with the traditional costing methods, as it may result in different product costs and profits .

Presenting Production Costs in Financial Statements - Cost of Production: How to Calculate and Report the Cost of Producing Your Goods or Services

Cost analysis is a vital process for any business that wants to optimize its production and maximize its profits. By evaluating the cost efficiency of each activity and resource involved in the production process, a business can identify areas for improvement and implement changes that can reduce costs, increase output, or improve quality. In this section, we will discuss some of the methods and tools that can help you perform a cost analysis for your business, as well as some of the benefits and challenges of doing so. We will also provide some examples of how cost analysis can be applied to different types of businesses and industries.

Some of the steps involved in conducting a cost analysis are:

1. Define the scope and objectives of the analysis. Before you start collecting and analyzing data , you need to have a clear idea of what you want to achieve with your cost analysis. What are the questions you want to answer? What are the criteria you will use to evaluate the cost efficiency of your production? What are the assumptions and limitations of your analysis? Having a well-defined scope and objectives will help you focus your efforts and avoid unnecessary or irrelevant information.

2. Identify and categorize the costs of production. The next step is to identify all the costs that are associated with producing your goods or services . These costs can be classified into different categories, such as fixed costs, variable costs, direct costs, indirect costs, opportunity costs, and sunk costs. Fixed costs are the costs that do not change with the level of output, such as rent, salaries, and depreciation. Variable costs are the costs that vary with the level of output, such as raw materials, utilities, and labor. Direct costs are the costs that can be directly attributed to a specific product or service, such as the cost of ingredients for a cake. Indirect costs are the costs that cannot be directly attributed to a specific product or service, but are necessary for the overall operation of the business, such as the cost of marketing, administration, and maintenance. Opportunity costs are the costs of the next best alternative that is forgone as a result of choosing a certain option, such as the profit that could have been earned by investing in another project instead of buying a new machine. Sunk costs are the costs that have already been incurred and cannot be recovered , such as the cost of research and development for a product that was discontinued. By identifying and categorizing the costs of production, you can have a better understanding of how your resources are allocated and how they affect your profitability.

3. Calculate the total cost and the unit cost of production . The total cost of production is the sum of all the costs that are incurred in the production process. The unit cost of production is the average cost of producing one unit of output, which can be obtained by dividing the total cost by the quantity of output . These two measures can help you assess the overall efficiency and performance of your production process, as well as compare it with other alternatives or competitors. For example, if your total cost of production is $10,000 and your output is 1,000 units, then your unit cost of production is $10. If your competitor's total cost of production is $8,000 and their output is 800 units, then their unit cost of production is $10 as well. This means that you and your competitor have the same level of cost efficiency, but you have a higher level of output and revenue .

4. analyze the cost drivers and the cost behavior. A cost driver is a factor that causes a change in the cost of an activity or a resource. A cost behavior is the relationship between a cost and its cost driver. By analyzing the cost drivers and the cost behavior, you can identify the factors that influence your costs and how they respond to changes in the level of output or activity. For example, if the cost of raw materials is a cost driver for your production, then you can analyze how the price and availability of raw materials affect your costs and how your costs change with the quantity of raw materials used. This can help you determine the optimal level of input and output that minimizes your costs and maximizes your profits.

5. evaluate the cost effectiveness and the cost benefit of your production. cost effectiveness is the measure of how well a certain option achieves a desired outcome relative to its cost. Cost benefit is the measure of the net value or benefit that a certain option provides relative to its cost. By evaluating the cost effectiveness and the cost benefit of your production, you can compare the costs and benefits of different options and choose the one that provides the best value for your money. For example, if you are considering whether to buy a new machine or upgrade an existing one, you can compare the costs and benefits of each option, such as the initial investment, the operating costs, the output quality, the productivity, and the environmental impact. This can help you decide which option is more cost effective and beneficial for your business.

Cost analysis can be applied to different types of businesses and industries, depending on the nature and purpose of the production. For example, a manufacturing business can use cost analysis to optimize its production process, reduce its waste, and improve its quality. A service business can use cost analysis to evaluate its service delivery, enhance its customer satisfaction , and increase its loyalty. A nonprofit organization can use cost analysis to justify its funding, demonstrate its impact, and increase its accountability. A government agency can use cost analysis to allocate its resources , prioritize its projects, and improve its efficiency.

Some of the benefits of conducting a cost analysis are:

- It can help you identify and eliminate unnecessary or inefficient costs, and allocate your resources more effectively .

- It can help you improve your output quality , quantity, and consistency, and increase your customer satisfaction and retention .

- It can help you increase your competitive advantage, market share, and profitability, and achieve your strategic goals and objectives .

- It can help you monitor and control your performance , and identify and address any problems or issues that may arise.

Some of the challenges of conducting a cost analysis are:

- It can be time-consuming and complex, and require a lot of data and information, which may not be readily available or accurate.

- It can be influenced by various factors, such as market conditions, customer preferences, technological changes, and external regulations, which may not be predictable or controllable.

- It can be subject to different assumptions, interpretations, and limitations, which may affect its validity and reliability.

- It can be affected by human errors, biases, and emotions, which may compromise its objectivity and rationality.

In this blog, we have discussed the importance of calculating and reporting the cost of production for your goods or services. We have also explained the different methods and approaches that you can use to measure and allocate your costs , such as variable costing , absorption costing , activity-based costing , and standard costing . We have also explored the benefits and drawbacks of each method, and how they can affect your decision making , profitability, and competitiveness. In this final section, we will summarize the main points and provide some insights and recommendations on how you can harness the power of accurate cost calculation and reporting for your business.

Here are some of the key takeaways and tips that you should remember:

1. Know your costs and margins. This is the first and most essential step for any business that wants to optimize its production and pricing strategies . You should be able to identify and track all the costs that are involved in producing your goods or services, such as direct materials , direct labor , overhead , and other expenses . You should also be able to calculate your contribution margin , which is the difference between your selling price and your variable costs , and your gross margin , which is the difference between your selling price and your total costs . These margins will help you determine your break-even point , which is the minimum sales volume that you need to cover your costs, and your target profit , which is the sales volume that you need to achieve your desired income.

2. Choose the right costing method for your business. There is no one-size-fits-all solution when it comes to costing methods. Different methods have different advantages and disadvantages , depending on your business type, size, industry, and objectives. For example, variable costing is simpler and more useful for short-term decision making, but it does not account for fixed costs and may understate your profitability. Absorption costing is more comprehensive and more aligned with accounting standards, but it may overstate your profitability and distort your product costs. Activity-based costing is more accurate and more reflective of your cost drivers, but it is more complex and more costly to implement. Standard costing is more efficient and more conducive to performance evaluation, but it may not capture the actual costs and variances. You should weigh the pros and cons of each method and select the one that best suits your needs and goals.

3. Report your costs and results regularly and transparently. Once you have calculated your costs and margins, you should communicate them clearly and consistently to your stakeholders, such as your managers, employees, investors, customers, and suppliers. You should prepare and present your cost reports , which show the details and breakdown of your costs, and your income statements , which show your revenues, expenses, and profits. You should also use cost-volume-profit analysis , which shows the relationship between your costs, sales, and profits, and how they are affected by changes in price, volume, or costs. These reports and analyses will help you monitor your performance, identify your strengths and weaknesses , and make informed and strategic decisions for your business.

Harnessing the Power of Accurate Cost Calculation and Reporting - Cost of Production: How to Calculate and Report the Cost of Producing Your Goods or Services

Read Other Blogs

The concept of a home office has become increasingly prevalent in the modern workforce,...

The concept of standard of living is multifaceted, encompassing the various goods, services, and...

Understanding the fundamentals of tax relief is essential for anyone navigating the complexities of...

In the dynamic world of business, understanding the market landscape is crucial for any company...

The metabolism of drugs in the human body is a complex process that involves various enzymes,...

In the realm of business expansion, the shift towards a model where stakeholders have a direct...

Understanding the Importance of Distribution Rights When it comes to the world of syndication and...

1. User-Centric Mindset: - Growth hacking starts with a deep understanding of...

Understanding Customer Lifetime Value (CLV) is pivotal for businesses aiming to thrive in today's...

Budgeting Resources

- Career Guides

- Interview Prep Guides

- Free Practice Tests

- Excel Cheatsheets

🕛 Time: 10:00-11:00 am EST 📅 Date: 12th December 💻 Venue: Online 🏃♂️ Seats : Limited

Production Cost Formula

Publication Date :

12 Oct, 2023

Blog Author :

WallStreetMojo Team

Edited by :

Ashish Kumar Srivastav

Reviewed by :

Dheeraj Vaidya, CFA, FRM

Table Of Contents

What Is The Production Cost Formula?

The production cost formula is composed of costs that the business or a company incurs in making finished goods or delivering specific services and includes typically direct labor, general overhead expenses, direct material expenses, or expenses on raw materials and supplies.

The production costs should be directly aligned with the business's revenue generation. The manufacturing business typically has raw materials costs and labor costs. In contrast, the specific service industry is composed of technical labor developing a specific service and material costs incurred in delivering such services to the clients. The production cost formula is generally used in managerial accounting to segregate costs into direct and indirect costs.

Production Cost Formula Explained

The production cost formula is a financial metric that is used for calculating the total cost incurred for production of any product or service within an organization. It includes all types of costs including the direct and indirect costs. Let us study the formula as given below.

The production cost formula can be expressed as follows: -

Overhead costs on manufacturing= Indirect labor cost + Indirect Material cost + Other variable overhead costs.

In the above formula for production cost , the direct cost is the cost that can be associated directly with the production of goods and services. These include the direct material and labor, which are the raw materials, components and supplies, salary and wages of laborers and employees.

Then comes the overhead cost of manufacturing that has all the indirect costs. The indirect labor cost are those wages and salaries of labors who are not directly involved in the manufacturing but help in the process, like supervisors, staff responsible for quality check, etc. The cost of indirect materials includes tools, lubricants, cleaning supplies, etc.

The other variable overhead in the formula for production cost has any other costs that contribute to the production process, like rent for the premises, maintenance costs for the building, plants, and equipment, depreciation on the machinery, etc.

Once the data for all the above are accumulated, they are put into the total production cost formula to calculate the total cost of production. It should be noted that even though the formula appears to be very simple, the actual implementation is quite complex due to various cost categories involved in a manufacturing process.

How To Calculate?

The calculation of Production Cost Equation can be done by using the following steps:

- Firstly in the total production cost formula , determine the costs of direct material. Direct materials are usually composed of costs related to the procurement of raw materials and utilizing them to produce finished goods.

- Next, determine the costs of direct labor. The direct labor cost is usually composed of costs on labor costs and costs of the workforce that are in line with the production process. Such costs generally consist of wages, salaries, and the benefits the business compensates to the labor for delivering finished goods or services.

- Next, Determine the costs of manufacturing. Such costs typically comprise costs that cannot be attributed to the production process but indirectly impact the production. Such costs can be bifurcated into indirect labor costs, indirect material costs, and variable costs on overhead.

- Next, add the resulting value in steps 1, step 2, and step 3 to arrive at the cost of production.

Examples (With Excel Template)

Let’s see some simple to advanced examples of per unit production cost formula to understand it better.

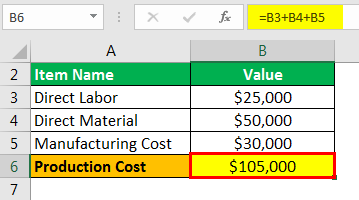

Let us take the example of a manufacturing business that incurs $25,000 indirect labor. It incurs $30,000 in manufacturing overheads and $50,000 in direct material costs. Help the business to determine the overall cost of production.

Use the given data for the calculation of production cost.

Calculation of Production Cost can be done as follows:

- = $25,000 + $50,000 + $30,000

Production Cost will be -

- Production Cost = $105,000

Therefore, the manufacturing business incurs a production cost of $105,000 when manufacturing finished goods.

Let us take the example of a business that specializes in producing chairs. The raw material cost accounts for $75,000. The wages and salaries for the labor and workers account for $40,000. The company compensates benefits worth $3,000 to the labor for delivering exceptional service. The company additionally bears once in a while polishing costs on chairs of $30,000.

The business stores the finished chairs in a rented warehouse. They pay a rental amount of $20,000. They additionally pay $15,000 as the wage for security guards. Help the business of finished chairs to determine the cost of production.

Calculation of Direct Labor using below formula can be done as follows,

Direct labor = Wages of Production Workers + Benefits of the Production Workers

- = $40,000 + $3,000

- Direct Labor = $43,000

The direct material costs correspond to the cost of raw material procured by the business, which would be regarded as $75,000. The manufacturing costs would account for the sum of polishing, rental expenses , and wages for the security guards.

Calculation of Manufacturing Cost using below formula can be done as follows,

Manufacturing Cost = Polishing Cost + Rental Expense+ Wage for Security Personnel

- = $30,000 + $20,000 + $15,000

- Manufacturing Cost = $65,000

- = $43,000 + $75,000 + $65,000

- Production Cost = $183,000

Therefore, the manufacturing business incurs a production cost of $183,000 when manufacturing chairs.

Relevance And Uses

Now let us analyse the various uses of the concept in the corporate and financial market.

- The determination of the per unit production cost formula is necessary as well as critical for the business to ensure its profitability of the business and sustainability. It also helps in the comparative analysis of the costs. Once the manufactured items reach completion, the business records the item's value as an asset on the balance sheet until the product is sold to the customers.

- The production cost has to be initially capitalized and not expensed. Additionally, reporting the value of the end products could be termed as a sophisticated way to inform all the necessary stakeholders on the level of productivity that is being delivered.

- Production cost formula usually is composed of direct materials, direct labor costs, and variable manufacturing overheads. The management accountants often transform these costs per unit basis. By doing so, they easily compare the per unit with the selling price the management is considering for the business, thereby determining its sustainability.

- It helps in decision making as well as cost control. The management is able to set competitive prices for its products and services based on the production cost because they need the prices to be abe to generate enough revenue that will cover its cost as well as initiate higher sales. The cost control helps in minimising wastage and optimizing resource usage, which ultimately leads to an increase in profitability.

- Management can use the data related to production cost as a benchmark to compare themselves with other peer companies. This acts as a guide to evaluate their competitive position within the sector.

Breaking Down Production Costs: A Guide for Small Businesses

Unlock smarter pricing and profitability with our guide to understanding all your production costs—simplified. 💡📈

Introduction

If you're serious about running a sustainable and profitable business, having a thorough grasp of your production costs is non-negotiable. In this guide, we'll simplify the complexities of direct, indirect, and overhead costs for you, demonstrating why understanding these elements is vital for your business's success.

1. What Are Production Costs?

Production costs are the expenses you incur to create a product or deliver a service. These costs directly affect your pricing strategy, profitability, and even your business's scalability. Think of them as the ingredients needed to make the perfect cake—or in your case, the perfect product or service.

2. Types of Production Costs

Direct costs.

Direct costs are those expenses that are directly tied to the production of your goods or services—think raw materials and labor. For instance, if you run a bakery, the cost of flour, sugar, and labor are your direct costs. Get this wrong, and you could either be overcharging your customers or, worse, losing money on every sale.

Indirect Costs

Unlike direct costs, indirect costs are not directly linked to production. These include utilities, rent, and maintenance. Let's say you have a co-working space where you rent out desks. The electricity bill for the entire floor is an indirect cost that needs to be allocated to each rentable desk to determine its profitability.

Overhead Costs

Overhead costs are a subset of indirect costs that keep your business running but don't directly contribute to earnings—like administrative expenses, marketing, and sales. There is a difference between manufacturing and administrative overhead. Manufacturing overhead includes costs like factory upkeep, while administrative overhead involves costs like office supplies for the management team.

3. Calculating Production Costs

Navigating the costs of production doesn't have to be daunting. By systematically breaking down the various components, you can arrive at a clear understanding of your total expenses. Here's a step-by-step guide to help you calculate production costs with illustrative examples:

- Identify Direct Costs These are costs that go directly into the production of your goods or services. For instance, if you own a bakery, the flour and sugar needed to make cakes would be direct costs.

Example : In a bakery, $50 for flour and $20 for sugar for one batch of cakes.

- Identify Indirect Costs :These are ongoing expenses that support your business but are not directly related to the production of individual products.

Example : The monthly electricity bill of $300 for running your bakery's ovens and lighting.

- Identify Overhead Costs : These are additional expenses necessary for the overall operation of your business, like administrative salaries, marketing, and utilities.

Example : $1,000 for marketing and $500 for administrative salaries in a month.

- Allocate Costs :Here, you'll distribute your indirect and overhead costs over your total number of products to get a cost-per-item. Different businesses use different allocation methods.

Example : If your bakery produces 1,000 cakes a month, and the total indirect and overhead costs are $1,800, then each cake carries an additional cost of $1.80.

- Total Up :This is where you sum up all the costs—direct, indirect, and overhead—to arrive at the total production cost per item.

Example : For each cake, add the cost of flour ($50), sugar ($20), indirect costs ($1.80), and overhead costs ($1.80) to get a total cost of $73.60.

By following these steps, you'll gain a better understanding of your production costs, which in turn will help you set appropriate pricing and make more informed business decisions.

To provide a clearer illustration, let's look at the production cost for making a batch of cakes in a bakery.

ItemCostFlour$50Sugar$20Electricity (Indirect Cost)$0.30Administrative Salary (Overhead)$0.50Marketing (Overhead)$1.00Total Cost per Cake$73.60

By breaking down the costs, you can see where your money is going and how each type of expense contributes to the total cost of producing a batch of cakes. This itemized list makes it easier to understand your production costs, helping you make more informed decisions for your business.

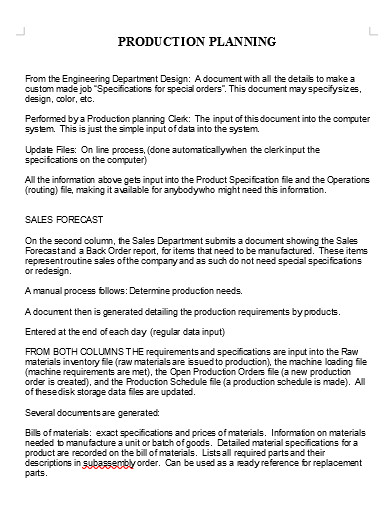

4. Bill of Materials: Your Production Recipe

Think of a Bill of Materials (BOM) as the recipe for your product. This comprehensive list outlines all the materials, ingredients, and other resources you need to create a product.

In our bakery example, the BOM would list out the exact type and amount of flour, sugar, and any other ingredients you'd need. A well-crafted BOM is essential for accurately allocating direct, indirect, and overhead costs, enabling you to pinpoint the total production cost per batch.

Cake Bill of Materials (BOM)

ItemMaterial/IngredientQuantityUnit Cost ($)Total Cost ($)FlourAll-Purpose10 lbs5.0050.00SugarGranulated4 lbs5.0020.00ElectricityUtilityPer batch0.300.30Administrative SalaryOverheadPer batch0.500.50MarketingOverheadPer batch1.001.00Total Cost per Batch72.80

This BOM outlines the costs involved in producing a single batch of cakes. While it focuses mainly on direct material costs, it also accounts for a simplified view of indirect and overhead costs to give a holistic understanding of production costs.

By understanding your Bill of Materials, you can identify areas for cost reduction, more efficient sourcing of materials, or optimization of production processes.

5. Cake Production Cost: A Complete Example

Ready to see how it all comes together? Let's walk through a real-life example of how to calculate the total cost of making a cake. We'll break down each type of cost—materials, labor, and those extra overhead expenses—to show you just how they all add up. This way, you'll know exactly where your money's going and maybe even find a few ways to save.

Direct Material Costs (BOM)

ItemMaterial/ComponentQuantityUnit Cost ($)Total Cost ($)FlourAll-purpose2 cups0.501.00SugarGranulated1 cup0.400.40EggsLarge30.200.60ButterUnsalted1 stick0.800.80Total Direct Material Cost2.80

Direct Labor Costs

TaskLabor TypeTime (hrs)Hourly Rate ($)Total Cost ($)MixingBaker0.515.007.50BakingBaker1.015.0015.00DecorationDecorator0.512.006.00Total Direct Labor Cost28.50

Indirect Costs (Overhead)

Overhead TypeAllocation MethodCost ($)RentPer cake2.00UtilitiesPer cake1.00Equipment DepreciationPer cake0.50Total Indirect Cost

Final Calculation: Complete Cost Breakdown

Cost ComponentCost ($)Total Direct Material Cost2.80Total Direct Labor Cost28.50Total Indirect Costs3.50Total Production Cost34.80

By adding up these components, you'll find that the total production cost for a single cake is $34.80.

This detailed breakdown helps you fully understand where your production costs are going, an essential part of running a successful cake-making business.

6. Importance of Understanding Production Costs

While it may seem straightforward, the significance of fully grasping your production costs can't be overstated. This isn't just a matter of setting the right price for your product; it's an essential foundation for your entire business strategy. Here's why:

- Pricing Strategy First and foremost, understanding production costs is crucial for setting a price that not only covers these costs but also leaves room for profit. Price too low, and you could be operating at a loss; price too high, and you might drive away potential customers.

- Budgeting and Financial Planning By breaking down each element of your production costs, you can create a more accurate and flexible budget. This aids in financial planning and helps you to allocate resources more effectively. In the long term, this can lead to greater profitability and less financial stress.

- Competitive Edge Knowing the nitty-gritty of your production costs also gives you a competitive advantage. It allows you to identify areas for cost-saving, whether that's in sourcing cheaper materials without sacrificing quality or streamlining your production process. These savings can either boost your bottom line or be passed onto the customer, making your products more attractive in a competitive market.

- Decision-Making With a deep understanding of production costs, you're better equipped to make informed decisions. Whether it's deciding to introduce a new product line, scale production, or even exit a market, you'll be making choices based on solid financial understanding rather than guesswork.

So, as you can see, getting a handle on production costs isn't just a numbers game—it's a pivotal part of your broader business strategy.

7. Production Costs and Break-even Analysis

The concept of a "break-even point" might sound like jargon, but it's a critical milestone that every business, big or small, aims to reach. Simply put, the break-even point is the moment when your total revenue equals your total costs—meaning you're not losing money, but you're not making any either. Here's why understanding your production costs is pivotal for this key business metric.

- The Role of Production Costs in Break-even Analysis Knowing the specifics of your production costs is the first step to accurately calculating your break-even point. The idea is to find out how many units of your product you must sell to cover all your costs. The more accurately you've calculated your production costs, the more precise your break-even point will be.

- Why Break-even Analysis Matters Reaching the break-even point is essentially the first sign of business sustainability. From there on, each additional unit sold is pure profit. But if you don’t know your production costs, you can't accurately determine when you'll start making a profit. That makes break-even analysis not just a nice-to-know, but a must-know for business owners.

- Dynamic Monitoring Your break-even point isn't set in stone. As production costs change due to fluctuating material prices, labor rates, or overhead costs, so will your break-even point. Continuous monitoring and updating of your production costs will allow you to adjust your break-even calculations, helping you stay on track toward profitability.

- Decision Making and Strategy An accurate break-even analysis can inform various strategic decisions, such as setting sales targets, pricing strategies, and marketing campaigns. It's an invaluable tool for evaluating the financial viability of new projects or product lines, helping you decide whether to go ahead or reconsider.