Stamp Duty on Debt Assignment

Home | Knowledge Center | Thought Papers Stamp Duty on Debt Assignment

13th Feb, 2018

- /our-partners/ /"> ,

Introduction

Assignment of debt is one of the most common forms of transactions in financial markets. It essentially entails transfer of a debt from a creditor (assignor) to a third-party (assignee). One of the biggest challenges faced in debt assignment transactions in India is the significant stamp duty implication on the deed of assignment. Considering the volume of assignment transactions undertaken generally by banks and financial institutions or by asset reconstruction companies (“ ARCs ”), the stamp duty levied becomes a significant cost in such transactions. The Constitution of India (“ Constitution ”) confers upon the Parliament and each State Legislature the power to levy taxes and other duties. The subjects on which the Parliament or a State Legislature or both can legislate are specified in the Seventh Schedule of the Constitution. The Seventh Schedule is divided into 3 (three) lists:

- Union List;

- State List; and

- Concurrent List.

The Parliament has the exclusive power to legislate on the subjects enumerated in the Union List. The State List enumerates the subjects on which each State Legislature can legislate and such laws operate within the territory of each State. The Parliament, as well as the State Legislatures, have the power to legislate over the subjects listed in the Concurrent List.

The entry pertaining to levy of stamp duty in the Union List is as follows: -

“91. Rates of stamp duty in respect of bills of exchange, cheques, promissory notes, bills of lading, letters of credit, policies of insurance, transfer of shares, debentures, proxies and receipts.”

The entry pertaining to levy of stamp duty in the State List is as follows: -

“63. Rates of stamp duty in respect of documents other than those specified in the provisions of List I with regard to rates of stamp duty.”

The entry pertaining to levy of stamp duty in the Concurrent List is as follows: -

“44. Stamp duties other than duties or fees collected by means of judicial stamps, but not including rates of stamp duty.” [emphasis supplied]

From the aforementioned entries, it is clear that the power to legislate on the rate of stamp duty chargeable on instruments of debt assignment (since it is not covered under Entry 91 of the Union List) is with the State Legislature. However, the power to determine whether stamp duty can be charged or not on a specific instrument is in the Concurrent List. In this regard, it may be noted that pursuant to the Enforcement of Security Interest and Recovery of Debt Laws and Miscellaneous Provisions (Amendment) Act, 2016 (“ Amendment Act ”), the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (“ SARFAESI ”) and the Indian Stamp Act were amended to provide for an exemption from stamp duty on a deed of assignment in favour of an ARC.

As mentioned above, the power to legislate on whether stamp duty is payable or not on an instrument is in the Concurrent List. Therefore, the Parliament has the power to legislate on the aforesaid subject.

Pursuant to the Amendment Act, section 5(1A) was inserted in SARFAESI which provides that any agreement or document for transfer or assignment of rights or interest in financial assets under section 5(1) of SARFAESI in favour of an ARC is not liable to payment of stamp duty.

In several States, notifications have been issued for remission and/ or reduction of stamp duties on debt assignment transactions. For instance, in Rajasthan, the stamp duty chargeable on any agreement or other document executed for transfer or assignment of rights or interests in financial assets of banks or financial institutions under section 5 of SARFAESI in favour of ARCs 1 has been remitted. Further, in Maharashtra, the stamp duty on instrument of securitization of loans or assignment of debt with underlying security has been reduced to 0.1% (zero point one percent) of the loan securitized or the debt assigned subject to a maximum of Rs. 1,00,000 (Rupees one lac) 2 .

Certain State Governments, such as those of Rajasthan and Tamil Nadu have reduced the stamp duty based on the nature of the financial asset being assigned. In Rajasthan, the stamp duty has been reduced for assignment of standard assets whilst in Tamil Nadu, the stamp duty has been reduced for assignment of non-performing assets and assignment in favour of ARCs.

This paper discusses a recent decision by the Allahabad High Court in the case of Kotak Mahindra Bank Limited v. State of UP & Ors. 3 (“ Kotak case ”), where it was held that an instrument of assignment is chargeable with stamp duty under Article 62(c) (Transfer) of Schedule 1B of the Indian Stamp Act, as applicable in Uttar Pradesh (“ UP Stamp Act ”), as opposed to Article 23 (Conveyance) of Schedule 1B of the UP Stamp Act.

The stamp duty payable in various States under Article 23 or the relevant provision for conveyance is on an ad valorem basis whereas the stamp payable under Article 62(c) or relevant provision for transfer of interest secured, inter alia, by bond or mortgage deed, is a nominal amount. For instance, in Uttar Pradesh, the stamp duty payable under Article 62(c) is Rs. 100 (Rupees one hundred).

Decision in the Kotak case

In the Kotak case, Kotak Mahindra Bank Limited (“ Kotak ”) had purchased and acquired certain loans from State Bank of India (“ Assignor ”) along with the underlying securities.

The question for consideration before the full bench of the Allahabad High Court was whether the deed executed by the applicant with the underlying securities would be chargeable with duty under Article 62(c) or Article 23 of Schedule 1B of the UP Stamp Act.

The court observed that in order to determine whether an instrument is sufficiently stamped, one must look at the instrument in its entirety to find out the true character and the dominant purpose of the instrument. In this case it was observed that the dominant purpose of the deed of assignment entered into between Kotak and the Assignor (“ Instrument ”), was to transfer/ assign the debts along with the underlying securities, thereby, entitling Kotak to demand, receive and recover the debts in its own name and right.

Article 11 of Schedule 1B of the UP Stamp Act provides that an instrument of assignment can be charged to stamp duty either as a conveyance, a transfer or a transfer of lease. The court observed that since the Instrument was not a transfer of lease, it would either be a conveyance or a transfer.

The court referred to the definition of conveyance in the UP Stamp Act, which reads as follows:

““ Conveyance ”. — “Conveyance” includes a conveyance on sale and every instrument by which property, whether movable or immovable, is transferred inter vivos and which is not otherwise specifically provided for [by Schedule I, Schedule IA or Schedule IB] [as the case may be];” [emphasis supplied]

The court held that the term conveyance denotes an instrument in writing by which some title or interest is transferred from one person to other and that the use of the words “on sale” and “is transferred” denote that the document itself should create or vest a complete title in the subject matter of the transfer, in the vendee. In this case since under the Instrument, the rights of the Assignor to recover the debts secured by the underlying securities had been transferred to Kotak, it was held that the requirement of conveyance or sale cannot be said to be satisfied.

The court further observed that debt is purely an intangible property which has to be claimed or enforced by action and not by taking physical possession thereof, in contrast to immovable and movable property. Where a transaction does not affect the transfer of any immovable or movable property, Article 23 of Schedule 1B cannot have any applicability.

The court’s view was that since debt along with underlying securities is an interest secured by bonds and/ or mortgages, transfer of such debt would be chargeable under Article 62(c).

The court further clarified that under the Instrument, merely the right under the contract to recover the debts had been transferred. Since the borrower(s) had never transferred the title in the immovable property given in security to the Assignor, the Assignor could merely transfer its rights i.e. mortgagee's rights in the property to recover the debts. It was further observed that the Assignor never had any title to the underlying securities and that it merely had the right to enforce the security interest upon default of the borrower(s) in repayment. The right transferred to Kotak was primarily the right to recover the debts, in accordance with law, by proceeding against the underlying security furnished by the bonds/ mortgage deed(s).

Therefore, the court held that the Instrument was chargeable with stamp duty under Article 62(c) of Schedule 1B of the UP Stamp Act.

Whilst coming to the conclusion that assignment of debt would not constitute a conveyance, the court referred to the definition of conveyance to state that debt is an intangible property which has to be claimed or enforced by action and not by taking physical possession thereof, in contrast to immovable and movable property.

In this regard, it may be noted that there are various judicial precedents 4 , where it has been held that an interest (including mortgage interest) in immovable property is itself immovable property.

However, even assuming assignment of debt with underlying securities over immovable property amounts to a conveyance, it

may be pertinent to refer to the definition of conveyance in the UP Stamp Act which specifically excludes a conveyance which is otherwise provided for by the Schedule to the UP Stamp Act.

Article 62(c) of the UP Stamp Act reads as follows:

“62. Transfer (whether with or without consideration) – … (c) of any interest secured by a bond, mortgagedeed or policy of insurance--”

In view of the above, transfer of any interest secured by a mortgage deed, which is covered under Article 62(c), would be excluded from the meaning of conveyance and would be chargeable to stamp duty under Article 62.

In this regard it may be pertinent to refer to the definitions of ‘bond’ and ‘mortgage deed’ under the UP Stamp Act, which is as follows:

“" Bond " includes

(a) any instrument whereby a person obliges himself to pay money to another, on condition that the obligation shall be void if a specified act is performed, or is not performed, as the case may be;

(b) any instrument attested by a witness and not payable to order or bearer, whereby a person obliges himself to pay money to another; and

(c) any instrument so attested, whereby a person obliges himself to deliver grain or other agricultural produce to another

“" Mortgage-deed ". — "mortgage-deed" includes every instrument whereby, for the purpose of securing money advanced, or to be advanced, by way of loan, or an existing or future debt, or the performance of an engagement, one person transfers, or creates, to, or in favour of another, a right over or in respect of specified property;”

In view of the above, where a debt secured by a bond or a mortgage deed is assigned under a deed of assignment, the stamp duty payable on such deed of assignment will be under Article 62(c) of the UP Stamp Act or corresponding provisions of the Stamp Act of other States.

However, in cases of unsecured loans or loans secured by an equitable mortgage (where there is no mortgage deed), the deed of assignment would attract ad valorem stamp duty chargeable on conveyance, since the same will not get covered under Article 62(c) or similar provisions in other states.

The market practice until now has been to stamp the deed of assignment of debt under the relevant article for Conveyance in the applicable Stamp Act. In fact, in States such as Maharashtra, the State Government has issued notifications for reduction of stamp duty on a deed of assignment under the article for Conveyance.

The judgment passed by the Allahabad High Court in the Kotak case may prove to be a welcome step in reducing the incidence of stamp duty on debt assignment transactions. However, it would need to be seen whether in other States a similar view is taken by stamp duty authorities.

This update has been prepared by Aastha (Partner), Debopam Dutta (Managing Associate) and Abhay Jain (Associate).

1 Notification No. F4(3)FD/Tax/2017-110 dated March 8, 2017 issued by Finance Department (Tax Division) Government Of Rajasthan.

2 Notification No.Mudrank-2002/875/C.R.173-M-1 dated May 6, 2002 issued by Revenue & Forests Department, Government of Maharashtra.

3 Reference Against MISC. Acts. No. 1 of 2016, order dated February 9, 2018.

4 Bank of Upper India Ltd. (in liquidation) v. Fanny Skinner and Ors., AIR 1929 All 161. See also Prahlad Dalsukhrai and Ors. v. Maganlal Muljibhai Tewar, AIR 1952 Bom 454 and Harihar Pandey v. Vindhayachal Rai and Ors., AIR 1949 Pat 170.

Our Offices

11, 1st Floor, Free Press House 215, Nariman Point Mumbai – 400021

+91 22 67362222

7A, 7th Floor, Tower C, Max House, Okhla Industrial Area, Phase 3, New Delhi – 110020

+91 11 6904 4200

68 Nandidurga Road Jayamahal Extension Bengaluru – 560046

+91 80 46462300

Binoy Bhavan 3rd Floor, 27B Camac Street Kolkata – 700016

+91 33 40650155/56

The rules of the Bar Council of India do not permit advocates to solicit work or advertise in any manner. This website has been created only for informational purposes and is not intended to constitute solicitation, invitation, advertisement or inducement of any sort whatsoever from us or any of our members to solicit any work in any manner. By clicking on 'Agree' below, you acknowledge and confirm the following:

a) there has been no solicitation, invitation, advertisement or inducement of any sort whatsoever from us or any of our members to solicit any work through this website;

b) you are desirous of obtaining further information about us on your own accord and for your use;

c) no information or material provided on this website is to be construed as a legal opinion and use of this website will not create any lawyer-client relationship;

d) while reasonable care has been taken in ensuring the accuracy of the contents of the website, Argus Partners shall not be responsible for the results of any actions taken on the basis of information provided in this website or for any error or omission in the website; and

e) in cases where the user has any legal issues, the user must seek independent legal advice.

- Log in to your account

- Sign up as individual

- Sign up as builder/agent

- Login to add properties to your shortlist

Maharashtra Stamp Act: An Overview On Stamp Duty And Registration Charges

Prahalad singh, maharashtra stamp act introduction.

In India, the Indian Stamp Act, 1899 (ISA) is a central legislation, while states have their own local stamp act to administer with issues rising within that particular state. The Bombay Stamp Act, 1958 which came into force on 16 February 1969 (BSA), is a law for stamp duty within the state of Maharashtra. The Constitution of India permits both the Parliament and the State Legislature to make provisions and legislation for stamp duty within its limits. Accordingly, certain documents specified in the ISA are included. Under the BSA, an instrument is defined to include every document by which any right or obligation is, or is made, transferred, limited, extended, extinguished or recorded while a bill of exchange, checks, promissory notes, etc. is not included. These documents are excluded, as governed under the aforesaid ISA.

What is Maharashtra Stamp Act?

In Maharashtra, stamp papers could be purchased before 1 May 1994 in the names of advocates or by any other name. However, the stamp paper is to be purchased in the name of one of the parties thereafter. In addition, the validity of the stamp paper is restricted for a period of 6 months and if stamp paper is used thereafter, it is assumed that the document is executed on ordinary paper without a stamp.

If an instrument falls into Schedule I of the Bombay Stamp Act (BSA) with several duties rates, the instrument is chargeable with the highest of the prescribed fees. Apart from this, the BSA also prescribes a methodology for adjournment (proper assessment), the refund of duties, grievance procedures and defects, etc. The Collector is usually authorized or vested with the power to authorize. If a document is not stamped or appropriately stamped, it is likely to be affixed.

The Act was recently amended and amendments include revision of stamp duty on gift deeds, e-payment of stamp duty, amendment of penalty sections, and increase in stamp duty under certain instrument clauses.

What Is Stamp Duty?

Stamp duty is a type of tax, such as sales/income tax, etc. and its basic purpose is to raise revenue for the government. Thus, like any other tax, the stamp duty will have to be paid to the government in full and on time, with a delay with penalties. In general, stamp duty is levied on an instrument (and not on a transaction); stamp duty is payable on the property (whether immovable/movable or tangible/intangible) either on a fixed basis or on the basis of the consideration mentioned in the instrument as the case may be. In the case of immovable property, there is an additional theory of valuation of the property, which is also taken into account while deciding the stamp duty payable.

How Is Stamp Duty Calculated?

The stamp duty is calculated based on the ready reckoner rates and the property value mentioned in the buyer-seller agreement. In Maharashtra, stamp duty on the property varies by location. For example, stamp duty for a property located in the municipal limit of urban areas in Mumbai will be 5% of the market value, while a property located within the limits of any gram panchayat will attract stamp duty of 3% of the market value.

Stamp Duty And Registration Charges In Maharashtra

The stamp duty rates on property depend on several measures in the state of Maharashtra. This includes whether the property is located in urban or rural areas, the total cost of the transaction, etc. Recently, the Maharashtra government has reduced the stamp duty on properties for the next two years in areas falling under the Mumbai Metropolitan Region Development Authority. (MMRDA) and the municipal corporations of Pune, Pimpri-Chinchwad, and Nagpur.

This means that stamp duty on properties in Mumbai, Pune, and Nagpur, will be charged at 5% (4% stamp duty + 1% metro cess).

Moreover, according to Article 34 of the Maharashtra Stamp Act, which was revised in 2017, stamp duty on gift deeds is 3% of the property’s value. However, if the property in consideration is a residential or agricultural property and is gifted (without any payment) to family members, then, the stamp duty is Rs 200.

Factors that Determine Your Fee on Stamp Duty & Registration

Stamp duty and registration charges are imposed by the state governments on homebuyers. These apply to both freehold and leasehold land (agricultural and non-agricultural) as well as other types of properties such as homes, flats, or commercial properties. There are certain factors that determine how much stamp duty is in Mumbai and registration will be payable:

- Type of property

The fees on residential will be comparatively less than a commercial property.

- The type of location

Properties in rural areas, as well as semi-urban areas, have to pay significantly less than in posh areas.

- Market Value

The market value of the property and the area of the property are taken into account for the calculation of stamp duty charges.

How To Pay Stamp Duty & Registration Charges Online In Mumbai?

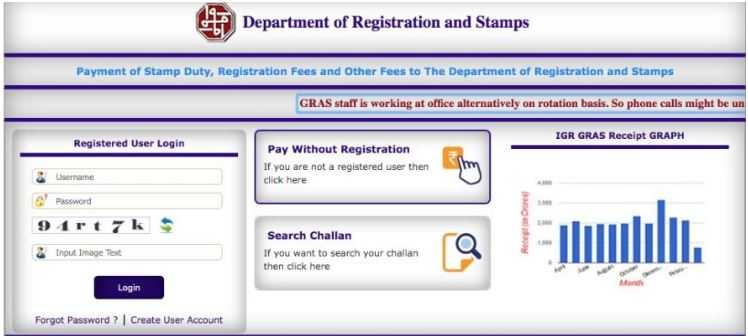

In Mumbai, you can go for payment of these charges through both online and offline mediums. The Government of Maharashtra has a dedicated portal ‘Government Receipt Accounting System’ (GRAS) in which you are required to enter all the necessary details about the property and its documents and make payments accordingly. Homebuyers must follow a few easy steps to pay the stamp duty and registration charges in Mumbai on the purchase of the property.

Step 1: Visit the Maharashtra Stamp Duty Online Payment Portal.

Step 2: If you are not registered with the portal, click ‘Pay without registration’. If you are a registered user, please fill in the login details.

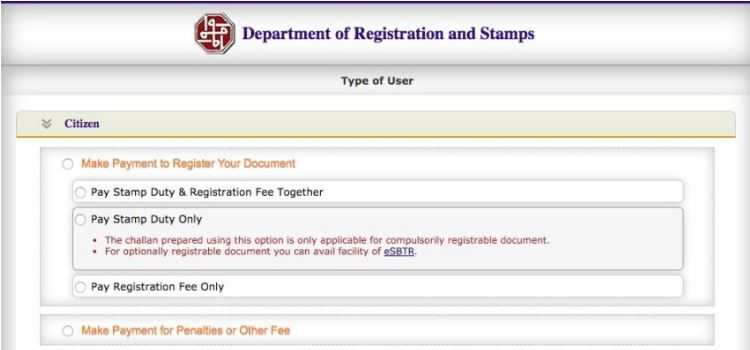

Step 3: If you have selected the option ‘Without Pay Without Registration’, you will be directed to another page, where you will have to select ‘select citizen’ and select the type of transaction you want to do.

Step 4: Select ‘Pay to register your document’. Now, you can choose to pay stamp duty and registration fee together or only stamp duty or registration fee only.

Step 5: Fill in the required details such as District, Sub-Registrar office, Payment details, Party details, Property details, and Property value details.

Step 6: Select the payment option and once completed, generate the challan, which will have to be submitted at the time of execution of the deed.

If you are doubtful or stuck at any step or you want to recreate your invoice, you can leave a mail at [email protected]

Modes of Payment of Stamp Duty in Maharashtra

There are 4 modes of payment of Stamp Duty in Maharashtra:

- Non-judicial Stamp Papers – This is the traditional but cumbersome and time-consuming mode of stamping, and forces one to obtain physical stamp paper by engaging with licensed vendors. The instrument to be executed is printed on such stamp paper. This option is not practicable in cases where stamp duty of larger denominations is required to be paid.

- Franking a document – The process of franking a document requires submitting an application with an authorized bank or franking agency to pay stamp duty and stamp (using the vending machine) by the authorized bank or franking agency on the document denotes value. Franklin can only be done before the execution of the document and the maximum stamp duty cap is Rs. 5000 / document.

- e-SBTR/Electronic Secured Bank Treasury Receipt – E-SBTR is an online payment service for payment of stamp duty through an electronic payment gateway. For this one has to fill the filling ‘input form’ at the branch office with any bank providing e-SBTR facility and pay the required amount of stamp duty. The bank then records these details in the Government Virtual Treasury and creates an e-SBTR on the special government pre-printed secure stationery which serves as proof of payment of stamp duty. Since the e-SBTR is issued on a special government stamp, it is necessary to physically collect an e-SBTR from the respective branch of the bank upon the presentation of the confirmation of online payment for the print of input form and stamp duty.

- GRAS/Government Receipt Accounting System – Like e-SBTR GRAS, there is an online payment of stamp duty through an electronic payment system. However, under an e-SBTR mechanism, there is no need to physically go to the respective branch of the banks as recognition of e-challan generated online under GRAS as an accepted method of payment in sub-registrar offices and other offices of the department. Although a completely online process, GRAS has the limitation that it can only be used for compulsory registrable documents (under Section 17 of the Registration Act, 1908), including, inter alia, the right, title, and interest to or in immovable property. In financing transactions, therefore, this mode of payment will only be available for documents such as mortgages and cannot be used to pay stamp duty on other important but non-mandatory mandatory documents such as loan agreements, security and guarantee documents.

Recent Clarification on Stamp Duty in Maharashtra

Providing some relief to the Office of Inspector General of Registration and Controller General of Maharashtra through a circular dated 27th April 2020 and notified certain relaxations in relation to (a) Some exemptions have been notified in respect of filing of information (in the matter of financing, transactions required for the creation of mortgages on immovable property, through title deeds or deposits of similar mortgages):): and (b) Payment of stamp duty on non-compulsory registrable financing documents executed during the nationwide lockout period. The fee/exemption offered under the circular is summarized in the table below.

Stamp Duty News

- On 6 March 2020, the Maha Vikas Aghadi (MVA) government in its landmark decision announced a 1% stamp duty concession and other related charges applicable to the registration of documents in areas falling under the Mumbai Metropolitan Region Development Authority (MMRDA) and Municipal Corporations of Pune, Pimpri-Chinchwad, and Nagpur by 2022.

- On 31st March 2020, the Central Government has extended the applicability of stamp duty by 3 months. The provisions of the amended Indian Stamp Act, which were to come into force from 1 April 2020, will now come into force from 1 July 2020.

- On 11th May 2020, the Maharashtra government has lost Rs 3885 crore in stamp duty in 40 days of lockdown. The state government has earned only Rs 15 crore through stamp duty and registration in the last 40 days – a steep fall in comparison to the Rs 4000 crore it usually generates in such a period.

- On 28th May 2020, the Maharashtra Government has announced 1% concession of stamp duty.

Data Source: Google, Image source: https://gras.mahakosh.gov.in/

Related Articles

You may have seen advertisements for “1 BHK, 2 BHK & 3 BHK homes available”, “spacious 3 BHK residences”, etc. on billboards, newspapers, or social media sites. Though it attracts potential homebuyers, these terms are still confusing for many people. Wondering What is BHK Full form and its meaning? Well, BHK in the real estate […]

A home buyer must know about carpet area, built-up area and super built-up area of a property/flat. If they know the difference between carpet area, built-up area & super built-up area, it becomes easy for them to invest in a property. So, let’s explore this blog to know everything about these: What is the carpet […]

Buying a home requires a lot of planning, looking for the ideal location, and making the decision to buy. After doing all these, your next step would be organizing documentation and registering the property. The property and apartment registration process in Tamil Nadu is important however it is not very complicated. Let’s read this blog […]

Once you have decided to buy a new home, the next big question is the selection between under construction and ready to move in. In both these, you get numerous options as per your budget. But it is confusing to choose any one because each of them has their own set of pros and cons. […]

Trending Article

How Union Budget 2024-25 Will Affect Real Estate Developers

Decoding bhk: full form and real estate meaning, a guide to know- best direction to sleep as per vastu, transforming pune: top 10 construction companies 2024-25, latest properties - flats, flats for sale in bangalore, flats for sale in delhi, flats for sale in mumbai, flats for sale in pune, flats for sale in chennai, flats for sale in kolkata, flats for sale in hyderabad, flats for rent in bangalore, flats for rent in delhi, flats for rent in mumbai, flats for rent in pune, flats for rent in chennai, flats for rent in kolkata, flats for rent in hyderabad, projects for sale in bangalore, projects for sale in delhi, projects for sale in mumbai, projects for sale in pune, projects for sale in chennai, projects for sale in kolkata, projects for sale in hyderabad, latest properties - villas, villas for sale in bangalore, villas for sale in delhi, villas for sale in mumbai, villas for sale in pune, villas for sale in chennai, villas for sale in kolkata, villas for sale in hyderabad, villas for rent in bangalore, villas for rent in delhi, villas for rent in mumbai, villas for rent in pune, villas for rent in chennai, villas for rent in kolkata, villas for rent in hyderabad, project for sale in bangalore, project for sale in delhi, project for sale in mumbai, project for sale in pune, project for sale in chennai, project for sale in kolkata, project for sale in hyderabad, luxury properties, luxury properties in bangalore, luxury properties in delhi, luxury properties in pune, luxury properties in chennai, luxury properties in hyderabad.

Area Calculator

- Quick Links

Square Feet

Square meter, square yard, latest videos.

- Browse Cities

- Properties for Sale in Bangalore

- Properties for Rent in Bangalore

- Browse Projects in Bangalore

- Browse Localities in Bangalore

- Agent Directory for Bangalore

- CommonFloor Groups

- Post Your Requirements

- Get Mobile App

- Call Us: 080-67364545

- All India Apartment Directory

Your details has been submitted successfully.