The Definitive Guide to Brand Awareness Studies

- Brand Experience , Survey Tips

The goal of most brand awareness studies is to answer this one crucial question:

What percentage of my target market is aware of my brand?

Understanding this metric is integral to developing a comprehensive marketing strategy. This is especially true for companies aiming to improve their brand recall and brand recognition. Measuring your brand’s market recognition and recall is often the best starting point. While other brand health studies are also critical, this metric provides essential insights for your marketing strategy.

Why Is Brand Awareness Important?

Why is this metric so vital? The answer is straightforward. Brand awareness plays a significant role in the top section of the customer purchase funnel. It also dictates how large that section can grow.

The logic is simple. You can only get out of the funnel as much as you put in. Therefore, it’s essential to know how your brand awareness compares to the competition.

Understanding Brand Awareness: Recognition vs. Recall

Brand awareness measures the extent to which consumers are familiar with your brand and products. As consumers, we engage with brands in various ways.

Some brands gain recognition when we hear their names or see their logos. In contrast, others remain “top of mind.” This means these brands immediately come to mind when it’s time to make a purchase.

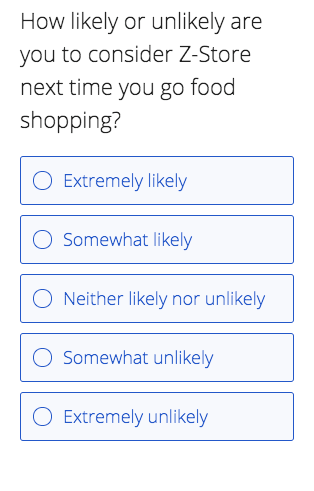

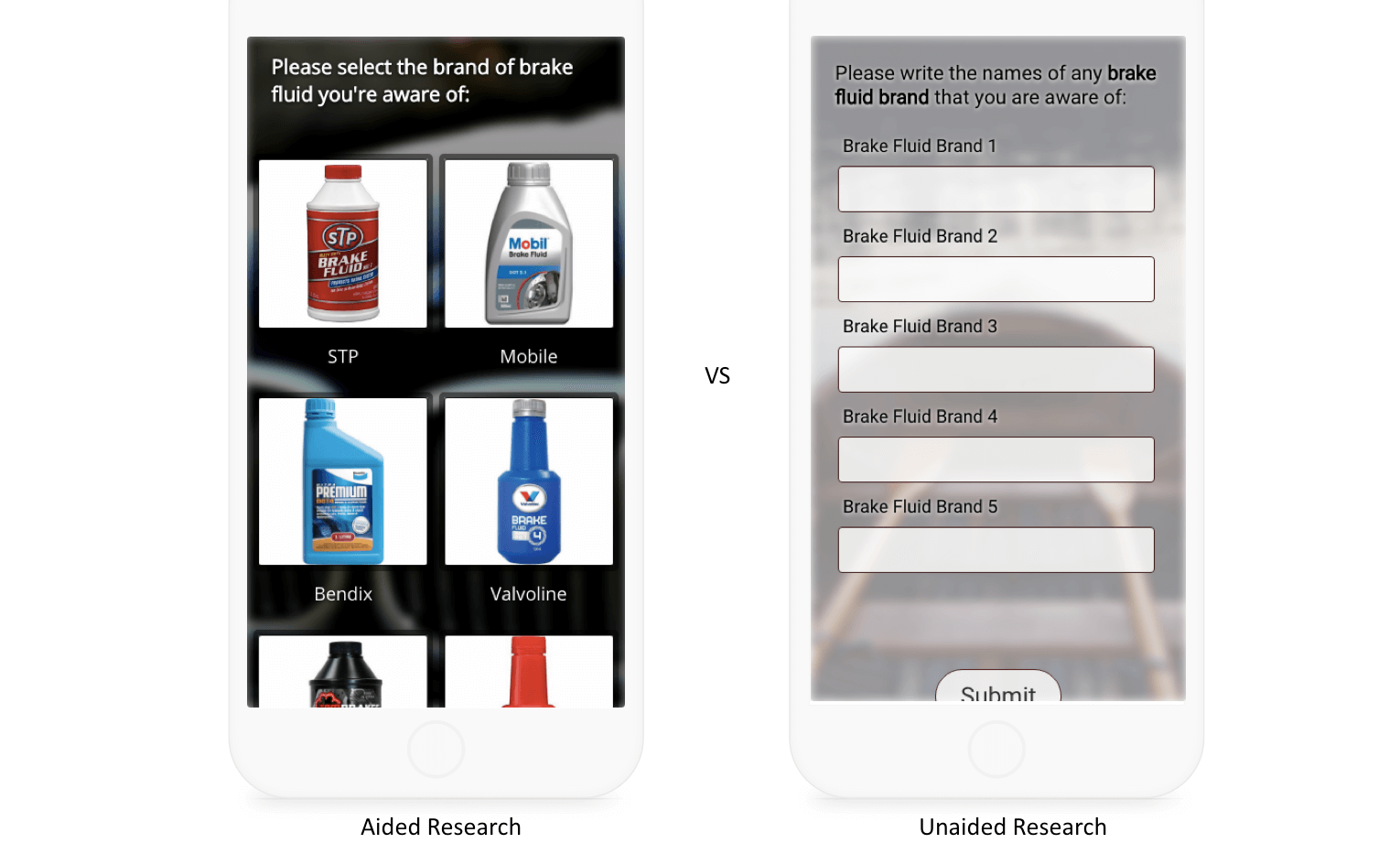

Brand Recognition (Aided Research)

Brand recognition studies measure the ability of customers to recognize your brand from a list of options presented. This is crucial when customers face a selection of products from various brands, such as in a supermarket aisle. Unless a customer has a “top of mind” choice, they will often gravitate toward brands they recognize.

For instance, consider the case of motor oil. You might not frequently purchase it and thus struggle to name a specific brand off the top of your head. When you scan the shelves at the auto parts store, a familiar yellow container may catch your eye. This recognition can lead you to choose that brand simply because it feels familiar.

Brand recognition is crucial for newer companies and brands that haven’t yet established a solid market presence. These studies can help gauge how well the public recognizes your brand compared to competitors.

Brand Recall (Unaided Research)

Brand recall studies measure customers’ ability to remember your brand without any prompts from a list. Researchers achieve this through open-ended questions that create a higher “hurdle” than aided research. Consequently, the data collected through this method tends to be of higher quality. Research has shown a higher correlation between consumer preference and the results of unaided studies than with aided ones.

Where possible, data collection through unaided question types is preferable compared to aided questionnaires. When consumers must recall a brand from memory, it indicates a stronger level of engagement and familiarity.

Four Additional Types of Brand Awareness & Health Studies

Brand awareness studies assess the percentage of your target market that recognizes your brand. While these insights are valuable, they should not be the sole foundation of your marketing strategy. Does your brand’s cultivated image resonate with those already familiar with the attributes you emphasize?

To develop a well-rounded marketing strategy, consider employing various brand awareness research methods alongside traditional studies. Here are several effective approaches to enhance your understanding and shape your strategy:

- Brand Image Study: This study collects both internal and external feedback. It aims to assess how closely your customers’ perceptions align with the brand identity you seek to cultivate. Understanding this alignment helps in refining your marketing messages.

- Brand Trust Study: In an era of data breaches and privacy concerns, monitoring brand trust levels is essential. If your brand lacks trustworthiness, retaining customers can be a significant challenge.

- Brand Loyalty Study: Loyal customers can evolve into brand evangelists, amplifying your marketing efforts. Tracking loyalty levels is necessary to determine how frequently this transformation occurs and to identify any potential issues affecting customer retention.

- Customer Profile Study: Changes in your core customer base may signal the need for a pivot in your product offerings or marketing messages (or both). Understanding the demographics and preferences of your customers allows for more targeted marketing strategies.

Conducting Your Brand Awareness Study: Online vs. Telephone Surveys

There are primarily two ways to conduct a brand awareness study: through online surveys and telephone surveys. Each method has its advantages and disadvantages, which we’ll explore in detail.

Advantages of Online Surveys for Your Brand Awareness Study

- Convenience: Participants can respond to surveys almost any time, making it easier to gather a larger sample size.

- Cost-Effective: Online surveys typically cost less than telephone or in-person field studies.

- Fast Results: You can conduct online surveys quickly, allowing for rapid data collection.

Disadvantages of Online Surveys for your Brand Awareness Study

- Anonymity Issues : Many online panel services do not collect personally identifiable information, which can hinder data richness.

- Lack of Personal Interaction : Without a live person to clarify questions, misunderstandings may arise.

- Technology Requirements : Access to a fast, web-connected laptop /smartphone can limit participation from certain demographics.

Telephone Surveys

While online surveys have their merits, telephone surveys remain a valuable tool for brand awareness studies. They allow for a more personal touch, which can lead to more in-depth responses.

Advantages of Telephone Surveys for Your Brand Awareness Study

- Targeted Responses: Telephone surveys allow for the targeting of specific respondents within a narrow demographic or geographic location.

- In-Depth Probing: Interviewers can delve deeper into responses and clarify questions, leading to more nuanced data.

- Willingness to Share: Respondents may be more willing to share personal information when speaking with a live person.

Disadvantages of Telephone Surveys for Your Brand Awareness Study

- Costly: Telephone surveys tend to be much more expensive than online surveys.

- Longer Field Times: Collecting data from your entire sample audience can take significantly longer compared to online methods.

Best Practices for Online Surveys in Brand Awareness Studies

Online surveys can yield high-quality data when conducting brand awareness studies. However, it is crucial to avoid common pitfalls and adhere to best practices to ensure accurate results. Here are several strategies to ensure you obtain the best results from your online surveys:

1. Reach Your Target Audience Using Disqualifying Questions

Even if the online panel company you choose claims to target individuals planning to purchase a car within the next 12 months, it’s essential to verify this. Including disqualifying questions early in the survey helps ensure you gather responses from the right audience. Online survey software often features “logic” functionalities that can automatically exclude those who do not meet your criteria.

2. Use Audience Quotas

To ensure that your data accurately represents your target audience, collect basic demographic information such as age, gender, location, and ethnicity. If you plan to segment your results, create quotas for each demographic. Many online panel providers offer census data that can aid in establishing these quotas.

3. Utilize Unaided Question Types

As discussed earlier, unaided questions provide more valuable data since they require respondents to make top-of-mind recollections. While aided questions may allow for some guesswork, unaided questions yield more accurate insights into brand familiarity.

4. Protect Yourself Against Bad Data

Most high-quality online survey platforms come with tools that automatically filter out low-quality responses. Here are some common culprits these tools target:

- Speeders: Respondents who complete surveys much faster than average may not be providing thoughtful answers.

- Straight-liners/Patterned Responses: Participants who select all options within a single column or follow a particular pattern (like zigzagging) may not be genuinely engaging with the survey.

- Gibberish and One-Word Responses: Entries that consist of gibberish or are limited to one word can skew your data. You should clean these from your dataset.

Additionally, consider using trap questions or red herring questions to filter out participants who do not read questions carefully.

5. Run Your Brand Awareness Study Before a New Marketing Campaign

The results of brand awareness studies can serve as invaluable benchmarks. By conducting these studies before and after a significant marketing effort, you can gain insight into the effectiveness of your initiatives. You should conduct brand awareness surveys annually at a minimum, but other opportunities may arise as you assess the strengths and weaknesses of your products.

One structured planning method that works well in conjunction with brand awareness studies is the SWOT analysis. This technique evaluates the strengths, weaknesses, opportunities, and threats facing your business.

- Strengths: What attributes give your brand an advantage over competitors?

- Weaknesses: What characteristics place your brand at a disadvantage relative to others?

- Opportunities: What can your organization gain from this venture?

- Threats: What external factors could pose challenges for your organization as a result of this venture?

SWOT analysis reveals many opportunities and threats, but what if external audiences do not validate your perceived strengths and weaknesses? A brand awareness study can provide you with a clearer understanding of how the marketplace perceives your strengths and weaknesses.

The Link Between Brand Awareness and Brand Preference

As brand awareness increases, so does brand preference. Numerous studies have documented this correlation. A notable study conducted by Cahners Research involving 23,341 businesses showed that brand preference rises alongside brand awareness, nearly in direct proportion.

This relationship underscores the importance of investing in brand awareness initiatives. As potential customers become more aware of your brand, they are more likely to choose it over competitors. This choice can be crucial in crowded markets where multiple brands vie for consumer attention.

Want to Learn More About Brand Awareness Surveys?

If you’re looking to delve deeper into the significance of brand awareness surveys, check out this blog entry: Why Brand Awareness Surveys Are Critical For An Effective Marketing Plan . Understanding the nuances of brand awareness studies is essential for any brand aiming to establish itself in the market and foster customer loyalty.

In conclusion, brand awareness studies are indispensable for understanding how consumers perceive your brand. By measuring both recognition and recall, businesses can gain insight into their market position and formulate strategies to enhance their brand’s visibility and preference. As you explore the various types of brand awareness research—such as brand image, trust, and loyalty studies—you’ll be better equipped to create a robust marketing plan that resonates with your target audience.

By following best practices for conducting online surveys, you can gather high-quality data that informs your brand strategy. Remember, as brand awareness increases, so does brand preference, creating a positive feedback loop that strengthens your market presence.

With the right approach to brand awareness studies, you can navigate the competitive landscape effectively and ensure your brand remains top-of-mind for consumers.

See all blog posts >

- Customer Experience , Voice of the Customer

- Alchemer Digital , Digital Feedback

See it in Action

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- Product Demos

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

- Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

Brand Experience

- Brand Research

See how Qualtrics Strategic Brand works

Brand research: what it is and how to do it.

14 min read Your brand identity, brand positioning, brand mission, and goals might all feel ironclad, but do consumers agree? Here’s how to undertake brand research, and the many reasons why…

What is brand research?

Brand research – sometimes called brand market research – is the act of investigating the various aspects of a new or longstanding brand to gain insights that can help curate brand value.

Brands are the culmination of lots of different factors. Beyond the products and services it offers, a brand is also an ethos, a personality, a visual brand identity, a vision, and a feeling that people have when they think of it. But for every brand, there will naturally be an ideal version of how that overall branding is landing, and then there’ll be a reality as seen by its customers and the general public.

Brand research will help you answer questions like “Who knows about my brand? where have they heard about my brand? what are their perceptions and judgments about my brand? what is their relationship with my brand- from unknown to a devoted user?

Brand research, then, is when we dig into how each of those two versions matches up – either before a company launches its branding, or as an effort to understand how longstanding branding is working out.

An important element to brand research is the fact that it is always done in comparison to the competition. Your brand is only as good as what it’s being compared to: e.g. You may love McDonalds more than Burger King because you think it’s more for music fans given their latest promotions featuring musician celebrities.

Turn your brand into an icon with BrandXM

What’s the difference between brand research and brand analysis?

Research in this instance describes the act of studying what people think of your brand, by way of surveys, focus groups, social listening, etc. It’s research in its truest form, where we’re investigating to find answers to a set of clearly defined questions.

Brand analysis is essentially what we do with those answers. Brand analysis assumes that we’ve already conducted our brand research (or are doing so on a rolling basis), and can now analyze the results to draw conclusions and find actions that can point the brand in the right direction as part of our brand strategy .

Markets are changing quickly: new competitors are emerging and consumers are changing their preferences. This means that there’s more urgency to do better and more frequent brand research.

A good approach to brand research will have an ongoing approach (as shown in the diagram) to make sure that your brand is in alignment with your target audience.

Put simply, brand research is the work we put in, and brand analysis is the insights we get out.

What does brand research entail?

We’ll go into greater detail on how to conduct brand research later in the article, but you probably want to know how much effort’s involved, right? Well, brand research can be incredibly in-depth or fairly straightforward, depending on a range of factors like the age and size of the brand, your research goals, and – importantly – the tools at your disposal.

For the most part, the effort you put in will correlate to the level of insights your brand research will yield. For instance, running in-person focus groups will naturally require more effort than an online survey, but you’ll probably garner a more in-depth view of how your brand is being perceived from the former than the latter.

Whatever the case, your brand research efforts can be made infinitely easier and smarter with the right technology. Brand experience management suites, brand trackers and brand research tools can all help streamline and – crucially – formalize the process, bringing parity to sometimes disparate sets of results by analyzing them all for you.

What’s the reward for the effort?

Ultimately, the goal of all this research is to come away with actionable insights that can positively shape, curate, and grow your brand value . Brand research is how you’ll take the guesswork away from decision-making when it comes to brand building.

Brand research: Terms to understand

When conducting brand research, there are several verticals to look at that can give you an idea of where your brand stands – both in terms of the competition and the general consumer perception:

Brand awareness

Brand awareness is a measure of whether people know your brand, either prompted or unprompted. That can mean naming your brand when asked to list companies in a certain industry (or from a logo, which we call brand recognition ), or it might mean brand recall; it’s about remembering your brand after buying a product or seeing an advertisement or other piece of marketing.

Brand associations

When people think about your brand, what else immediately springs to mind? Are you known for great customer service? Do people think your products are expensive? Are you synonymous with environmentalism? These are all associations around your brand, and you’ll want to measure them to see how the reality stacks up against your aims. Associations can be positive or negative, so it’s wise to be realistic and expect to find that customers harbor views on both sides of that coin.

Brand perception

Differing slightly from the broadly positive and negative aspects of brand associations, brand perceptions are the overall picture people have of your brand. Every time consumers interact with your brand – whether that’s passively by watching an advertisement, or actively through a purchase or customer support query – they make small judgments that build to overall brand perception .

Brand equity

Equity is the value – perceived or actual – that your brand has over others of similar standing. As an example, Coca-Cola has much higher equity than an off-brand cola, even if the ingredients are largely similar. Think also about something as simple as hayfever tablets. Thanks to marketing and branding efforts, name-brand tablets tend to have a higher standing than the pharmacy’s version, even if the ingredients and dosage are exactly the same. That’s brand equity , in a nutshell.

Brand loyalty

Brand loyalty leans on metrics like NPS and CSAT to determine how likely people are to buy from you again and recommend you to their friends. High brand loyalty is a strong indicator of the success of a number of smaller factors, like your products’ quality, your customer service, and your marketing efforts hitting their mark. Brand loyal customers are more loyal to choose you over a rival, even if there’s a more competitive product elsewhere.

Brand preference

Brand preference is a metric that shows how many people would prefer to choose your products over a competitor’s. Whereas brand loyalty focuses on customers who know and love your brand, brand preference is broader – giving insight into what even people who have never purchased from you before have to say. In that way, it’s similar to brand equity, where a preference for your brand shows that your marketing and branding are paying off.

What are the benefits of conducting brand research?

When companies invest millions of dollars into their brands it’s important to understand the output of that investment

The benefits are:

- Brand research can show how your brand has grown (e.g. in awareness or stronger perceptions) and tell you if your communications are working.

- Having more efficient tactics: When you know what’s working, you can concentrate on doing more of that and spend less time on tactics that don’t move the needle. When resources are constrained you’ll be able to use research to justify where you spend those resources

Actionable insight carries inherent value – if you know the areas you need to improve, it makes changing course infinitely easier.

Beyond this, however, brand research is the first step along the path to enhancing the customer experience. As we’ve discussed, research leads to analysis, which leads to action. And that action should make things more appealing to your target audience. When you improve the customer and brand experience, you’ll improve customer retention – and when you do that, you’ll move the needle with brand awareness and brand loyalty.

So this kind of research is cyclical. It ultimately benefits the metrics you monitor in the first place, on a path of continuous improvement.

In fact, research from HingeMarketing shows that continuous research yields strong profitability:

At the end of the day, your exact ROI on performing brand research will vary, but the investment will generally yield branding decisions that drive higher sales and revenue.

How to conduct brand research

Ok, so how do you put all this into practice? There are several clearly-defined ways to conduct qualitative and quantitative brand and marketing research around your brand. Here are the core brand research methods:

Survey research

Surveys remain a great way to solicit feedback on your brand, whether it’s via email, an online form, or on the phone. There’s no limit to the kinds of questions you can ask, and you can collect survey feedback at any time if you include a survey as part of the purchase process.

One common survey type for brand-based research is the Net Promoter Score (NPS) , which asks the customer how they feel about the brand concerning willingness to recommend it. But email and online surveys can also be used to assess things like brand awareness and brand perception if you’re aiming it at people who haven’t necessarily already bought something from you. It’s all about choosing the right questions.

Example questions to ask:

- How likely would you be to recommend [BRAND]?

- What words come to mind when you think of [BRAND]?

- When you think of [PRODUCT CATEGORY], what brands come to mind?

- What led to that decision?

- What brand is the most recognizable in [PRODUCT CATEGORY]?

- If [BRAND] was a person, how would you describe them?

- If so, where?

- What did they make you think?

- List five words you would choose to describe [BRAND]

Focus groups

Focus groups, whether in a room together on in a digital space, allow for more in-depth answers to common brand research questions. You can use these groups to dive a little deeper into qualitative insights – like brand perception and brand associations.

Focus groups can be organized in person by finding willing local participants (for example, by contacting existing customers or by advertising on social media), or they can be conducted online. For example, Twitter Insiders acts as a way to solicit feedback and insights from thousands of online users. Traditionally, these groups offer incentives to participants.

There are also plenty of focus group and research panel providers out there; if you’re thinking of using one, here are a couple of things to look for:

1. A large respondent pool

It sounds obvious, but they need to be able to provide the right people at the right time. The best providers will have a vast range of possible respondents across different countries and demographic and social groups.

2. Support when you need it

A great provider will do more than just deliver the sample. They’ll be on hand to support you with questions about designing your survey , running the process, and conducting the right analysis afterward.

Digital listening

If you want to know what people are saying about your brand, you just have to listen! People will be talking about your organization on social media, on third-party review sites, over email, and on the phone to your contact center agents; the smartest brands are the ones who know how to piece all that information together.

An intelligent brand experience management suite can listen to all these disparate conversations for you, bring them together in one place, and use AI and natural language processing to assign qualitative values like emotion and sentiment – and then turn all that information into useful, actionable suggestions.

BrandXM , for example, can both listen and engage with consumers – passively and proactively – on a continuous basis. Our brand tracking tools then assign meaning to those interactions, painting a vivid picture of your brand perception, awareness, loyalty, and more.

Research as part of ongoing brand tracking

Research like this should never be seen as a one-and-done tactic. Instead, it’s a core part of building brand value on an ongoing basis. The insights you glean from your research will be inherently more accurate and useful if they derive from real-time listening and frequent questioning, so it’s crucial to think of research as one part of a permanent improvement strategy.

Identify the greatest areas of opportunity for your brand, so you can focus on strengthening the attributes that drive consumers and differentiate you from the competition

Make decisions faster, with real-time access to the brand insights and the ability to drill down whenever curiosity strikes

Simulate scenarios for your brand so you can anticipate how your tactics can move key metrics like awareness or equity

Understand the business value of your rebranding efforts and discover the factors that drive your success, easily replicating positive action

Related resources

Brand Equity

Brand Value 7 min read

Customer-based brand equity models 10 min read, brand equity research 5 min read, brand equity 20 min read, top of mind awareness 11 min read.

Market Segmentation

Market Fragmentation 9 min read

Brand Perception

Brand Sentiment 18 min read

Request demo.

Ready to learn more about Qualtrics?

What is Brand Awareness and How Do You Measure It?

Create your brand awareness survey, form, or poll now!

What is Brand Awareness Research ?

Anyone not living under a rock recognizes Nike’s swoosh and Apple’s, well, apple. But not many people have probably heard of Bob’s Bait Shop. These brand awareness examples highlight the wide spectrum of awareness that exists among brands.

Brand awareness , then, is the number of people who are aware of a particular brand, company, or product. Understanding your brand’s position in the market helps when trying to build a presence, develop marketing initiatives, and increase sales.

Brand awareness studies conducted by Cahners Research reveal that brand awareness is the first step toward increasing brand preference, which leads to an increase in market share and sales. In addition, as greater levels of awareness are reached, conversion to preference comes more quickly (for example, as awareness increases from 25% to 35%, preference increased from 10% to 15% (a 5% difference); between 85% and 95% awareness, preference increased from 55% to 70% (a 15% difference).

These results demonstrate how important it is for companies with low brand awareness to get their message out; otherwise, sales, and the company, will suffer. Of course, many companies don’t know how often people actually think about them, which is where brand awareness research comes in.

Two Types of Brand Awareness: Recognition vs. Recall

Consumers remember brands in different ways. Some brands have such an overwhelming cultural presence and global reach that they enjoy “top of mind” brand recognition, such as Coca Cola, McDonald’s, Disney, and the aforementioned Nike and Apple. Other brands only come to a consumer’s mind when they are reminded of them when they see their logo or hear their name.

Brandwatch , a company dedicated to tracking what various brands customers think about, writes about how to measure levels of brand awareness in a blog post here that’s definitely worth your time. Now, let’s take a look at two types of brand awareness research .

Brand Recognition (Aided Research)

When measuring brand awareness using aided research, people are provided with brand visuals or names to determine the percentage who recognize your brand among the other brands. Having a high recognition level in aided recall questions is important when customers are at a store and are presented with the same product offered from several different brands.

For example, brake fluid is not something you buy every day. When you do need to buy it, you may have forgotten the name of the brand you used last time. But, when you’re in the auto parts store, you may suddenly recognize that brand when you see the familiar silver oil container or the logo.

Brand Recall (Unaided Research)

U naided brand recall asks the customers to remember the name of a brand without having it appear in a list or picture gallery like shown in the example survey above. This makes recall the highest level of brand awareness . To conduct unaided research through a brand recall survey , questions must be open-ended as presented in the example below. Research shows that a higher correlation is found between customer preference of a brand and the brands they mentioned in the unaided research.

Measuring Brand Awareness Using Brand Awareness Tools

How do you measure brand awareness? When it comes to traditional advertising such as television and radio campaigns, marketers look at reach and frequency to determine if their message is reaching the masses. For other forms of marketing, different metrics can be used—and it’s probably easier than you think! Here are some useful tips regarding brand awareness metrics you can use to determine whether you’re good to go, or need to up your marketing game!

1. Conduct Brand Awareness Surveys

Brand awareness survey questions can help you gauge how familiar people are with your company. Whether your survey is done online, sent by mail, or conducted over the phone, you should consider a two-prong approach:

- Asking existing customers how they heard of you to understand what means of marketing, from television ads to basic word of mouth, has been most successful.

- Asking random people if they have heard of your brand to gain insight into how many people can recall your brand.

Pro Tip: Always conduct both unaided and aided brand awareness surveys to give yourself the best foundation for decision-making regarding your company’s brand and its market awareness.

2. Check Website Traffic and Online Search Volume

Web traffic is a lot like road traffic; the more congested it is, the more popular the route! Analyzing your website traffic with Google Analytics over time can provide a number of insights into levels of brand awareness .

Direct traffic is a good indicator, showing the number of people who typed your URL into their address bar, used a browser bookmark, or clicked a link. Of course, this isn’t an infallible measure of brand awareness; for example, someone purchasing Ziploc bags is probably going to buy them through a supermarket or on Amazon, not through Ziploc’s website.

Google Adwords Keyword Planner and Google Trends are other brand awareness tools you could use. These allow you to view how many people are searching for your brand name, and to track it over time to see if search volumes are increasing. Of course, data can be skewed if your brand name is also a common word, such as Tide (boaters, for example, may be looking for high tide and low tide times, not the detergent).

3. Use Social Listening Tools

Sure, you can look at the number of followers your brand has on social media versus competitors, but it doesn’t paint the full picture. Social listening, on the other hand, is an effective tactic as it lets you see what people are talking about organically. “Listening” to unsolicited opinions across the web gives you insight into consumer’s natural thoughts about your brand.

A social listening tool (such as the aforementioned Brandwatch ) helps you write refined searches that can eliminate irrelevant mentions, such as in the “tide” scenario.

Finally, you may also want to check your social media share count. Shared Count is one free tool that allows you to quickly see how many times a piece of content has been shared socially across platforms like Facebook and Linkedin. Just pop the URL you want to check out into the Share Count box and click “analyze.” Social media management tools such as Hootsuite can also track your performance on social channels.

How to Increase Brand Awareness

This could be a blog all on its own! As a survey creation company, we feel one of the best ways to increase brand awareness is to ask existing customers how they heard about your brand; if it becomes clear that one method of your marketing mix is doing most of the heavy lifting, you may choose to invest more in that initiative and less in those that are yielding little results.

Of course, there are many other ways to increase your brand awareness, and often it will have to do with your budget. Here are 15 ways to increase brand awareness to get your wheels spinning.

- Offer referral rewards

- Invest in traditional media

- Become active on social media

- Pay influencers to promote your product

- Offer free samples

- Develop more unique branding

- Perform search engine optimization

- Hold contests

- Try guerrilla marketing

- Sponsor events

- Get involved with the community/donate to causes

- Co-brand with more established brands

- Offer valuable content

- Improve customer service to increase word of mouth

- Do email marketing

Brand Awareness Survey Questions

While no two brands are alike, brand awareness survey questions are often quite similar! Here are some common brand survey question examples you’ll want to consider asking of your participants:

- When was the last time you used our product category?

- When you think of this product category, which brands come to mind?

- Which of the following brands have you heard of?

- When did you first hear about our brand?

- In the past three months, where have you seen or heard about our brand?

- How familiar with our brand are you?

- In the past three months, how often did you hear people talking about our brand?

- How would you describe your overall opinion of our brand?

- Has your perception of our brand changed in the past three months?

- Would you be likely to recommend our brand to a friend or colleague?

Want to see this particular survey in action, with the responses included? Check out our Brand Awareness Survey Template .

Build Brand Awareness By Building Surveys!

Are you ready to put the power of surveys to work for you? SurveyLegend is leading the way in easy online survey creation, and we’ve worked with some of the world’s biggest brands ! Our surveys can help you gauge your brand awareness and recognition among customers and non-customers, giving you the data you need to put a stronger marketing plan into place. Sign up today for free!

Jasko Mahmutovic

Related Articles You Might Like

7, 6, 5, 4, 3, 2, 1… Seven Types of New Year Surveys!

Another Auld Lang Syne will soon be upon us, as we say goodbye to 2024 and usher in the new year. Of course, a new year comes with many...

How to Host a Halloween Costume Contest – for People & Pets!

People have been wearing costumes since the Greeks first donned them in village festivals. However, today there is no better time of year to don a costume than Halloween!...

How to Host a Pumpkin Carving Contest for Halloween

Halloween is just around the corner, which means cooler weather, creative costumes, pumpkin spice lattes, fun-size candies, and of course, contests! Pumpkin carving contests are especially popular this time...

Privacy Overview

‘Branding’ explained: Defining and measuring brand awareness and brand attitude

- Published: 29 December 2014

- Volume 21 , pages 533–540, ( 2014 )

Cite this article

- John R Rossiter 1

15k Accesses

27 Citations

Explore all metrics

Writing in the very first issue of this journal, the present author proposed a comprehensive model of ‘branding’, a managerial process that requires the marketer to establish, in the consumer’s mind, two essential communication effects: brand awareness and then brand attitude. In the present article, he expands this model from two to now three types of brand awareness (brand recognition, category-cued brand-name recall and brand recall-boosted recognition) and from three to now five levels of brand attitude (reject, unaware, acceptable if on special, one of my several preferred brands and my single preferred brand). Also, he shows how to most efficiently measure these two necessary components of branding.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Aaker, D. (2014) Aaker on Branding. New York: Morgan James.

Google Scholar

Rossiter, J.R. (1993) Brand awareness and acceptance: A seven-set classification for managers. Journal of Brand Management 1 (1): 33–40.

Article Google Scholar

Rossiter, J.R. and Percy, L. (1987) Advertising and Promotion Management. New York: McGraw-Hill.

Rossiter, J.R. and Percy, L. (1997) Advertising Communications & Promotion Management. New York: McGraw-Hill.

Rossiter, J.R., Percy, L. and Slowikowski, S. (forthcoming) Managing Advertising and Promotion.

Taute, H.A., Peterson, J. and Sierra, J.J. (2014) Perceived needs and emotional responses to brands: A dual-process view. Journal of Brand Management 21 (1): 23–42.

Download references

Author information

Authors and affiliations.

Faculty of Business, University of Wollongong, NSW 2522, Australia

John R Rossiter

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to John R Rossiter .

Rights and permissions

Reprints and permissions

About this article

Rossiter, J. ‘Branding’ explained: Defining and measuring brand awareness and brand attitude. J Brand Manag 21 , 533–540 (2014). https://doi.org/10.1057/bm.2014.33

Download citation

Received : 04 November 2014

Revised : 04 November 2014

Published : 29 December 2014

Issue Date : 01 November 2014

DOI : https://doi.org/10.1057/bm.2014.33

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- branding as positioning

- brand awareness types

- brand attitude levels

- efficient measures

- Find a journal

- Publish with us

- Track your research

IMAGES

VIDEO